In an unexpected turn of events, recent statements from the Federal Reserve have stirred up the cryptocurrency market, as analysts warn that significant price fluctuations in Bitcoin could be on the horizon. The Fed’s warnings have sparked conversations across financial platforms, with many suggesting that no investor is truly insulated from potential chaos. With looming decisions set to impact the staggering trillion market in April, all eyes are on Bitcoin and its ability to weather the storm.

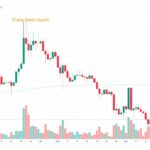

As excitement builds, some cryptocurrency enthusiasts speculate that Bitcoin could be on the verge of achieving new all-time highs. Notably, prominent voices in the industry, including recognized analyst Arthur Hayes, have hinted that Bitcoin might soon reach what he describes as a ‘numerically interesting number,’ potentially signifying a bullish trend. With Bitcoin’s recent price movements breaking out of notable patterns, traders are left wondering if the sky-high target of 0,000 could soon become a reality.

“Bitcoin’s chart shows bullish breakout dynamics that suggest upward momentum may be swift,” stated one analyst.

However, not all cryptocurrency assets are poised for such optimism. In a somewhat contrasting forecast, XRP has been projected to face a steep decline of up to 40%, demonstrating the volatile nature of the crypto landscape. As March approaches its end, investors are urged to pay close attention to the Hodler’s Digest reports, which encapsulate the latest trends and insights within the market.

As this pivotal moment unfolds, the cryptocurrency community remains on high alert, navigating the intricate dance between regulatory influences and market sentiment. The coming weeks promise to be a rollercoaster ride, with uncertainty looming just as much as opportunity.

Nobody Is Safe—Shock Fed Trump Warning Could Suddenly Trigger Bitcoin Price Chaos

The recent developments in the cryptocurrency market present several critical points that could significantly impact investors and the broader economy. Here are the key aspects to consider:

- Federal Reserve’s Influence:

The warnings related to the Federal Reserve’s policies signal potential volatility in the market.

- Impact of Economic Decisions:

A sudden change in Fed policy could lead to significant price fluctuations in Bitcoin and other cryptocurrencies.

- Projected Cryptocurrency Value Changes:

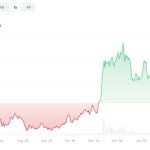

- trillion liquidity transition expected in April, which may result in a substantial price change for Bitcoin.

- Bitcoin might achieve an all-time high (ATH) sooner than anticipated, potentially affecting investor confidence and decision-making.

- XRP’s forecasted drop of 40% could create ripples across the crypto market, affecting associated investments.

- Market Predictions:

Experts like Arthur Hayes suggest Bitcoin is on the brink of reaching a “numerically interesting number,” highlighting potential market peaks.

- Technical Analysis Indications:

Bitcoin’s breakout from a falling wedge pattern raises questions about whether 0,000 could be the next target price, indicating bullish sentiment.

As the cryptocurrency landscape continues to shift, investors must stay informed about both economic factors and technical patterns that could impact their holdings.

Market Volatility: A Deep Dive into the Latest Bitcoin and Fed Dynamics

The cryptocurrency landscape is electric with speculation and tension as recent forecasts paint a vivid picture of impending volatility driven by Federal Reserve actions. Major publications like Forbes and Cointelegraph spotlight the alarming warnings regarding potential market shifts. The phrase “Nobody Is Safe” illustrates the unpredictable nature of the current economic climate, suggesting that any Bitcoin holder should brace for impact as the Fed’s monetary policy could initiate a chaotic ripple effect across crypto prices.

Comparative Advantages: Key news insights highlight the broad implications of Fed actions on Bitcoin prices, positioning the cryptocurrency as both a refuge and a target. The analysis from Arthur Hayes, suggesting a potential Bitcoin surge to “numerically interesting” heights, resonates with investors seeking lucrative opportunities amid volatility. This perspective is bolstered by reports indicating a trillion market flipping in April, a movement that could spell significant gains for some while heightening risk levels for others.

However, as demonstrated by speculative reports from other outlets, such as the forecasted 40% drop in XRP, the negative sentiments surrounding certain altcoins can lead to heightened caution among traders. The potential dropping of a major player like XRP can impact the whole market’s morale, leading to uncertainty which often hampers investor confidence in riskier assets, including Bitcoin itself.

Disadvantages of Current Trends: For newcomers or more conservative investors, the chaos anticipated from Fed movements could pose real challenges. Those not well-versed in market fluctuations may find themselves ill-equipped to navigate the rapid changes. The stark notion that “nobody is safe” suggests a cautionary tale that could deter less experienced investors from engaging in the market, resulting in decreased liquidity and participation.

Ultimately, this turbulent landscape could prove highly lucrative for seasoned traders who thrive in volatility, while also creating significant hurdles for casual investors who prefer stability in their portfolios. As the market braces for possible swings, it remains crucial for all participants to stay informed and agile, adapting strategies that align with the evolving dynamics of both the cryptocurrency and traditional financial markets.