In an exciting development for the cryptocurrency landscape, Bitso Business, a prominent player in Mexico’s crypto exchange sector, has announced the launch of a new stablecoin, MXNB, which is pegged to the Mexican peso. This innovative stablecoin will operate on the Ethereum layer-2 network known as Arbitrum and will be managed by Bitso’s newly created subsidiary, Juno. In their March 26 statement, Bitso Business emphasized that MXNB will be fully backed by Mexican pesos on a one-to-one basis, providing stability and confidence to users.

Ben Reid, the head of stablecoins at Bitso Business, highlighted that MXNB aims to facilitate foreign investment and trade in Latin America by offering a more efficient alternative to traditional financial infrastructure. He pointed out that global companies often encounter significant monetary hurdles, such as high intermediary costs and slow transaction times, when navigating new markets and conducting cross-border payments.

“Global companies face significant monetary challenges when it comes to serving customers in new markets and conducting cross-border payments,” Reid stated.

Set to operate independently, Juno will oversee the management of the stablecoin and ensure trustworthiness by conducting regular audits of its reserves. Public attestation reports will be made available on the token’s official website, adding an extra layer of transparency for potential users.

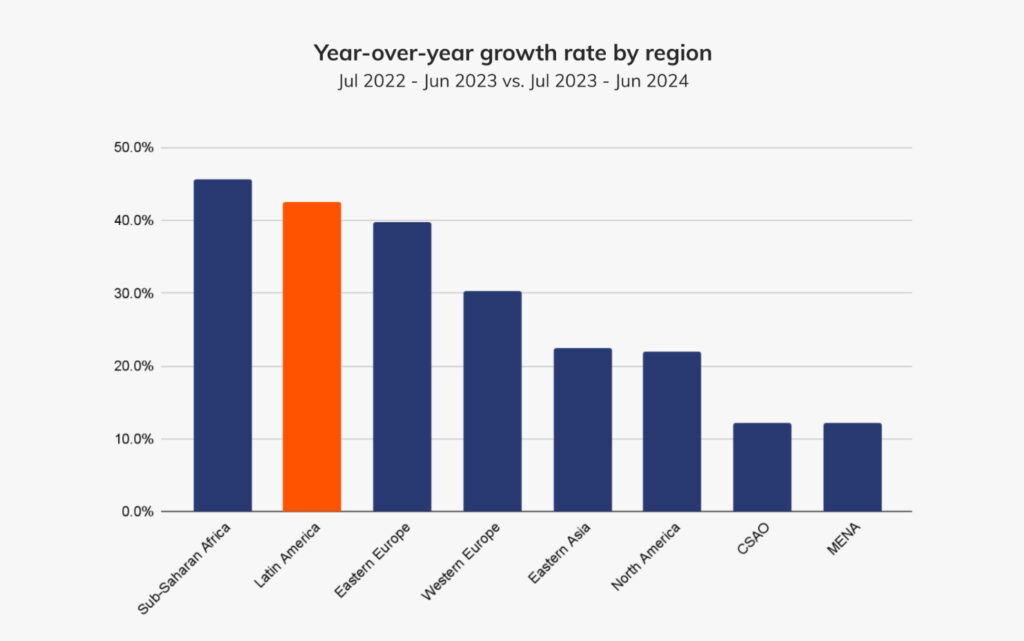

Mexico has become a notable hub for cryptocurrency-based remittances; a report from crypto research firm Chainalysis identified the country as a key player in this domain. The World Bank estimated that Mexico received around billion in remittances annually, ranking it as the second-largest receiver globally. Meanwhile, Latin America has emerged as a rapidly growing region for crypto transactions, with Chainalysis reporting a remarkable 42.5% year-on-year increase in crypto value received from July 2023 to June 2024.

“In Latin America, challenging macroeconomic conditions, characterized by high inflation and currency devaluations, drove increased cryptocurrency adoption — particularly stablecoins — as a reliable store of value,” noted a report by Bitso.

