The cryptocurrency landscape is experiencing a significant transformation with the introduction of BlackRock’s USD Institutional Digital Fund, known as BUIDL. This innovative fund marks BlackRock’s first foray into tokenized money market funds, merging the traditional finance sector with blockchain technology. By allowing high liquidity, short-term debt instruments to be traded as cryptographic tokens, BUIDL aims to offer investors a secure place to invest their funds while earning returns.

As the world’s largest asset manager, BlackRock’s launch of BUIDL represents a critical institutional move towards integrating traditional finance with blockchain-based assets. The fund has already shown remarkable growth, escalating from $667 million to an impressive $1.8 billion in just three weeks. This surge is indicative of the increasing interest among both seasoned investors and those new to the digital asset space.

“In the year since BUIDL’s launch, we’ve experienced significant growth in demand for tokenized real-world assets, reinforcing the value of offering institutional-grade products onchain,” says Carlos Domingo, CEO and co-founder of Securitize.

With operations spanning seven different blockchains, including Ethereum and Solana, BUIDL is not only enhancing liquidity and accessibility for investors but also providing the allure of daily accrued dividends via a steady yield. This innovative approach allows for near-instant trading and settlements, a stark contrast to the slower processes often associated with traditional finance. As institutions begin to recognize the practicality of blockchain, the BUIDL fund stands poised to pave the way for greater capital inflows and wider acceptance within the financial sector.

While the fund showcases the potential of tokenization in modern finance, it also introduces new risks and challenges, such as liquidity concerns and the potential for market manipulation. Therefore, understanding these complexities becomes essential for investors looking to navigate this evolving financial ecosystem.

The strategic development of BUIDL highlights a pivotal moment in crypto history, where institutional giants are not just endorsing blockchain technology, but actively contributing to its mainstream adoption. With the ever-growing intersections between traditional finance and digital assets, BUIDL could serve as a vital catalyst for further integration of these two worlds.

What is BlackRock’s BUIDL Fund?

The BlackRock USD Institutional Digital Fund, known as BUIDL, represents a significant development in the intersection of traditional finance and blockchain technology. Here are the key points regarding this innovative fund:

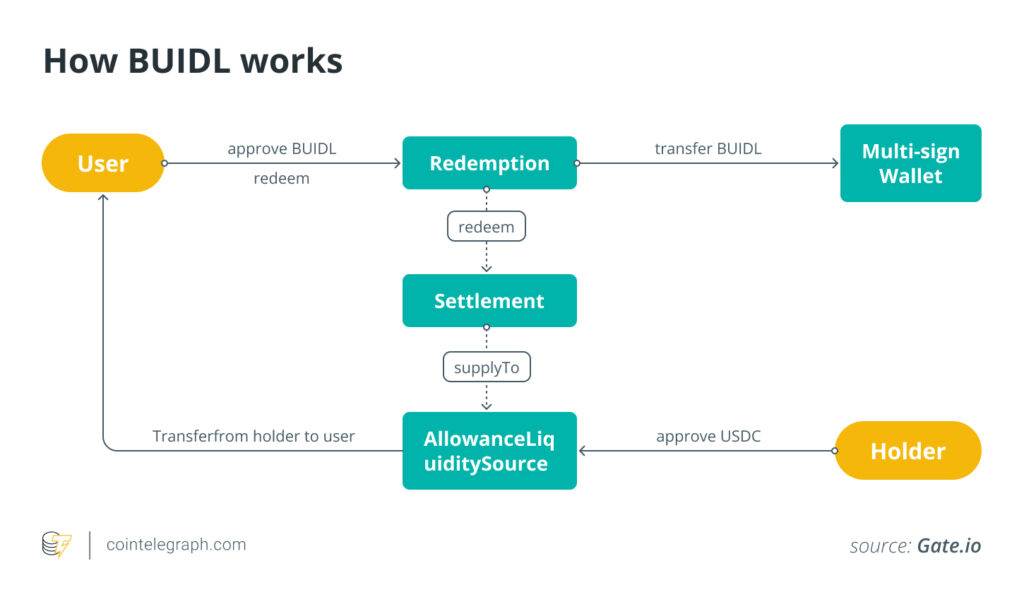

- Tokenized Money Market Fund: BUIDL is BlackRock’s first tokenized money market fund, allowing traditional financial products to be traded as cryptographic tokens on blockchains.

- Asset Growth: The fund experienced remarkable growth, increasing from $667 million to $1.8 billion in assets under management within three weeks.

