In an exciting development for the cryptocurrency landscape, Bloomberg Intelligence has significantly increased its projections regarding the likelihood of U.S. regulators approving a Solana exchange-traded fund (ETF) by 2025. According to a recent post on the X platform, the odds have now surged to a striking 90%, up from a previous estimate of 70% made just a few months ago. Analyst Eric Balchunas also noted more favorable chances for other altcoin ETFs, such as those linked to XRP and Dogecoin.

This uptick in optimism is reflective of an evolving regulatory climate, with six asset managers, including notable names like Grayscale and VanEck, eagerly awaiting clearance from the U.S. Securities and Exchange Commission (SEC) to list these innovative investment products. Bloomberg’s data indicates that the same number of firms is also pursuing approval for XRP ETFs, while three more are seeking to launch Dogecoin funds.

“The SEC has until October to review and potentially approve the proposed funds,” Bloomberg noted, highlighting the urgency and anticipation surrounding these applications.

The growing interest in altcoin ETFs has caught the eye of asset managers across the industry, with approximately 70 crypto ETF filings waiting for SEC review as of April. This flood of applications comes amid increasing efforts by policymakers to soften the regulatory stance on cryptocurrencies. Notably, the Chicago Mercantile Exchange recently began offering futures contracts tied to Solana, which could pave the way for more positive developments in the ETF space.

As the SEC prepares to evaluate these proposals, analysts remain cautious yet hopeful. While Bloomberg’s research suggests a timeline for approval could extend into 2026 due to the Commission’s extensive review process, the prospect of Solana, XRP, and Dogecoin ETFs is generating considerable excitement within the cryptocurrency community.

Bloomberg’s Increased Odds for Solana ETF Approval in 2025

The recent analysis from Bloomberg Intelligence highlights significant developments in the cryptocurrency ETF landscape, specifically regarding Solana and other altcoins. Here are the key points to consider:

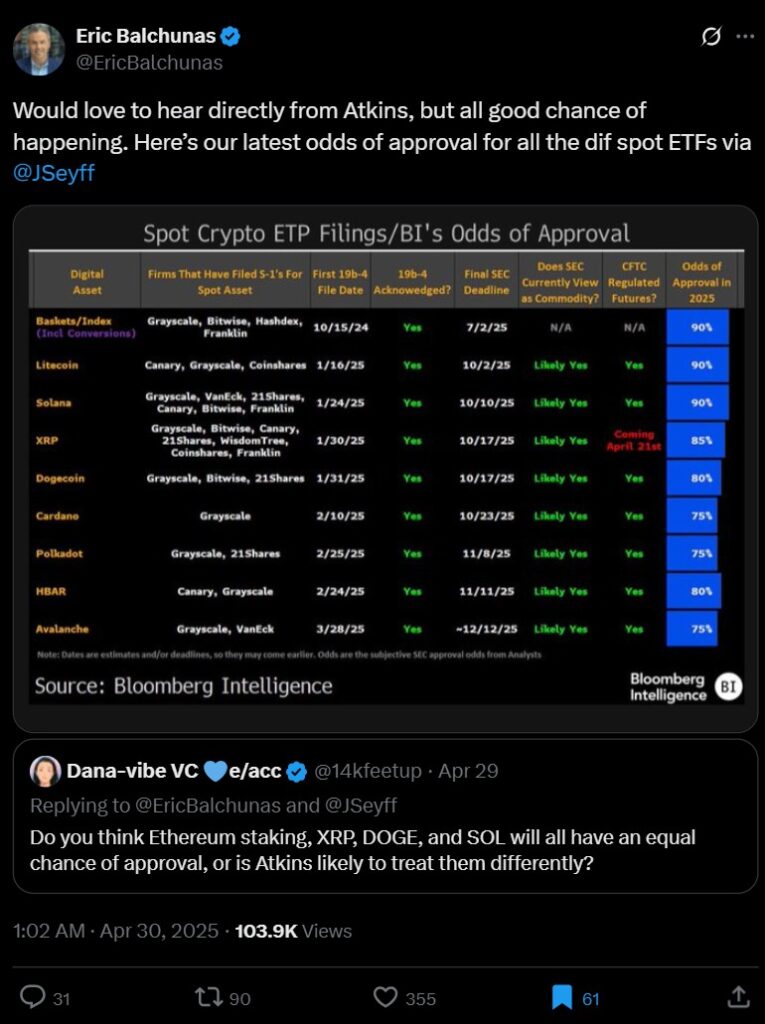

- Boosted Approval Odds: Bloomberg has raised the likelihood of US regulators approving a Solana ETF in 2025 to 90%, up from 70% previously.

- Improved Outlook for Altcoins: The approval chances for other altcoin ETFs, such as those for XRP (65%) and Dogecoin (75%), have also seen favorable adjustments.

- Pending Applications: Six asset managers, including notable firms like Grayscale and VanEck, are currently awaiting SEC clearance for Solana ETFs, with the same number hoping for approvals for XRP ETFs.

- Crypto ETF Filings Surge: A total of up to 70 crypto ETF filings are under SEC review, indicating a significant interest in altcoin ETFs.

- Impact of Regulatory Posture: These filings have been influenced by efforts from US government figures to temper the SEC’s regulatory stance toward cryptocurrencies.

- Timeline Considerations: The SEC has until October to review the proposed ETFs, though the overall approval timeline could extend into 2026 based on past practices.

- Market Signals: The CME’s listing of Solana futures has been interpreted as a precursor to potential ETF approvals, possibly influencing market sentiment favorably.

“The timeline could extend into 2026 due to the SEC’s precedent of taking 240–260 days to review filings.” – James Seyffart, Bloomberg Analyst

Understanding these developments is crucial for investors and stakeholders in the cryptocurrency space, as they may influence investment decisions, market trends, and regulatory expectations moving forward.

Bloomberg’s Solana ETF Approval Odds: A Game Changer for Altcoins

The recent surge in Bloomberg Intelligence’s projected odds for a Solana exchange-traded fund (ETF) to 90% approval by 2025 is a significant development in the cryptocurrency landscape. This positive forecast is not just confined to Solana; it also extends to other altcoin ETFs such as those for XRP and Dogecoin, indicating a broader optimism about the regulatory environment surrounding cryptocurrencies. Previously, the odds for a Solana ETF were set at a mere 70%, with even lower expectations for XRP and DOGE. These heightened probabilities signal a crucial shift in investor sentiment and regulatory acceptance.

Competitive Advantages

The increase in Solana ETF approval odds positions it favorably against competing cryptocurrencies, enhancing the appeal of altcoins in a market previously dominated by Bitcoin and Ethereum. As major asset managers like Grayscale and VanEck gear up for potential listings, the increased institutional interest could create additional upward momentum for Solana and its peers. This is particularly important as ETFs typically attract more retail and institutional investors, providing a more accessible entry point into cryptocurrency investments. Moreover, the fact that the SEC has acknowledged the influx of ETF filings implies a potential softening of the agency’s stringent stance toward crypto, making now an opportune moment for altcoins to gain traction in the US market.

Disadvantages and Challenges

Beneficiaries and Potential Issues