In a significant development for the cryptocurrency world, BlackRock’s innovative tokenized money market fund, known as the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), has officially expanded its presence to the Solana blockchain. This exciting move comes as the fund’s market capitalization approaches an impressive billion, highlighting its growing popularity in the rapidly evolving digital asset landscape.

“We aim to make offchain assets unboring,” said Michael Sonnenshein, COO of Securitize, emphasizing the fund’s vision of modernizing traditional money market dynamics.

Launched in March 2024 in partnership with Securitize, BUIDL has made a remarkable impact, currently boasting a market cap of .7 billion and capturing nearly 34% of the market for tokenized United States Treasuries. This growth trajectory is particularly impressive, as the fund has doubled its market capital in just seven months, rising from 0 million in mid-July to its current valuation. As part of its commitment to investor returns, BUIDL distributes monthly dividends, amounting to a notable million paid out to holders as of August.

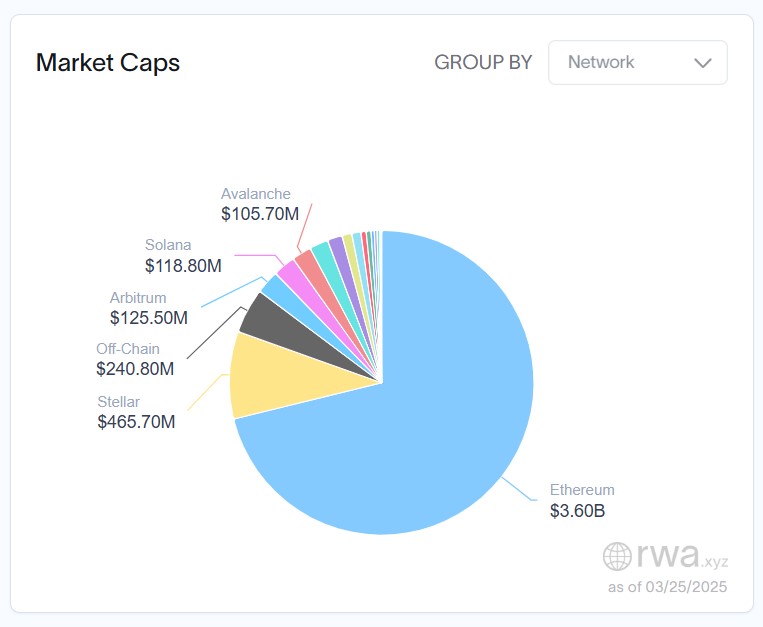

The expansion to Solana, announced by Carlos Domingo, Securitize’s CEO, occurs against a backdrop of a broader trend towards multichain developments, marking the fund’s integration into various blockchain ecosystems. Prior to Solana, BUIDL successfully ventured onto other notable networks including Aptos, Arbitrum, Avalanche, Optimism, and Polygon. While Ethereum remains the leading platform with a significant market capitalization of .6 billion, BUIDL’s entry into Solana illustrates a strategic move to diversify its investor base and further its influence in the tokenized asset market.

This evolution in the cryptocurrency sector confirms that tokenized assets are redefining how traditional finance interacts with the digital world, making what was once seen as a niche avenue something increasingly accessible and attractive to a wider audience.

BlackRock’s Tokenized Money Market Fund Expansion

BlackRock’s movement into the blockchain space through its USD Institutional Digital Liquidity Fund (BUIDL) represents a significant shift in how real-world assets (RWA) can be tokenized and leveraged. Here are the key points surrounding this development:

- Launch of BUIDL: BlackRock launched BUIDL in March 2024 in collaboration with Securitize.

- Expansion to Solana: BUIDL has recently expanded to the Solana blockchain, enhancing its accessibility and appeal to investors.

- Market Capitalization Growth: The fund’s market capitalization has surged to .7 billion, indicating strong market interest and confidence.

- Dominance in Tokenized Treasurys: BUIDL leads the Tokenized US Treasurys market with a 34% market share, outperforming other competitors like Hashnote and Franklin Templeton.

- Significant Dividends: The fund pays out dividends, having distributed million to holders in August 2024, showcasing its profitability.

- Multichain Strategy: Prior to Solana, BUIDL expanded to multiple blockchain networks, indicating a strategy aimed at attracting a broader investor base.

- Comparison with Ethereum: Despite the expansions, Ethereum remains a leader in the tokenized treasuries market, with a market cap of .6 billion.

The advancement of BUIDL into different blockchain ecosystems demonstrates the evolving landscape of asset tokenization and its potential impact on traditional finance, making investments potentially more accessible to a wider audience.

These developments may impact readers by offering new investment opportunities and shaping the future of asset management. As tokenized funds like BUIDL gain traction, individuals may find innovative ways to diversify their portfolios and participate in the digital asset economy.

BlackRock’s BUIDL on Solana: A Game Changer or a Risky Move?

BlackRock’s foray into the realm of tokenized funds through its USD Institutional Digital Liquidity Fund (BUIDL) is certainly making waves, especially with its expansion into the Solana blockchain. As the fund approaches a market cap of billion, it’s essential to analyze the competitive landscape of tokenized money market funds and the implications of this growth.

Competitive Advantages: One of BUIDL’s significant advantages lies in its swift rise to dominance within the tokenized US Treasurys sector. With a 34% market share and a staggering 240% growth since its inception, BlackRock is clearly capitalizing on the demand for alternative financial products that promise liquidity and returns. This momentum is complemented by its partnership with Securitize, which adds credibility and technological prowess, potentially allowing BUIDL to attract traditional investors looking for modern solutions. Furthermore, expansion into Solana, known for its high-speed transactions and lower fees, could enhance user experience and network scalability, further developing investor interest.

Potential Disadvantages: However, this expansion doesn’t come without its challenges. Despite BlackRock’s advancements, Ethereum continues to hold a lion’s share of the market with 72% of tokenized treasuries, highlighting a possible over-reliance on Solana’s growth. There’s also the inherent risk associated with investing in newer blockchain ecosystems, as factors like network congestion can lead to instability. Additionally, while BlackRock aims to “make off-chain assets unboring,” this tagline may not sufficiently appeal to risk-averse investors accustomed to traditional money markets.

The timing of BUIDL’s expansion also plays a crucial role. Among the various competitors, including Hashnote and Franklin Templeton, there is a growing concern about market saturation and the potential for diminished returns across companies vying for the same investor base.

Who Benefits? Who Faces Challenges? The successful appeal of BUIDL’s product could mean substantial gains for institutional investors seeking yield in a low-interest-rate environment. Additionally, the tech-savvy demographic interested in exploring decentralized finance may find the product attractive. On the flip side, traditional investors who may not fully understand or trust newer blockchain technologies could feel alienated. Moreover, other tokenized treasury providers may find themselves under pressure to innovate rapidly or risk falling behind BlackRock’s pace of growth.

Ultimately, while BlackRock’s move to Solana could usher in a new wave of investment opportunities, it equally presents challenges for various stakeholders in the evolving landscape of tokenized finance.