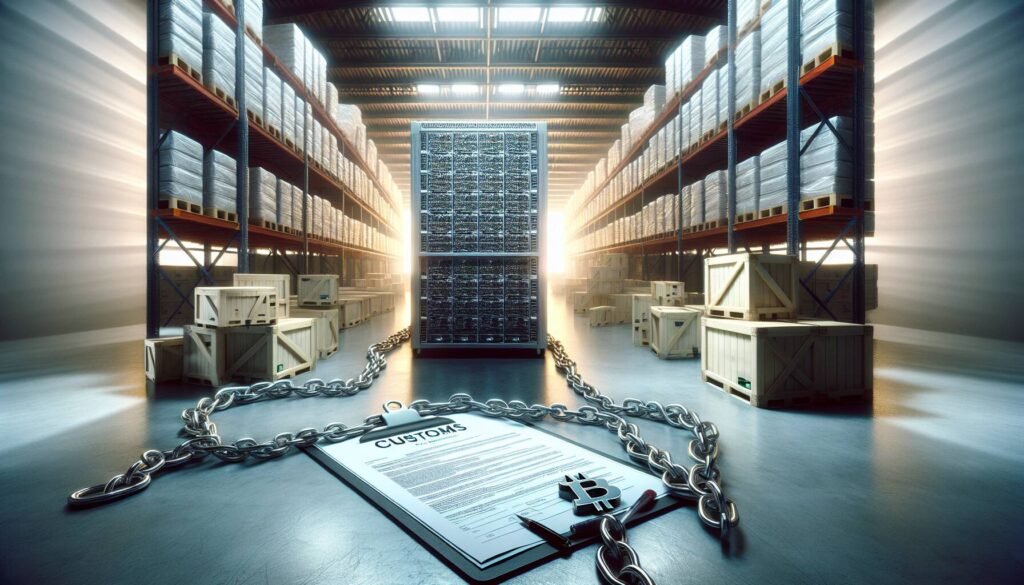

In a recent investigation by CoinDesk, it has come to light that certain players in the bitcoin mining industry are reportedly undervaluing shipments of mining rigs when dealing with U.S. Customs and Border Protection (CBP). This practice is not only aimed at circumventing customs duties but is also becoming increasingly relevant as the Trump administration implements higher tariffs on imported goods, particularly from Southeast Asian countries. Jill Ford, the founder of BitFord Digital, highlighted that while some miners declare shipments at significantly lower values to reduce import costs, such actions carry substantial risks, including potential legal repercussions.

With the U.S. emerging as a significant hub for bitcoin mining following China’s crackdown on the activity in 2021, the demand for application-specific integrated circuits (ASICs)—the specialized machines used for mining—has soared. However, the majority of these machines are produced by Chinese companies, raising complications in light of new trade policies. Following the announcement of increased tariffs, uncertainty now looms over the industry, particularly for miners who may face hefty import taxes on essential machinery.

Ford revealed that while underreporting the value of shipments has become a common industry practice, recent shifts in CBP enforcement have made such tactics riskier. The agency, which oversees customs audits, has reportedly tightened oversight on mining rig imports, with some regions experiencing stricter enforcement than others. This inconsistency has led to confusion among miners, who are now reconsidering their import strategies in response to these unpredictable tariffs.

As firms navigate this increasingly fraught landscape, it remains to be seen how these developments will impact investment in mining infrastructure and the broader cryptocurrency market. While some industry players are pushing forward, others are opting to pause their operations amid rising costs and regulatory scrutiny, signaling a moment of reckoning for the U.S. bitcoin mining sector.

“Tariffs will likely cause a material slowdown, if not a halt, in new projects,” stated Taras Kulyk, co-founder of Synteq Digital, emphasizing the potential ripple effects of this tariff regime on future infrastructure developments.

Impacts of Undervaluing Bitcoin Mining Rig Shipments

The practice of undervaluing bitcoin mining rig shipments has implications not only for U.S. customs and trade regulations but also for the broader bitcoin mining industry and stakeholders involved. Here are the key points:

- Undervaluation Prevalence:

- Many in the bitcoin mining industry regularly undervalue mining rig shipments to reduce customs duties.

