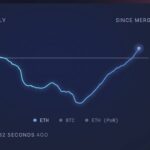

Bitcoin is currently going through an intriguing phase described by analysts as a “shakeout.” This term refers to the period where market volatility causes some investors to sell their assets, often resulting in a dip in prices. But don’t be fooled—this isn’t indicative of the end of Bitcoin’s four-year cycle, according to experts. Many are optimistic, suggesting that this phase is part of a natural ebb and flow in the world of cryptocurrency.

As Bitcoin navigates these turbulent waters, enthusiasts and investors alike are keeping a close eye on the market, eager to understand what comes next. The excitement surrounding this digital currency remains strong, even amidst uncertainty. Analysts emphasize that despite the fluctuations, the fundamental strength of Bitcoin still holds, hinting at a potential resurgence in the near future.

“This shakeout is a natural part of market cycles, and it could pave the way for new opportunities,” says one analyst, highlighting the resilience of Bitcoin in the face of challenges.

In the ever-changing landscape of cryptocurrency, staying informed is key. Whether you’re a seasoned investor or just starting your journey with Bitcoin, the current market situation offers important lessons in patience and strategy. The future of Bitcoin is still very much on the horizon, and the buzz surrounding it continues to capture attention across the globe.

Understanding Bitcoin’s Current Market Dynamics

The recent developments in the Bitcoin market have raised questions about the future trajectory of its value and the overall cryptocurrency market. Here are some key points to consider:

- Shakeout Phenomenon: Analysts describe the current market conditions as a “shakeout,” where weaker hands are selling off their Bitcoin holdings.

- Not the End of the 4-Year Cycle: Experts suggest that this shakeout does not signify the end of Bitcoin’s traditional four-year market cycle, indicating potential for recovery.

- Impact on Investors: Investors might experience increased volatility; understanding this cycle is crucial for making informed decisions.

- Long-term Potential: Despite short-term fluctuations, Bitcoin’s long-term value proposition remains significant according to various market analysts.

“The shakeout is a natural part of the market cycle, allowing stronger hands to accumulate Bitcoin at lower prices.”

These factors together highlight the complexity of the Bitcoin market and underline the importance of staying informed. By recognizing the patterns within these cycles, readers can better navigate their investment strategies in the cryptocurrency landscape.

Bitcoin’s Shakeout: Analyzing Market Sentiments and Predictions

The current conversation surrounding Bitcoin suggests a “shakeout” phase rather than a definitive end to its 4-year cycle, as highlighted by various analysts and Cointelegraph. This assertion parallels the broader narrative within the cryptocurrency sphere, where fluctuations often incite speculation about the market’s longevity and resilience. Such insights not only capture the attention of investors but also hold significant implications for market strategies and future predictions.

Competitive Advantages: Analysts emphasizing that the recent downturn is merely a shakeout phase can provide reassurance to both novice and seasoned investors. This perspective may fuel confidence, encouraging those who might hesitate to engage in the cryptocurrency market to reconsider, thus potentially boosting investment volume. Furthermore, framing the downturn as part of the natural cycle could attract more institutional investors looking for market correction opportunities, aligning their strategies with historical patterns that suggest eventual recovery.

Disadvantages: However, this optimistic outlook is not without its risks. Skeptics may argue that such predictions could lead to misguided investment decisions, particularly for those unfamiliar with market volatility. If the anticipated recovery fails to materialize as expected, it could lead to significant financial losses, impacting market stability and investor sentiment adversely. Additionally, the ever-changing regulatory landscape adds a layer of uncertainty, which could undermine the analysts’ predictions of an inevitable bounce back.

For Whom It Benefits: The insights from analysts regarding Bitcoin’s cyclical nature could particularly benefit long-term investors who understand and appreciate the potential of market fluctuations. Moreover, educational platforms and financial advisors could utilize this information to guide clients in making informed decisions, reinforcing the importance of a well-thought-out investment strategy in the volatile cryptocurrency space.

Potential Problems: Conversely, day-traders and those seeking quick returns might find themselves in hot water if they misinterpret the current shakeout as a sustained downtrend. The lure of potential gains, coupled with the fear of missing out (FOMO), can lead to rash decisions that overlook the inherent risks associated with Bitcoin investments. As the market evolves, such dynamics will undoubtedly continue to shape individuals’ futures in the cryptocurrency arena.