- Investments in Stable Assets: BUIDL invests in dollar-equivalent assets like US Treasury bills, cash, and repurchase agreements, making it stable and secure for investors.

- Daily Dividend Payments: Investors earn daily yields through dividend payments in the form of new tokens, ensuring a steady income stream.

- Use of Blockchain Technology: The fund operates on multiple blockchains including Ethereum and Solana, leveraging the efficiencies of distributed ledger technology.

- Institutional Legitimacy: BUIDL’s launch marks a significant step towards mainstream acceptance of crypto assets by institutional investors.

- Accessibility and Liquidity: Unlike traditional funds with limited trading hours, BUIDL allows for 24/7 trading, enhancing liquidity and accessibility for investors.

- Bridge Between TradFi and Crypto: The BUIDL fund exemplifies the merging of traditional finance with blockchain, potentially attracting institutional investments and mainstream adoption of digital assets.

- Challenges and Risks: Investors should be aware of liquidity concerns, market volatility, and technical vulnerabilities associated with blockchain technology and smart contracts.

“The BUIDL fund’s early success might catalyze further institutional investment as mainstream adoption of cryptocurrencies continues to grow.”

These key aspects of BUIDL not only represent an evolution in investment strategies but may also impact readers looking to diversify their portfolios with innovative financial products. The combination of traditional finance with blockchain technology could provide new opportunities for securing assets and generating income while embracing the future of finance.

BlackRock’s BUIDL Fund: A Leap Towards Institutional Crypto Adoption

BlackRock’s launch of the BUIDL fund signifies a pivotal moment in the fusion of traditional finance and the blockchain space, positioning the firm as a trailblazer in tokenized money market funds. By trading traditional financial products as cryptographic tokens, BUIDL offers a unique proposition that could reshape how institutional investors engage with cryptocurrencies. However, this innovation comes with its own set of competitive advantages and drawbacks, especially when compared to similar offerings in the space.

Competitive Advantages of BUIDL

BlackRock’s stature as the world’s largest asset manager lends enormous credibility to BUIDL, which may attract a multitude of traditional investors looking for safer avenues into the cryptocurrency landscape. This fund capitalizes on rapid transaction speeds and 24/7 accessibility, significantly enhancing liquidity over traditional funds that often impose restrictive trading hours. Furthermore, BUIDL’s daily dividend payments empower investors to enjoy consistent returns, an attractive feature for those disillusioned by the volatility commonly associated with direct cryptocurrency investments.

In contrast to Franklin Templeton’s similar blockchain initiatives, which have already achieved substantial market caps, BUIDL is riding high on its immediate popularity, having skyrocketed to $1.8 billion in assets under management soon after launch. This strong traction demonstrates that institutional trust in crypto-based solutions may be more attainable than previously imagined, as evidenced by the fund’s quick uptake among crypto-focused institutions such as Ondo Finance.

Challenges Faced by BUIDL

However, BUIDL is not without its challenges. The technical vulnerabilities inherent in blockchain technology, especially concerning smart contract functions, present a palpable risk. An underlying reliance on Ethereum means that any instability or breach could jeopardize fund security. In addition, liquidity concerns grow as the current investor base aligns closely with accredited investors, possibly limiting broader market adoption. This contrasts sharply with more established competitors, which may have already built robust channels for widespread acceptance.

Moreover, given the nature of cryptocurrency markets, risks of market manipulation loom large. As BUIDL matures, the sector needs strategies to mitigate these risks effectively and protect investor interests.

Beneficiaries and Potential Pitfalls

Institutions aiming to step into the crypto realm can benefit significantly from BUIDL’s operational framework, as it affords a smoother transition by merging the reliability of traditional investments with the innovations of blockchain technology. Conversely, new entrants unfamiliar with the rapidly evolving landscape may face substantial challenges. Questions regarding regulatory compliance, risk management, and investor education remain paramount as institutions navigate this uncharted territory. Additionally, with every leap into digital assets, the specter of cryptocurrency’s high volatility and rapid technological changes presents a double-edged sword for institutions already wary of the ephemeral nature inherent in digital assets.

BlackRock’s BUIDL fund represents a leap toward crypto mainstream acceptance, striking a balance between traditional finance and innovative technology. The long-term success of BUIDL will hinge not just on investor interest, but on how effectively BlackRock and similar players manage the associated risks and challenges of this new investment frontier.