The cryptocurrency market is buzzing with excitement as Bitcoin’s spot price has recently surged past the impressive mark of $111,000. According to insights from CoinDesk analyst Omkar Godbole, this upward momentum suggests that Bitcoin could potentially rise another 30%, pushing its price beyond $140,000. Central to this analysis is the daily price chart of BlackRock’s Nasdaq-listed spot bitcoin ETF, known as IBIT, which has also witnessed a significant boost, climbing 2.85% on Wednesday and briefly surpassing its May high of $63.70.

This upward trend reaffirms a bullish flag breakout that signaled the end of a five-and-a-half-week counter-trend consolidation. In technical analysis, flags are recognized as bullish continuation patterns, pointing toward sustained upward movements. According to the well-regarded measured move method, analysts anticipate an upward price movement that corresponds to the initial rise, indicating a potential 30% increase for both the IBIT ETF and Bitcoin’s spot price.

The persistence of flags in trading signals a low failure rate, paving the way for cautious optimism among traders. However, the crypto market remains sensitive to macroeconomic factors that could reverse this trend, pushing prices back into a consolidation phase.

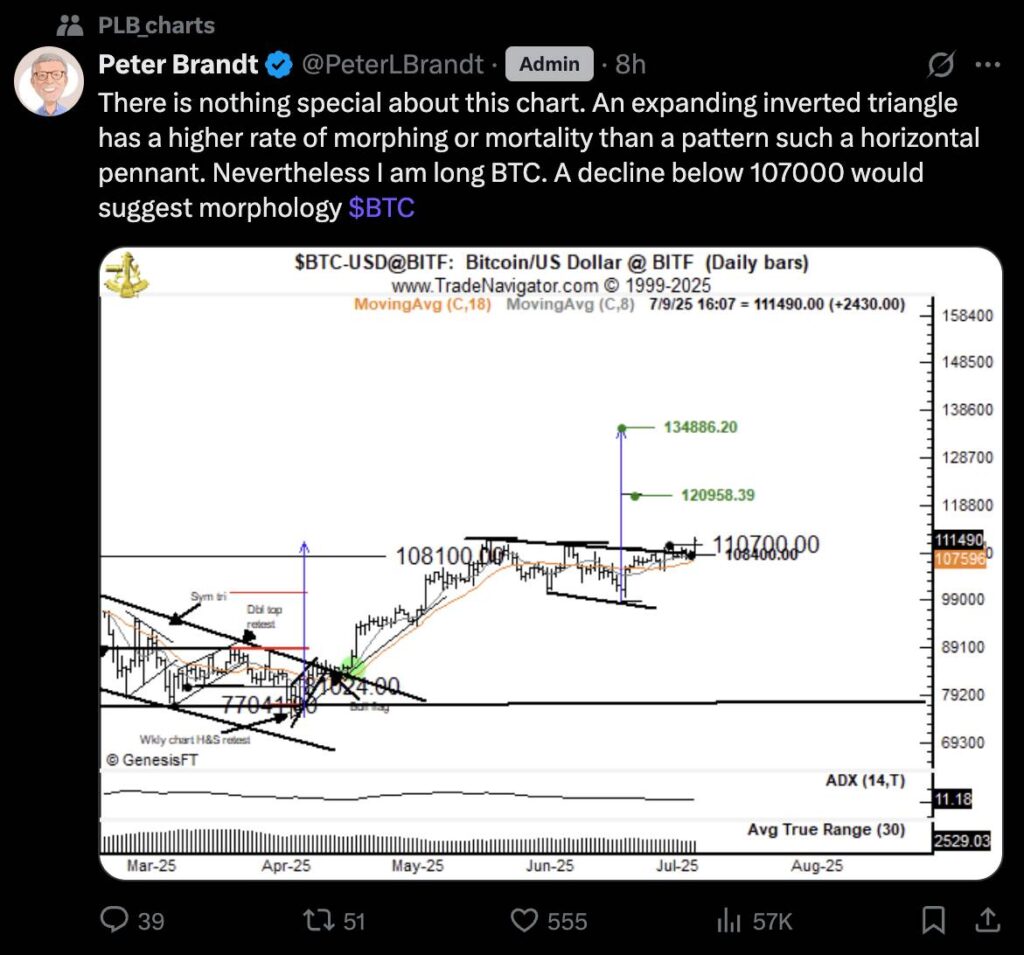

Adding to the bullish sentiment, veteran chart analyst Peter Brandt suggests that Bitcoin’s spot price could even rally to around $134,000 if current trends hold. As traders and investors closely monitor these developments, the focus remains on the resilience of this rising market and its ability to maintain momentum amid economic fluctuations.

Bitcoin Price Analysis and Market Insights

Key insights from the technical analysis by CoinDesk analyst Omkar Godbole:

- Bitcoin’s Current Price Status:

- Bitcoin’s spot price has surpassed $111,000.

- Potential rise of another 30% could exceed $140,000.

- BlackRock’s Bitcoin ETF (IBIT):

- IBIT rose 2.85% on Wednesday, surpassing the May high of $63.70.

- ETF mandated to closely track Bitcoin spot price, which reflects investor sentiment.

- Technical Indicators:

- Breakout from a bull flag pattern indicates continuity of upward momentum.

- Previous five-and-a-half-week period of consolidation has ended, resuming the uptrend from April lows.

- Analyst Perspectives:

- Analysts anticipate a price rally, using the measured move method which estimates at least 30% upside.

- Veteran analyst Peter Brandt suggests potential rally could reach $134,000.

- Risk Considerations:

- Low failure rate of flag patterns but vulnerable to macroeconomic shifts.

- Possible reversion to consolidation phase may negate positive forecasts if adverse conditions arise.

Bitcoin Bull Run: Analyzing IBIT’s Momentum and Market Dynamics

The recent surge in Bitcoin’s spot price, marking over $111,000, has ignited a wave of optimism among investors and analysts alike. The notable performance of BlackRock’s Nasdaq-listed spot Bitcoin ETF, IBIT, showcases a vital competitive edge. Unlike other funds, IBIT’s direct correlation with Bitcoin’s spot price positions it as a primary investment vehicle for those looking to capitalize on Bitcoin’s upward trajectory. The ETF’s ability to closely track Bitcoin’s performance, as evidenced by its recent 2.85% rise, emphasizes its role in validating the bullish sentiment in the cryptocurrency market.

Moreover, the identification of a bull flag breakout strengthens the case for further price increases. Such technical patterns typically precede substantial rallies, making IBIT an attractive option for traders seeking a higher risk-reward ratio. However, the optimism surrounding this ETF could be jeopardized by adverse macroeconomic conditions, which might lead to a significant pullback in both the ETF and Bitcoin prices. This unpredictability underlines a potential disadvantage for conservative investors who may prefer more stable asset classes.

The current bullish outlook could be particularly beneficial for institutional investors looking to diversify their portfolios with cryptocurrency exposure. Additionally, retail investors eager to ride the wave of Bitcoin’s resurgence may find IBIT to be a sufficient gateway into the market without the complexities of directly holding digital assets. However, caution should be exercised; those unaccustomed to the volatility of cryptocurrencies could face challenges if the anticipated upward price movement falters in the face of broader economic shifts.

In sum, while IBIT presents a promising opportunity as a beacon of hope amidst a turbulent market landscape, the inherent risks associated with cryptocurrency volatility and macroeconomic shifts could pose significant challenges for traditional investors.