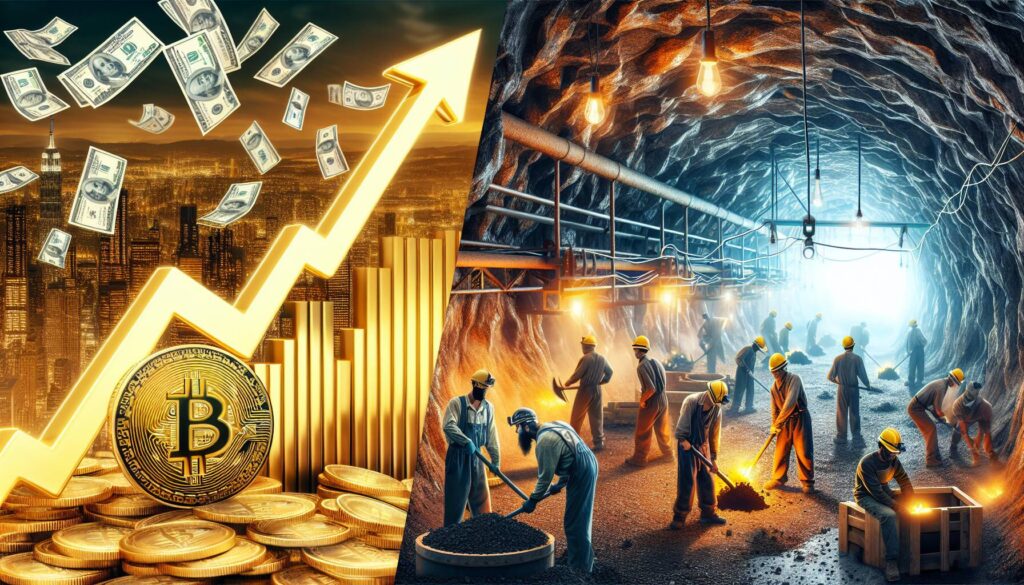

A recent surge in Bitcoin’s value has sparked a notable rally, registering an impressive 6% increase. This upward momentum has not only energized the cryptocurrency market but has also propelled investment vehicles like IBIT to outshine traditional funds, including the well-known VOO. The excitement around Bitcoin’s rebound suggests a renewed interest among investors in digital assets, reflecting the volatile yet enticing nature of cryptocurrencies.

However, the landscape is not uniformly bright. Crypto mining companies, which are integral to the blockchain ecosystem, faced significant challenges as evidenced by sharp declines in stocks such as IREN and CIFR. These contrasting performances between Bitcoin’s rally and the losses in the mining sector highlight the complexities within the cryptocurrency market, where not all participants benefit from rising asset values.

“The divergent paths of Bitcoin and crypto miners illustrate the intricate dynamics at play in the broader cryptocurrency ecosystem, where gains in one area may not necessarily translate to success across the board.”

This current scenario underscores the multifaceted nature of the crypto market, prompting investors and enthusiasts alike to stay tuned to further developments as they unfold amidst increasing volatility and shifting trends.

Bitcoin Rally and Its Impact on Investment Funds

Recent developments in the cryptocurrency market have shown significant fluctuations that impact various investment avenues.

- Bitcoin’s 6% Rally:

- Boosted the performance of crypto-related investment funds.

- Increased interest in digital assets among traditional investors.

- IBIT’s Performance:

- Ahead of major funds like VOO, indicating growing confidence in Bitcoin.

- Potential for higher returns for investors who align with crypto trends.

- Steep Losses in Crypto Miners:

- Companies like IREN and CIFR reported significant declines.

- Reflects the volatility and risks associated with crypto mining investments.

This situation could lead investors to reconsider their portfolio strategies, balancing between traditional assets and the risks of cryptocurrency investments.

Bitcoin’s Surge: IBIT Outperforms Major Funds Amid Mining Setbacks

The recent 6% rally in bitcoin has acted as a catalyst for IBIT, positioning it ahead of prominent funds such as VOO. This positive momentum showcases the competitive edge of bitcoin-related investments, appealing particularly to investors looking for alternatives to traditional funds. The surge indicates a growing interest in cryptocurrency as a viable asset class, potentially attracting a younger, more tech-savvy demographic eager to diversify their portfolios.

However, while IBIT celebrates its success, the contrasting performance of crypto miners like IREN and CIFR highlights the volatility inherent in the sector. These companies have experienced significant losses, raising concerns about the sustainability of mining operations amidst fluctuating bitcoin prices. This situation presents a dual-edged sword for investors; while IBIT may thrive, the turbulence in the mining industry could dissuade those reluctant to engage with high-risk ventures. Furthermore, investors who had previously invested in mining stocks may find this period particularly challenging, as they face the consequences of a declining market segment.

The positive buzz around IBIT could benefit individual retail investors who are increasingly looking to capitalize on the cryptocurrency boom. Conversely, traditional fund investors and miners may face hurdles, as they grapple with the implications of this rally and its associated risks. The contrasting narratives paint a complex picture of the current crypto landscape, where potential rewards exist alongside significant challenges.