In a remarkable turn of events, Bitcoin (BTC) has surged to a stunning all-time high, hitting $111,875 early Thursday, surpassing the previous day’s record and solidifying its position in the cryptocurrency landscape. This price jump reflects a substantial increase of approximately 3.8% within a 24-hour period, igniting excitement among investors amidst a generally tumultuous atmosphere in traditional financial markets.

The backdrop of Bitcoin’s ascent is noteworthy, as it unfolds against rising bond yields and heightened concerns surrounding mounting U.S. debt. The yield on the 10-year U.S. Treasury has climbed to 4.6%, while the 30-year yield breached the 5% mark, largely influenced by fears associated with a significant tax bill proposed during President Trump’s administration. This proposed legislation could potentially add up to $5 trillion to the nation’s debt, according to reports from Reuters.

Globally, the situation mirrors that of Japan, where yields on long-term government bonds have also surged to record highs, raising alarm bells over the sustainability of national debt that now sits at a staggering 234% of GDP.

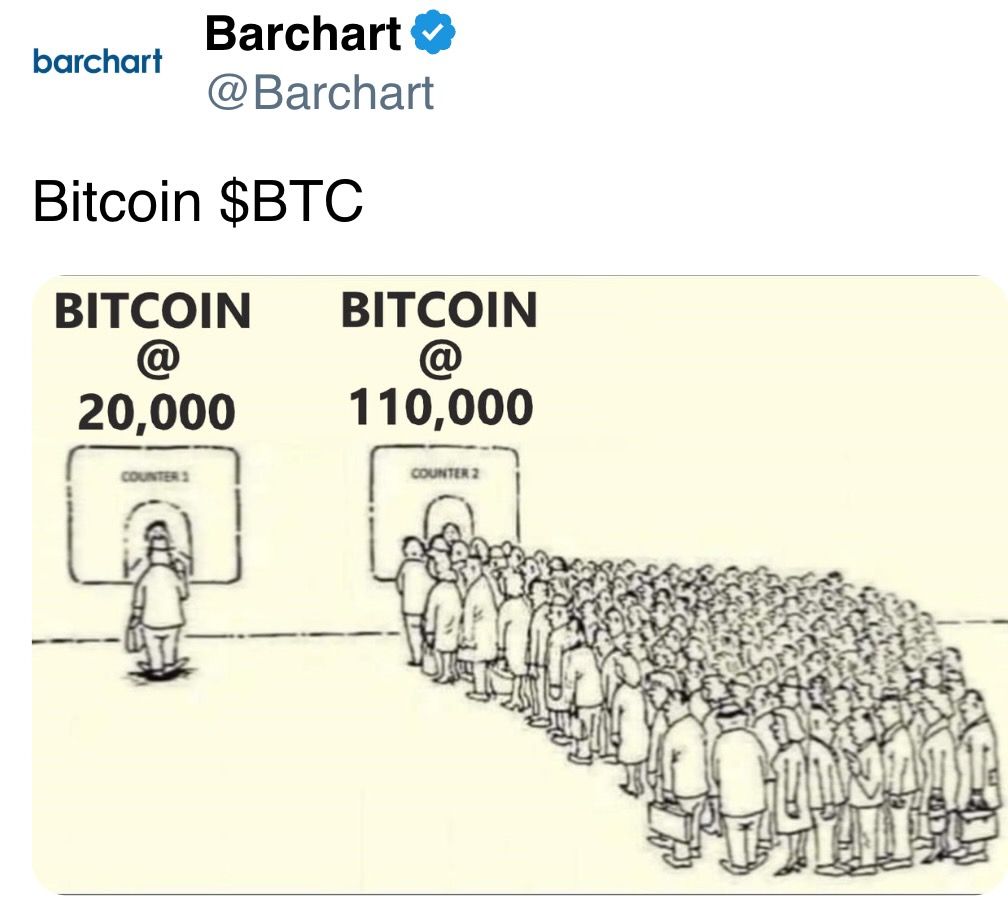

Despite these pressures, Bitcoin continues to draw bullish sentiment from traders, evident in the growing number of long positions and a rising open interest in BTC options. Notably, there is substantial activity in contracts with expiration dates later this year, with many focused on strike prices of $110,000, $120,000, and even $300,000, indicating strong confidence in Bitcoin’s bullish trajectory.

The appetite for cryptocurrency exposure is further amplified by significant inflows into U.S.-traded spot bitcoin exchange-traded funds (ETFs), which have attracted $1.6 billion in net inflows just within the past week, pushing total assets in these products to a record $129 billion. However, some analysts note signs of caution among traders, as bearish positioning begins to surface amid the excitement, hinting at a potential consolidation phase rather than a sharp downturn.

