The cryptocurrency market is witnessing an intriguing blend of optimism and caution this week. Arthur Hayes, co-founder of BitMEX, suggests that Bitcoin could soar to an impressive 0,000 before considering a retreat to the ,500 range. This prediction comes on the heels of decreasing inflation fears and a potential shift in US monetary policy that may favor riskier assets, including Bitcoin, which has recently closed above ,000.

“I bet $BTC hits 0k before it retests .5k,” Hayes stated, emphasizing a shift from quantitative tightening (QT) to easing measures by the Federal Reserve.

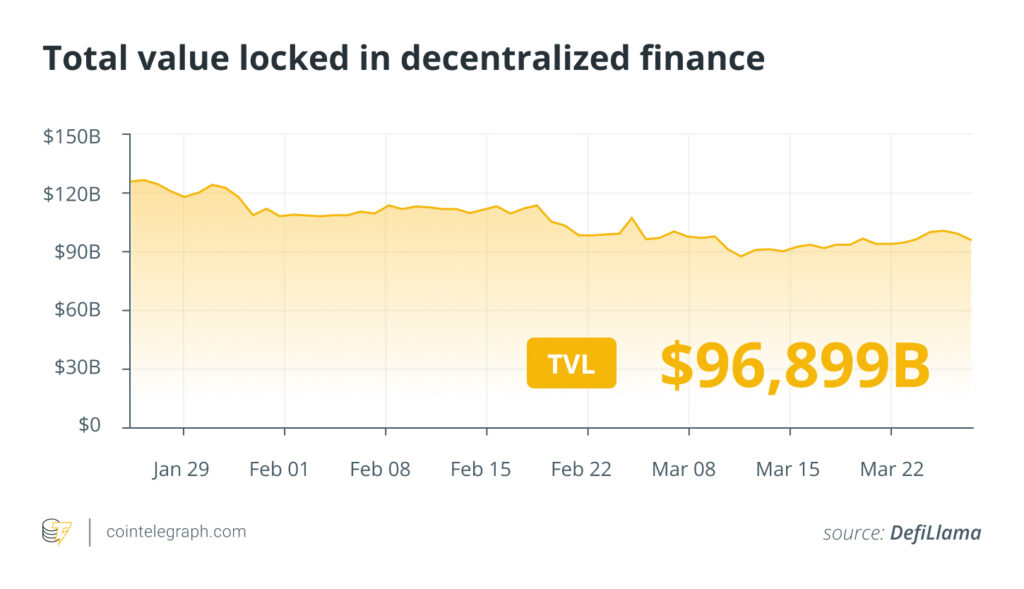

While analysts, including Benjamin Cowen, clarify that QT isn’t entirely off the table, the sentiment underlining this bullish outlook remains strong. Simultaneously, the decentralized finance (DeFi) sector faced turbulence as an unidentified whale exploited a trading platform to secure over million from a memecoin short position, illustrating the volatility that still lingers within crypto markets.

In another noteworthy development, Fidelity Investments is stepping further into the cryptocurrency realm by preparing to launch a US dollar-backed stablecoin. This initiative aligns with a growing trend among financial institutions to embrace digital assets as favorable regulatory conditions emerge. Additionally, Fidelity is advancing its offerings with an Ethereum-based share class designed to enhance transparency and accessibility in cryptocurrency investing.

Further complicating the landscape, Polymarket—a prominent decentralized prediction market—faced scrutiny over governance issues related to a high-stakes bet involving U.S.-Ukraine mineral dealings. The market settled under controversial circumstances, raising questions about potential exploitation by large stakeholders.

On a positive note, DWF Labs has initiated a substantial 0 million fund aimed at fostering growth in mid- to large-cap blockchain projects, reinforcing their commitment to increasing real-world adoption of Web3 technologies.

As we delve into the dynamic world of cryptocurrencies, it’s evident that while Bitcoin is generating significant attention with its potential price movements, the underlying DeFi environment continues to grapple with both innovative breakthroughs and significant challenges.