As the demand for stablecoins continues to rise in Latin America, existing players like Tether’s MXNT, which debuted in 2022, highlight the growing importance of peso-pegged stablecoin solutions. Other emerging options in this market, including MMXN and MXNe, further demonstrate the increasing interest in this innovative financial segment. With this backdrop, the launch of MXNB by Bitso Business marks a significant step in enhancing the cryptocurrency ecosystem in Mexico and beyond.

Launch of MXNB: A Peso-Pegged Stablecoin in Mexico

The forthcoming release of Bitso’s MXNB stablecoin is set to impact various aspects of finance and trade in Latin America.

- Bitso’s MXNB Stablecoin:

- Launched by Bitso Business’ new subsidiary, Juno.

- Fully backed by Mexican pesos at a one-to-one ratio.

- Utilizes the Ethereum layer-2 network Arbitrum for efficiency.

- Enhanced Business Efficiency:

- Designed to promote foreign investment and trade within Latin America.

- Aims to reduce costs associated with traditional finance infrastructure.

- Addresses issues with high intermediary costs and slow transaction times.

- Contribution to Remittances:

- Mexico: Second-largest recipient of remittances worldwide, primarily from the U.S.

- billion received annually, highlighting the significance of crypto-based remittances.

- Growth of Cryptocurrency in Latin America:

- Crypto transaction value in Latin America increased by 42.5% year-on-year.

- Stablecoins like USDC and USDT show rising popularity amidst inflation and currency devaluation.

- Regulatory and Trust Aspects:

- Juno will operate independently for transparency and credibility of MXNB.

- Regular audits and public attestation reports will enhance user trust.

- Emerging Competition:

- Presence of other peso-pegged stablecoins, such as Tether’s MXNT.

- Market growth driven by both established and smaller players in the space.

“In Latin America, challenging macroeconomic conditions… drove increased cryptocurrency adoption.” – Bitso’s Report

Bitso Business Launches MXNB: A Strategic Entry into the Peso-Pegged Stablecoin Market

The recent launch of MXNB, a peso-pegged stablecoin by Bitso Business, signals an ambitious stride into the burgeoning cryptocurrency market in Mexico and Latin America. Compared to other players like Tether’s MXNT, which has already established its footing, Bitso’s product offers a distinctive competitive advantage by being fully fiat-backed, thereby possibly attracting users who prioritize security and trust. Managed by its subsidiary Juno, MXNB is positioned as an independent entity, enhancing consumer confidence with regular audits and transparent reserve management, which is crucial in a market often riddled with skepticism.

One significant advantage of MXNB is its alignment with the needs of foreign companies looking to invest and operate within Latin American economies. As Ben Reid, head of stablecoins, pointed out, the efficient transaction capabilities provided by MXNB could help mitigate monetary challenges like high intermediary costs and lengthy processing times that traditional finance encounters. This can position MXNB as a favored option in cross-border transactions, especially for businesses looking to streamline operations and minimize costs.

However, potential drawbacks exist. The stablecoin market in Mexico is already somewhat saturated with offerings like MXNT, MMXN, and others, creating a competitive environment that may dilute Bitso’s market share. While Bitso intends to cater to the growing demand for stablecoins, it must contend with the established user bases of these existing offerings—users who may be resistant to switching due to familiarity or perceived reliability.

The target beneficiaries of MXNB are likely to be international businesses seeking robust solutions for remittances and transactions in Mexico, particularly given the substantial remittance inflows that signal a strong market for crypto solutions. Yet, the emergence of new competitors might pose challenges for smaller local exchanges or individuals who rely on existing systems, as users may gravitate toward more popular, well-known brands unless Bitso can significantly differentiate itself.

Moreover, as the World Bank highlights the enormity of remittance flows into Mexico, MXNB’s success hinges upon its ability to capture a share of this lucrative market and convince users of the benefits over traditional methods. If positioned well, MXNB could not only facilitate smoother trade for large enterprises but also disrupt conventional financial systems, creating seamless pathways for money movement across borders.

Ultimately, while MXNB introduces fresh potential for enhancing financial efficiency within the region, it must navigate an intricate landscape of established players and varying consumer preferences to maximize its impact.