“The largest block flow this week continues to be ETH December call spreads, while overnight BTC butterfly positions hint that some traders are positioning for consolidation around current levels,” said Jake O., a trader at Wintermute OTC.

As Bitcoin fans celebrate this newfound milestone, they are also advised to keep an eye on the intricate balance within the wider financial context, where rising bond yields could impact the allure of riskier assets, including cryptocurrencies. The cryptocurrency market remains dynamic, with a newfound focus on the potential for continued upward movement while navigating the complexities of the broader economic landscape.

Bitcoin Hits All-Time High Amid Rising Market Tensions

The recent surge of Bitcoin to an all-time high has significant implications for both the cryptocurrency market and traditional financial systems. Here are the key points that can impact readers’ understanding and decisions:

- Bitcoin’s New Record

- Bitcoin reached an all-time high of $111,875.

- This surpasses the previous record set earlier in the week, indicating a strong bullish trend.

- Institutional Demand

- Increased interest from institutional investors is driving Bitcoin’s price rise.

- Total net inflows into U.S.-traded Bitcoin ETFs reached $4.24 billion in May.

- Growing demand may enhance cryptocurrency’s legitimacy and integration into financial portfolios.

- Impact of Rising Bond Yields

- The 10-year U.S. Treasury yield rose to 4.6%, affecting investor sentiment.

- Higher bond yields generally reduce the appeal of riskier assets like cryptocurrencies.

- Market Volatility and Sentiment

- Open interest in Bitcoin options has surged, indicating strong bullish sentiment with large positions around $110,000 and $120,000.

- Traders must remain cautious of potential market corrections despite current bullish trends.

- Global Economic Factors

- The uncertainty surrounding the U.S. debt and potential tax bills may influence investor strategies.

- International economic conditions, such as Japan’s rising bond yields, could affect global market stability.

- Upcoming Events to Monitor

- Significant financial data releases on GDP and inflation could impact market sentiment.

- Crypto events like Bitcoin Pizza Day may garner public attention and influence retail investor behavior.

Understanding these key factors is crucial for making informed investment decisions in a rapidly evolving financial landscape.

Bitcoin Surges to New Heights Amid Financial Market Turmoil

Bitcoin’s impressive rise to an all-time high of $111,875 is not just a headline; it’s a reflection of a significant shift in investor sentiment, particularly amidst struggles in traditional financial markets. As U.S. bond yields climb and concerns about national debt mount, many investors are turning to cryptocurrencies as an alternative investment. This trend highlights some compelling advantages and disadvantages for Bitcoin compared to its traditional and crypto counterparts.

Competitive Advantages:

Bitcoin’s surge showcases its growing institutional adoption. With a record $4.24 billion in inflows to U.S.-traded spot Bitcoin ETFs just this month, it’s clear that institutions see Bitcoin as a compelling hedge against potential losses in equities amid rising bond yields. Additionally, the market’s bullish openness, evidenced by high demand for $110K and $120K options, indicates a robust confidence in Bitcoin’s ongoing rally.

Furthermore, Bitcoin’s price resilience amid external challenges such as the credit downgrade of the U.S. indicates its appeal as a ‘digital gold’ alternative. As Bitcoin garners considerable attention, it attracts participants motivated by speculative futures trading, making it a lucrative avenue for both seasoned investors and newcomers.

Competitive Disadvantages:

On the flip side, the current volatility may not be suitable for all investors. The significant gains experienced can often lead to equally dramatic corrections, raising the question of how sustainable this rally is. Additionally, the mixed market signals, where some traders are positioning for consolidation instead of continued growth, suggest a potential for price pullbacks. As institutional interests grow, their actions could equally dampen the excitement if profit-taking leads to a substantial sell-off.

Potential Beneficiaries and Challenges:

Bitcoin’s resurgence could primarily benefit institutional traders and retail investors who can absorb the fluctuations without risking significant capital. However, for risk-averse investors, particularly those accustomed to traditional equities, this crypto volatility may present a daunting challenge. As fears over U.S. governmental debt and economic instability linger, such new entrants may struggle with the abrupt market shifts that Bitcoin embodies, questioning whether this asset class aligns with their investment strategies.

In essence, Bitcoin’s remarkable ascent is poised to reshape market dynamics. While it marches forward as an attractive alternative investment, it brings with it a dichotomy of opportunity and risk that will significantly impact a variety of players within the financial landscape.