The cryptocurrency exchange Bitget has announced a significant development in its ongoing investigation into alleged market manipulation involving the VOXEL token. As tensions rise following an incident that saw eight account holders purportedly pocketing over $20 million, Bitget is taking decisive legal action. The exchange plans to send letters from its legal team to those implicated, marking a notable step in addressing what it describes as “abnormal trading activity” associated with its VOXEL/USDT perpetual futures contract.

On April 20, Bitget reported a striking spike in trading volume, with over $12 billion executed in just one day—far surpassing similar metrics on other platforms like Binance. In response to these irregularities, the exchange temporarily suspended accounts it suspected of engaging in price manipulation and moved to reverse the suspicious trades. Xie Jiayin, Bitget’s head of Chinese operations, emphasized that only the eight accounts directly involved would be held accountable, reassuring other traders that they would not face any repercussions and that their accounts are operating normally.

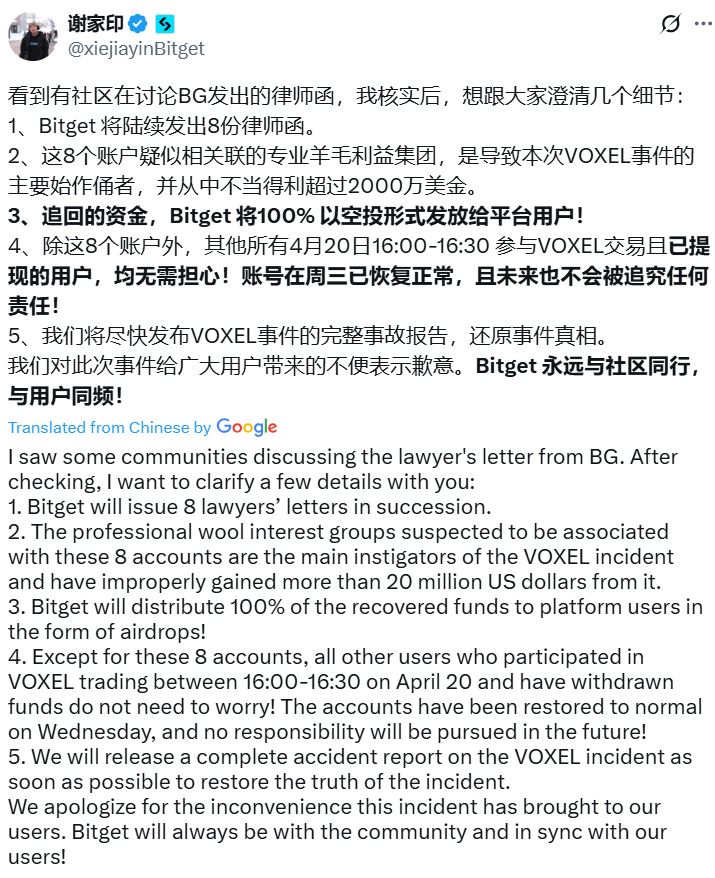

“These eight accounts are the main instigators of the VOXEL incident and have improperly gained more than 20 million US dollars from it,” Jiayin stated on social media.

As part of the fallout, Bitget informed users that it intends to redistribute 100% of the recovered funds to affected customers through airdrops. The exchange continues to investigate the incident’s origins, with speculation that the unusual trading circumstances may have stemmed from a bug in a market maker bot. This situation echoes a previous incident on the decentralized exchange Hyperliquid, highlighting the broader concerns of market integrity as cryptocurrencies gain traction.

VOXEL serves as the native utility token for Voxies, a tactical RPG game operating on the Ethereum blockchain, reflecting the growing intersection of gaming and digital currencies. As Bitget navigates this challenging terrain, the outcome of their investigation could have lasting implications not only for those accused but for the broader cryptocurrency ecosystem.

