In a dramatic turn of events on April 9, Bitcoin (BTC) witnessed a swift rise to $78,300 as the pressure in the equities market prompted some traders to act impulsively. This sudden surge came on the heels of deepening concerns surrounding a US-China trade war, which had previously seen Bitcoin retreat from the crucial $80,000 mark the day before.

Recent data highlights that Bitcoin’s value fluctuated significantly, oscillating around five-month lows below $75,000 before making a rebound just as trading began in New York. In an extraordinary display of market volatility, the S&P 500 index recorded what many analysts described as its most substantial intraday reversal ever. The trading resource The Kobeissi Letter remarked, “You have just witnessed history,” referencing the unprecedented shifts triggered by US tariff announcements and China’s retaliatory measures.

“Both bulls AND bears feel ‘uncomfortable’ in these market conditions,” noted The Kobeissi Letter, emphasizing the erratic nature of trading where massive market capitalizations fluctuated based on the statements from influential figures like US President Donald Trump.

As the cryptocurrency market reacted to these developments, the Crypto Fear & Greed Index dipped to levels not seen since early March, illustrating heightened trader anxiety. Keith Alan, co-founder of Material Indicators, expressed a desire to remain cautious amidst the tumultuous market dynamics, hinting that the current atmosphere might not stabilize quickly.

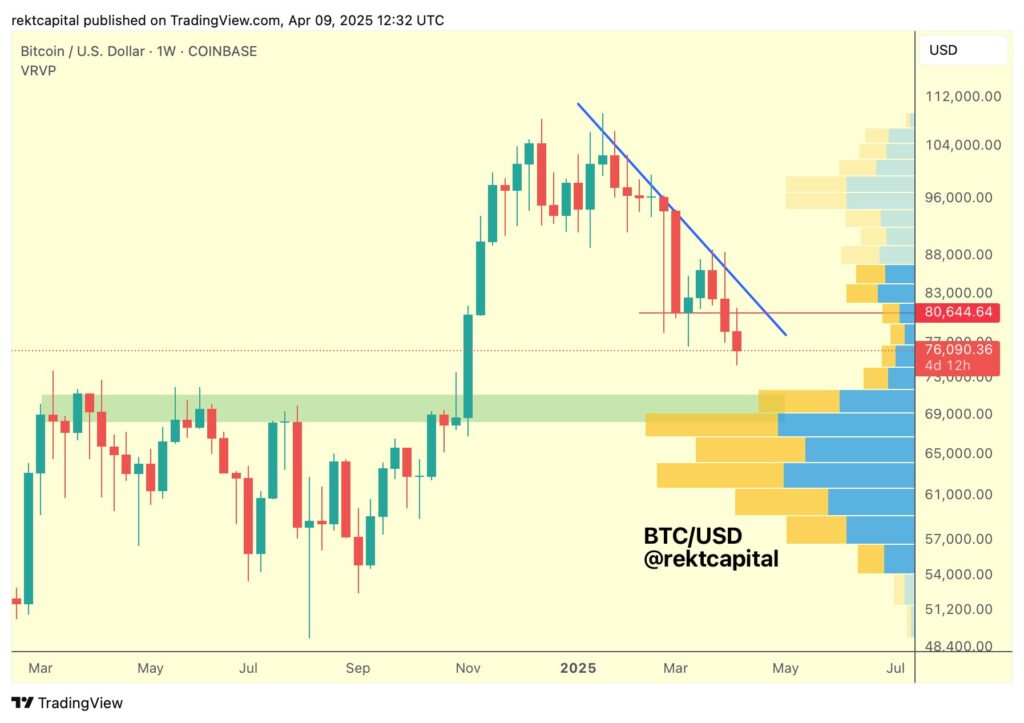

On a technical front, cryptocurrency analysts pointed to notable resistance levels for Bitcoin, particularly a gap in the CME Group’s Bitcoin futures chart, indicating potential challenges for BTC to surpass the $82,000 mark. Analyst Rekt Capital noted that after breaking from a sideways trend, Bitcoin has encountered considerable resistance moving forward, suggesting a trading range between $71,000 and $83,000 could be established.

