The ongoing trade war initiated by former President Donald Trump has recently sent shockwaves through global financial markets, ushering in an era of heightened volatility and uncertainty. As investors seek refuge in various asset classes, many have expressed hope that Bitcoin (BTC) might serve as a reliable hedge against market chaos, often referring to it as “digital gold.” However, the current data paints a different picture, revealing that Bitcoin’s trajectory has become increasingly intertwined with the Australian dollar-Japanese yen pair (AUD/JPY), a well-known risk indicator in the foreign exchange market.

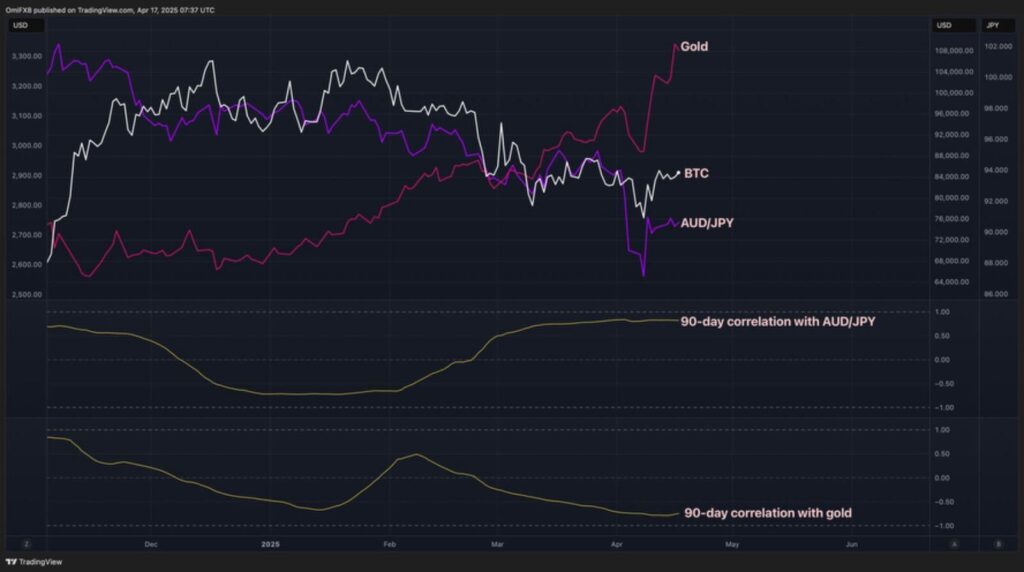

According to recent findings from TradingView, the correlation between Bitcoin and the AUD/JPY has flipped positive, reaching levels not seen since November 2021. This strong correlation of 0.80 indicates that both assets are moving in tandem, suggesting that Bitcoin is now perceived by traders more as a risk asset than a safe haven. In contrast, Bitcoin’s relationship with gold has taken a turn for the worse, with the 90-day correlation dropping to a negative 0.80, showcasing a notable divergence in their value propositions during this tumultuous time.

“The tit-for-tat tariff war has led to staggering cumulative levies on Chinese imports, prompting a renewed focus on stagflation risks,” added Federal Reserve Chairman Jerome Powell, highlighting the economic backdrop against which these movements are taking place.

This shift in correlation is particularly intriguing, as the AUD is sensitive to commodity demand while the yen is considered a safe haven, especially when global markets turn cautious. Traders often look to the AUD/JPY pair as a barometer of risk sentiment; an increase in the AUD typically signals optimism among investors, while a drop in its value hints at growing risk aversion. Bitcoin’s evolving role as a proxy for this risk sentiment further underscores how the cryptocurrency landscape continues to adapt amidst ongoing financial upheaval.

Impact of President Trump’s Trade War on Bitcoin and Financial Markets

The ongoing trade war initiated by President Donald Trump has created notable fluctuations in financial markets, affecting investment strategies and asset correlations. Here are the key points to consider:

- Volatility in Financial Markets:

- The trade war has led to significant market turbulence since March, prompting investor behavior changes.