Bitget’s Legal Action on Market Manipulation of VOXEL Token

Bitget, a cryptocurrency exchange, is taking measures against account holders accused of manipulating prices related to the VOXEL token. Here are some key points regarding the incident:

- Account Holders Targeted:

- Eight accounts are allegedly responsible for a price manipulation incident on April 20.

- These accounts reportedly profited approximately $20 million from their actions.

- Legal Steps:

- Bitget’s lawyers are sending letters to the accused accounts.

- Only the eight identified accounts will face legal scrutiny, with the rest of the users unaffected.

- Market Activity:

- On April 20, Bitget paused accounts due to “abnormal trading activity” related to VOXEL/USDT contracts.

- The trading volume reached over $12 billion, significantly surpassing that of similar contracts on Binance.

- Recovery of Funds:

- Bitget plans to distribute 100% of the recovered funds to affected users through airdrops.

- A full incident report is being prepared for transparency.

- Community Reactions:

- Some community members speculate that a bug in a market maker bot caused the increased volume and subsequent price manipulation.

- High-leverage traders may have exploited this situation for profit.

- Relevant Incidents:

- Bitget CEO noted that this incident was distinct from platform-wide issues, assuring users that their funds are safe.

- A similar incident occurred on March 27 involving the JELLY token, highlighting the risks within decentralized exchanges.

The actions taken by Bitget may serve as a cautionary tale for other platforms and traders, emphasizing the importance of vigilance against market manipulation and the potential for exploitation in volatile trading environments.

Bitget Takes Action Against Alleged Market Manipulators: Comparative Insights

The recent move by Bitget, a prominent crypto exchange, to send legal notifications to several account holders accused of manipulating the VOXEL token’s perpetual futures contracts highlights urgent issues in the fast-evolving crypto landscape. This incident, where Bitget alleges that eight accounts collectively pocketed over $20 million from illicit activities during an ‘abnormal trading’ period, raises pertinent comparisons with similar situations in the industry.

Competitive Advantages: Bitget’s proactive approach in addressing the supposed manipulation serves as a significant competitive advantage. By swiftly halting transactions and investigating claims of misconduct, the exchange positions itself as a responsible platform that prioritizes the integrity of user funds and market fairness. This could enhance user trust and attract legitimate traders who value regulatory compliance and ethical trading practices. Furthermore, the promise of distributing 100% of recovered funds to affected users via airdrop affirms Bitget’s commitment to customer welfare, potentially fostering a loyal user base.

In contrast, other exchanges, like Hyperliquid, faced backlash for their handling of similar situations. Following a considerable exploit involving a whale on March 27, Hyperliquid opted to delist its perpetual futures for the JELLY token, which could be interpreted as a lack of confidence in the integrity of their trading environment. While swift action may alleviate some pressures, it also raises concerns about market stability and trader confidence.

Disadvantages and Potential Issues: However, Bitget’s legal maneuvering could backfire. The decision to pursue legal action could alienate traders who may fear punitive repercussions, even if they were merely participants in the affected trading activity. This atmosphere of tension could deter new user registrations and dissuade existing users from trading activities on the exchange. Moreover, should the investigations reveal negative findings about Bitget’s operational standards, it could tarnish the company’s reputation, leading to a potential decline in user trust across the board.

Both Bitget and Hyperliquid reveal a common dilemma within the crypto industry — balancing aggressive management of market integrity while nurturing a supportive environment for users. Exchanges must juggle swift action to protect against market manipulation and the need to cultivate trust amongst their user communities. This delicate balance resonates particularly with high-volume traders and laypeople who are uncertain about the waters they’re navigating.

Looking ahead, Bitget’s maneuver could serve as a cautionary tale for users engaged in the burgeoning crypto space. While legitimate trades benefit from corrective measures and protection from exploitation, the incident may also discourage speculative trading practices, prompting a shift toward more conservative strategies and platform choices. Observers and traders alike will be keen on monitoring how Bitget navigates this complex situation and whether they can sustain user confidence amidst scrutiny.