- This illegal practice has been common due to lax enforcement by the U.S. Customs and Border Protection (CBP).

- Impact of Tariffs:

- The Trump administration’s tariff increases are making undervaluation attempts more relevant.

- Potential tariffs on shipments from Southeast Asia threaten the economic viability of U.S.-based mining operations.

- Increased Scrutiny from CBP:

- Recent investigations have resulted in tighter controls over ASIC imports, leading to more enforcement of proper reporting.

- Variability in enforcement across states complicates the situation for miners operating in different jurisdictions.

- Legal Consequences:

- Misreporting values can lead to significant penalties, including financial recovery demands and potential criminal charges.

- Costs associated with penalties may change the calculus for miners considering undervaluation.

- Market Response:

- Some mining operations are re-evaluating capital expenditures due to tariff uncertainties, affecting future planning and project timelines.

- Alternative markets, such as Canada, may see increased demand as U.S. miners reconsider their strategies.

“If my client wants to do that, that’s on them … We ask, ‘What do you want to declare your package as?’” – Jill Ford, BitFord Digital

The implications of these points extend to the legality of operations, financial stability of mining companies, and the overall dynamics of the bitcoin market in the U.S. Readers involved in or considering entering the bitcoin mining space should be aware of these complexities and the associated risks in their operations.

Challenges and Opportunities in Bitcoin Mining Amidst Evolving Tariff Landscape

The recent revelations surrounding the undervaluation of bitcoin mining rig shipments have sent shockwaves through the industry, shedding light on practices that have long gone under the radar. While some industry players have managed to skirt around the ever-tightening regulatory environment, the upcoming changes in tariffs under the Trump administration significantly alter the dynamics of the bitcoin mining landscape. This situation presents unique advantages and disadvantages for various stakeholders in the sector.

Competitive Advantages: For brokers like BitFord Digital, who facilitate the procurement of mining rigs, there remains an ongoing opportunity to thrive despite the risks associated with undervaluing shipments. As the demand for efficient and powerful ASICs surges in the wake of China’s ban on bitcoin mining, these middlemen could capitalize on their knowledge of tariff loopholes—at least until regulations catch up. The temporary moratorium on tariffs allows miners a brief window to optimize their logistics strategies without incurring heavy costs, giving them some breathing space amidst the uncertainty.

Furthermore, jurisdictions that had previously seemed less attractive for mining operations may become new hotspots. As miners reevaluate their options, locations with favorable regulatory conditions, such as Canada, are emerging as front-runners. This redirection could potentially stabilize or even enhance mining operations moving forward, by attracting a more diverse range of participants drawn by their welcoming policies.

Competitive Disadvantages: On the flip side, the tightening customs enforcement presents substantial challenges. Companies that have routinely undervalued their shipments now face the risk of scrutiny from the U.S. Customs and Border Protection (CBP), leading to potential legal repercussions. Not only do these practices put companies at risk of hefty fines, but they also create an unpredictable operational landscape fraught with delays and stalled projects. For example, miners located in states with stringent customs practices, such as Kentucky, may find themselves at a significant disadvantage compared to those in states like Oregon, where enforcement appears more relaxed.

Potential Beneficiaries and Challengers: The evolving tariff situation could create significant challenges for small to mid-level miners who may not possess the resources to navigate these regulatory waters. As costs increase and uncertainties loom, some may opt to halt operations altogether, confident in the knowledge that this pause allows them to reassess their capital needs. This shift could lead to an unlevel playing field, favoring larger mining operations with greater flexibility and deeper pockets to absorb the increased costs. Conversely, smaller players may find opportunities to collaborate with larger firms or seek innovative solutions that could offer a competitive edge despite industry-wide pressures.

Ultimately, while the landscape of bitcoin mining is shifting in response to evolving tariffs and heightened scrutiny, there’s room for adaptation and strategy. Stakeholders that react nimbly to the challenges presented could not only survive but thrive, carving out new paths for growth amid a complex regulatory framework.