In a significant move that showcases the growing intersection of traditional finance and blockchain technology, asset management giant BlackRock has submitted a filing to create digital ledger technology (DLT) shares tied to its money market fund, the BLF Treasury Trust Fund. This innovative approach aims to utilize blockchain to maintain a transparent and secure record of share ownership, enhancing how investors interact with financial assets.

The DLT shares, which are designed for institutional investors and require a minimum initial investment of $3 million, will exclusively track BlackRock’s money market fund, currently holding over $150 million primarily in US Treasury bills and cash. The shares are to be managed through BlackRock Advisors and The Bank of New York Mellon (BNY), with BNY leveraging blockchain to create a “mirror record” of ownership, although they will not be tokenized like some other digital asset offerings.

“The shares are expected to be purchased and held through BNY, which intends to use blockchain technology to maintain a mirror record of share ownership for its customers,” BlackRock stated in its April 29 filing with the Securities and Exchange Commission.

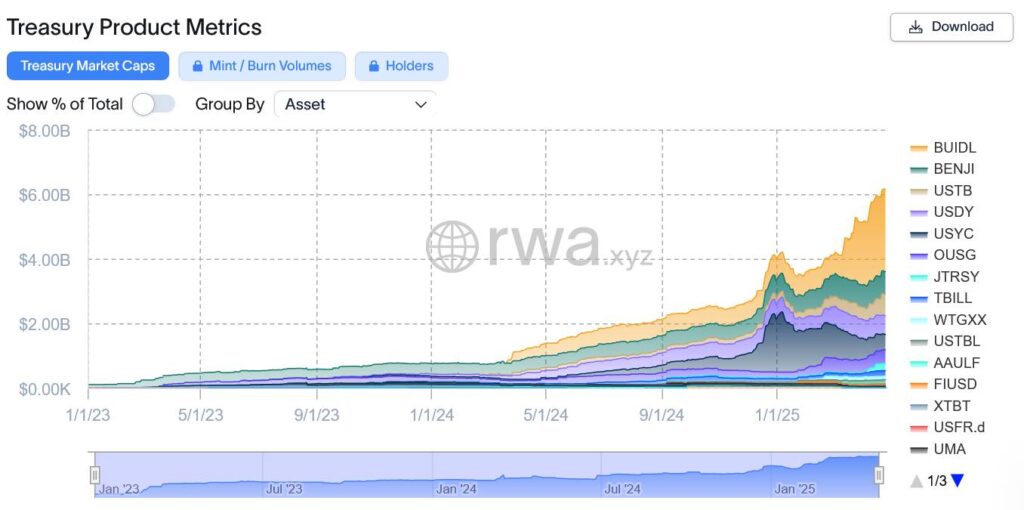

This development follows closely on the heels of Fidelity’s recent filing for an Ethereum-based OnChain share class, indicating a trend among major asset managers to explore blockchain’s capabilities deeply. As the treasury tokenization market gains traction, currently valued at $6.16 billion, the momentum suggests that major players in finance are keen on harnessing blockchain solutions to enhance transparency and efficiency in asset management.

BlackRock’s CEO, Larry Fink, has been vocal about the transformative potential of tokenization in the investment landscape, heralding it as a means to revolutionize how assets are treated in the financial ecosystem. With Ethereum emerging as a dominant platform for such innovations, along with significant contributions from networks like Stellar and Solana, the cryptocurrency landscape continues to evolve, influencing how financial instruments are structured and traded.

BlackRock’s Digital Ledger Technology Shares

BlackRock is venturing into the world of blockchain technology by filing to create digital ledger technology (DLT) shares for its Treasury Trust Fund. Here are the key points related to this development:

- DLT Shares Creation: BlackRock is proposing DLT shares from its money market fund to maintain a mirror record of share ownership for investors.

- Investment Fund Details: The shares will track the BlackRock BLF Treasury Trust Fund (TTTXX), which holds over $150 million in assets mainly invested in US Treasury bills and cash.

- Purchase Process: DLT shares can only be purchased through BlackRock Advisors and The Bank of New York Mellon (BNY).

- Ownership Verification: The blockchain technology will serve as a transparency tool to verify ownership, with traditional book-entry records maintained as the official ledger.

- Initial Investment Requirements: Institutions will need a minimum initial investment of $3 million to purchase DLT shares.

- Market Trends: BlackRock’s filing follows similar initiatives in the industry, such as Fidelity’s proposed Ethereum-based OnChain share class.

- Growing Blockchain Interest: Major asset managers are exploring blockchain for tokenizing Treasury bills and bonds as the technology gains traction in finance.

- Valuation of Tokenization Market: The treasury tokenization market is valued at $6.16 billion, showcasing significant growth potential in this niche.

- Heavyweight Interest in Tokenization: Blockchain is becoming increasingly popular among large firms, indicating a shift in traditional investing practices.

- Future of Investing: BlackRock’s CEO foresees the potential of RWA tokenization to revolutionize the investment landscape.

The implications of these developments could significantly impact investors by offering new avenues for liquidity and ownership transparency. As financial institutions adopt blockchain technologies, investors may see increased efficiency and reduced costs in their transactions.

BlackRock’s Digital Shares: A Game Changer or Just Another Trend?

The recent move by BlackRock to introduce digital ledger technology (DLT) shares for its BLF Treasury Trust Fund positions the asset management titan at the forefront of integrating blockchain into mainstream finance. This strategic launch offers a glimpse into the future of asset management, echoing similar endeavors by competitors like Fidelity, which recently filed for an Ethereum-based OnChain share class. Both firms are navigating the evolving landscape of treasury tokenization, yet they chart distinct paths through innovation.

Competitive Advantages: BlackRock’s DLT shares emphasize accountability and transparency by employing blockchain to create a mirror record of ownership. This approach not only enhances investor trust but aligns with the growing demand for robust verification methods in finance. The firm’s notable asset backing, over $150 million in US Treasury bills, reinforces the credibility of these digital shares, catering particularly to institutional investors with the hefty $3 million initial investment threshold. It distinguishes itself through the integration of a more traditional ownership ledger alongside the blockchain feature, aimed at combining innovative technology with established practices.

Disadvantages and Challenges: However, BlackRock faces significant challenges. For one, the exclusive purchasing route—only through BlackRock Advisors and The Bank of New York Mellon—could limit market accessibility, particularly for smaller institutional investors. Additionally, the absence of a proposed ticker or management fee may hinder investment enthusiasm in the short term, potentially leaving investors hesitant. In contrast, Fidelity’s approach of entering the Ethereum ecosystem could attract a different demographic keen on the digital asset space, giving its offerings a competitive edge.

This focus on Ethereum could pose problems for BlackRock, as market participants and investors might prefer the perceived innovation and flexibility of Ethereum tokenization over BlackRock’s more conservative framework. Furthermore, as the total addressable treasury tokenization market grows to a promising $6.16 billion, the competition intensifies. Firms like Franklin Templeton with their Franklin OnChain US Government Money Fund are also in the game, which could dilute market share and attract similar institutional interests.

The implications of these advancements are profound. Institutional investors seeking transparency and streamlined processes could greatly benefit from BlackRock’s innovative approach. However, traditionalists within the financial sector may view these changes with skepticism, worrying about the overabundance of digital products amidst regulatory growing pains. With industry leaders like Larry Fink promising revolutionary changes through RWA tokenization, the coming months will be crucial in determining which firm can capitalize on this nascent market trend and establish dominance while potentially reshaping investor perceptions in the process.