Bitcoin Price Predictions and Recent Market Developments

In recent updates from the cryptocurrency world, several key points have emerged that could significantly influence investor sentiment and market dynamics:

- Bitcoin Price Forecast:

- Arthur Hayes predicts Bitcoin could reach 0,000 before dipping to ,500.

- This outlook is supported by easing inflation and favorable monetary policy in the US.

- Bitcoin’s recent bullish momentum includes a close above ,000.

- Impact of Monetary Policy:

- The Federal Reserve’s transition from quantitative tightening (QT) to quantitative easing (QE) is expected to encourage risk asset investment.

- Less tightening of monetary policy may lead to increased liquidity, supporting bullish market sentiments.

- Decentralized Finance (DeFi) Vulnerabilities:

- A whale manipulated the price of a memecoin, resulting in over million in profit, highlighting risks in the DeFi space.

- The incident demonstrates the need for improved security measures in decentralized exchanges.

- Fidelity’s Stablecoin Launch:

- Fidelity Investments is nearing the launch of a US dollar-pegged stablecoin, signaling a shift in institutional crypto engagement.

- This initiative may make cryptocurrency more accessible and trustworthy for traditional investors.

- Polymarket Controversy:

- Polymarket faces scrutiny over a potentially manipulated betting outcome regarding a US-Ukraine mineral deal.

- The incident raises concerns about governance and market integrity in prediction markets.

- DWF Labs’ 0 Million Fund:

- DWF Labs has launched a fund aimed at fostering mainstream crypto adoption through strategic investments in promising blockchain projects.

- This move could drive growth in the crypto space and enhance user trust in blockchain technologies.

The developments in the cryptocurrency market suggest that both opportunities and risks are evolving rapidly, with institutional players increasingly entering the space and DeFi protocols facing significant challenges.

Market Dynamics: Bitcoin’s Surge Amidst DeFi Turmoil

The cryptocurrency scene is witnessing a fascinating juxtaposition of optimism surrounding Bitcoin’s potential price surge and the alarming vulnerabilities within the decentralized finance (DeFi) sector. Arthur Hayes’s bullish forecast for Bitcoin, predicting a climb to 0,000, is underscored by factors such as easing inflationary pressures and a pivot toward less stringent monetary policies by the US Federal Reserve. This analysis identifies significant competitive advantages and disadvantages related to these developments.

Competitive Advantages: Bitcoin’s anticipated rally is likely to attract both institutional and retail investors looking for a secure haven amidst shifting economic landscapes. With major financial institutions slowly embracing crypto offerings, like Fidelity’s stablecoin initiative, there is increasing mainstream recognition of digital assets as viable investment options. This integration bolsters Bitcoin’s legitimacy, presenting potential for substantial capital inflows. Furthermore, the growing optimism about US monetary easing could enhance risk appetite across the board, benefiting Bitcoin at the expense of more volatile altcoins.

Competitive Disadvantages: On the flip side, the DeFi market is grappling with heightened scrutiny following recent exploitative incidents—such as the Hyperliquid incident involving a whale generating substantial profits through manipulation. Such events undermine investor confidence in decentralized protocols and highlight systemic risks, which may deter participation in this segment. Consequently, as Bitcoin rises, the DeFi sector may struggle to maintain its user base, as traders might prefer to avoid platforms perceived as insecure.

This scenario could benefit certain stakeholders significantly. Investors bullish on Bitcoin may find this an opportune moment to capitalize on favorable conditions. Conversely, the unresolved vulnerabilities within DeFi pose serious concerns for project developers and investors alike, who might face significant losses if these issues continue unchecked. Additionally, regulatory bodies may focus more on DeFi protocols to safeguard investors, potentially introducing stricter regulations that could stifle innovation and agility within the space.

In summary, while Bitcoin’s bullish outlook creates a distinct competitive edge, the challenges confronting the DeFi sector reflect the complexities of a rapidly evolving cryptocurrency landscape. Investors will need to navigate these waters carefully to reap the benefits without falling prey to the ongoing risks in decentralized finance.