- Bitcoin’s Role as a Safe Haven:

- Traditionally viewed as ‘digital gold,’ Bitcoin (BTC) is currently not considered a safe haven asset amidst the trade war.

- Investors attempting to hedge against volatility may need to rethink their strategies regarding BTC.

- Correlations with AUD/JPY:

- Bitcoin’s correlation with the Australian dollar-yen pair (AUD/JPY) has surged, indicating BTC’s ties to risk sentiment.

- A strong correlation coefficient of 0.80 suggests BTC’s price movements are alike to those of AUD/JPY, a risk barometer.

- Impact of Tariffs on Chinese Imports:

- A 245% cumulative levy on Chinese imports to the U.S. has heightened economic tensions and uncertainty.

- Federal Reserve Chairman Jerome Powell warns of stagflation risks, emphasizing the economic stakes involved.

- Bitcoin vs. Gold Correlation:

- Bitcoin’s correlation with gold has recently flipped to negative (-0.80), suggesting that while both are alternate investments, they are now moving in opposite directions.

- This shift impacts how investors consider BTC relative to traditional safe havens like gold during economic uncertainty.

- Understanding Risk Assets:

- The Australian dollar is deemed sensitive to global commodity demand, while the yen serves as a safe haven investment.

- Monitoring AUD/JPY trends can provide insight into overall market risk appetite, reflecting investor sentiment towards BTC.

The reevaluation of Bitcoin’s role in the market could influence individual investment strategies and expectations about asset performance during times of geopolitical and economic stress.

Bitcoin’s New Role: Risk Proxy Amid Trump’s Trade Turbulence

The recent shifts in the cryptocurrency market, particularly Bitcoin’s evolving correlation with traditional financial indicators, underscore a significant transformation driven by external economic factors. Unlike previous narratives that cast Bitcoin as ‘digital gold’ and a safe-haven asset, the current analysis indicates its tight relationship with the AUD/JPY currency pair—a recognized barometer for risk sentiment in the financial markets. While this shift presents certain competitive advantages, especially for traders looking to align with risk trends, it also raises questions about Bitcoin’s viability as a hedge against economic uncertainty.

Competitive Advantages

Bitcoin’s newfound correlation with the Aussie dollar-yen pair suggests that it has become a reliable indicator of market sentiment, which can attract traders looking to capitalize on its volatility in this turbulent landscape. This adaptability positions Bitcoin differently, showcasing its responsiveness to global economic shifts, thereby appealing to a different segment of investors compared to gold and similar safe-haven assets. The ongoing trade war has heightened the demand for assets that can quickly react to global sentiment, and Bitcoin’s ability to mirror the AUD/JPY movements may serve well for those seeking quick trades based on market risk appetite.

Potential Disadvantages

However, these developments also come with notable drawbacks. The negative correlation with gold illustrates that Bitcoin may no longer serve the role of a protective asset during economic downturns, potentially disillusioning long-time bullish investors. As the trade war escalates and stagflation risks become more pronounced, risk-averse investors might gravitate back toward traditional safe havens like gold, leaving Bitcoin vulnerable to significant sell-offs. This shift could alienate a core group of investors who once considered Bitcoin a robust alternative to traditional hedges.

Who Stands to Benefit or Suffer?

Traders focused on short-term gains and those who thrive on market volatility are likely to benefit from Bitcoin’s emerging identity as a risk proxy. These market participants can leverage Bitcoin’s new correlation to fine-tune their trading strategies. On the flip side, conservative investors and those relying on Bitcoin as a digital store of value might find this evolving narrative problematic. Their strategies, built around the premise of Bitcoin as a stable hedge against inflation and market turmoil, could face severe challenges in a landscape where the cryptocurrency aligns more closely with risk assets than traditional havens.

In essence, the changing dynamics of Bitcoin during President Trump’s trade war present a complex tapestry of opportunities and challenges—one that every investor must navigate with a keen sense of market indicators and evolving correlations.