In the latest developments of the cryptocurrency market, Bitcoin has seen a notable decline, falling toward the $83,000 mark. This downturn comes as the United States faces a partial government shutdown, creating an atmosphere of uncertainty among traders and investors.

As the news unfolds, market participants are adopting a defensive stance, particularly with a crucial House vote anticipated on Monday. This vote could have significant implications for various sectors, including the financial markets, which are closely watching the potential impact on economic stability.

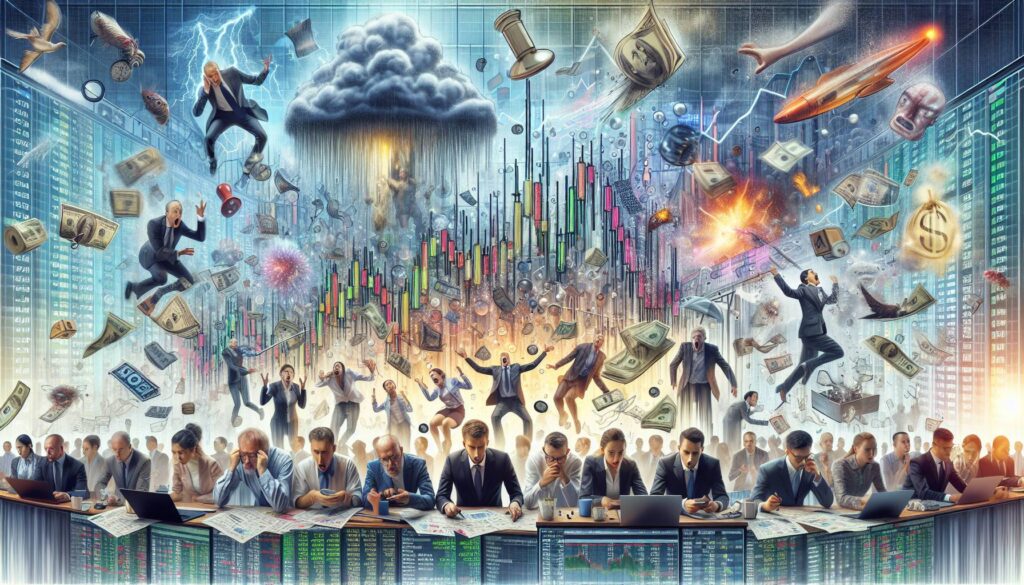

The combination of political uncertainty and market volatility is influencing trading strategies, prompting many to reassess their positions and approach as they navigate this fluctuating landscape.

The cryptocurrency sector has a history of reacting to external economic pressures, and the current situation underscores the interconnected nature of traditional finance and digital assets. Investors are keenly analyzing the market’s response to unfolding domestic political events, which could sway sentiments as the week progresses.

Impact of Bitcoin’s Fluctuation Amid U.S. Government Shutdown

Key points regarding the current state of Bitcoin and its potential implications for traders and investors:

- Bitcoin Price Movement: Bitcoin has fallen toward $83,000, indicating volatility in the market.

- U.S. Government Shutdown: The ongoing partial shutdown of the U.S. government may contribute to financial uncertainty.

- Trader Sentiment: Traders are adopting a defensive approach ahead of a House vote, reflecting cautious behavior in the investment community.

- Potential for Increased Volatility: The uncertainty surrounding government operations can lead to fluctuations in cryptocurrency markets.

- Market Reactions: Economic and political instability often influence market confidence, potentially leading to decreased investment in riskier assets like Bitcoin.

Impact on Investors: Traders and investors may need to reassess their strategies in light of ongoing political events, prioritizing risk management.

Bitcoin’s Price Movement Amid U.S. Partial Shutdown: A Competitive Analysis

The recent decline of Bitcoin towards the $83,000 mark coincides with the onset of a partial government shutdown in the United States. This situation has triggered a defensive stance among traders, particularly with a crucial House vote looming on Monday. In the realm of cryptocurrencies, such a market reaction is not unprecedented; however, it highlights the ongoing interplay between traditional economic events and digital asset pricing.

When comparing Bitcoin’s current state to similar news segments, we notice other cryptocurrencies often exhibit more volatility during governmental uncertainties. For instance, Ethereum and Binance Coin have frequently shown resilience or even short-lived gains during economic downturns. This can be attributed to their diversified utility and stronger community backing, which may tilt the focus of investors towards them during tumultuous times. Therefore, while Bitcoin remains a strong candidate due to its well-established reputation, it could face significant challenges from these alternative assets.

Furthermore, Bitcoin’s traditional advantage of being the flagship cryptocurrency, attracting institutional interest and mainstream adoption, may be overshadowed by the potential for increased regulatory waves stemming from a government shutdown. Traders and institutions could face delays in decision-making, impacting liquidity and increasing volatility in the markets. This scenario could serve as a disadvantage for Bitcoin, as it positions the cryptocurrency as a more risky asset in uncertain times, while others may leverage agility and adaptability to thrive.

The current situation might benefit traders who favor short-selling or put options, as they could capitalize on Bitcoin’s decline. Conversely, long-term holders may feel a pinch as they grapple with decreased valuation, prompting a sell-off to mitigate losses. New entrants into the crypto space, witnessing Bitcoin’s instability, might be discouraged, ultimately creating a barrier to entry that could stymie overall market growth. As this narrative unfolds, understanding these dynamics will be crucial for players in the cryptocurrency market, with the potential to redefine investment strategies as developments continue.