With the market showing signs of volatility and uncertainty, some experts are pondering the implications for Bitcoin’s long-term trajectory. As always, market participants are reminded of the inherent risks associated with trading cryptocurrencies, and they are encouraged to perform thorough research when considering their options.

Bitcoin Market Analysis and Impact

This article delves into the recent volatility in the Bitcoin (BTC) market, highlighting key movements, associated market behaviors, and broader economic implications.

- Bitcoin Price Fluctuation:

- BTC price surged to $78,300, then retargeted lows under $75,000.

- Recent events in U.S.-China trade relations impacted Bitcoin’s ability to maintain the $80,000 mark.

- Historical Market Behavior:

- The S&P 500 experienced a record intraday reversal which exceeds fluctuations seen in 2020, 2008, and 2001.

- This volatility suggests a highly reactive market influenced by political statements, particularly from President Trump.

- Investor Sentiment:

- A decline in the Crypto Fear & Greed Index indicates heightened fear among investors.

- Some traders prefer to wait for market stability, highlighting uncertainty in buying opportunities even with lower prices.

- CME Futures and Bitcoin Resistance Levels:

- A gap in CME Group’s Bitcoin futures indicates resistance levels between $82,000 and $85,000.

- Analysts suggest that Bitcoin may drop further to fill a Volume Gap between $71,000 and $83,000.

“You have just witnessed history.” – The Kobeissi Letter

Understanding Bitcoin’s Recent Price Movements Amid Market Volatility

The cryptocurrency landscape has been a whirlwind of activity recently, particularly with Bitcoin (BTC) prices experiencing rapid fluctuations as equities markets tremble in response to the evolving U.S.-China trade relations. This environment is not without its challenges, but it also provides unique opportunities for savvy investors and analysts alike. The recent surge to approximately $78,300, before retracting below the $75,000 mark, underscores the sensitive interplay between cryptocurrency and traditional stock markets.

When comparing Bitcoin’s performance to similar narratives in the stock market, one cannot overlook the significant impact of external factors, such as US tariff announcements. These economic pressures have resulted in notable volatility, particularly reflected in historical data, with some analysts suggesting that the S&P 500’s intraday swings are unprecedented. In this tumultuous environment, Bitcoin is not just reactive but also serves as a barometer for market sentiment, demonstrating how crypto-assets can be influenced by broader economic trends.

A competitive advantage for Bitcoin lies in its liquidity and the global decentralized nature of trading, which allows it to absorb shocks while also attracting investors looking for alternatives amidst stock market turmoil. Players in the market, from seasoned traders to new entrants, find Bitcoin appealing as an asset with the potential for substantial price movements. However, the current market behavior has led to a pronounced sense of anxiety that permeates both the bulls and the bears, creating a challenging atmosphere for decision-making.

Moreover, the Crypto Fear & Greed Index reaching recent lows indicates a growing concern among traders about complacency or indecisiveness in the market. This heightened state of fear could deter less experienced investors from participating, ultimately stifling Bitcoin’s price recovery. On the flip side, it may attract risk-tolerant investors who see opportunities in undervalued assets. Traders like Keith Alan highlight the potential bargains amidst this volatility, suggesting that those with a higher risk threshold could benefit significantly from capitalizing on current low prices for assets like Ether and Solana.

Yet, with such significant price resistance levels identified, particularly around the CME gap above $82,000, it also indicates that Bitcoin’s ascent will be met with substantial hurdles. While seasoned traders may revel in the challenge, this steep resistance poses a considerable disadvantage for newcomers who might struggle to navigate these turbid waters. Thus, while the backdrop of market volatility presents enticing prospects for some, it also poses risks of substantial losses for those unprepared for the potential swings.

In conclusion, Bitcoin’s recent movement highlights the importance of vigilance and research in trading. The rapidly changing environment can create both pathways for profit and pitfalls for the unwary, making active participation in the market a decision fraught with complexities and necessitating a nuanced understanding of current and upcoming trends. Investors and traders alike must remain adaptable and informed as they navigate these tumultuous times in the cryptocurrency space.