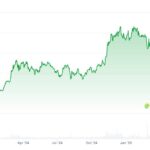

In a significant move that could reshape the landscape of cryptocurrency investment, David Bailey, known for his advisory role to former President Trump on crypto matters, is joining forces with the Bitcoin-native holding company Nakamoto. Together, they are merging with KindlyMD®, a health-focused entity, to establish a robust Bitcoin treasury business. This ambitious venture aims to create a powerful investment firm with an initial capital infusion of $300 million dedicated to Bitcoin.

This merger marks a pivotal step for Bailey, who is looking to capitalize on the increasing interest and adoption of cryptocurrencies. According to various reports, the newly formed company is set to navigate the ever-evolving market, leveraging Bitcoin’s potential as a store of value and medium of exchange. With Bailey’s experience and connections, particularly from his tenure as a crypto advisor, this partnership could signal a new era for public investments in Bitcoin.

“We are committed to building a Bitcoin treasury that can withstand market fluctuations and provide sustainable returns,” said Bailey in a recent press release.

The strategic collaboration highlights a growing trend among traditional sectors looking to integrate cryptocurrencies into their business models. Bailey’s vision aligns with the broader movement of institutional interest in Bitcoin, as more companies begin to understand its transformative potential. As the crypto market continues to evolve, the establishment of this Bitcoin treasury could set a precedent for future investment strategies in the digital asset space.

With the increasing legitimacy of Bitcoin, this merger not only adds to the financial landscape but also underscores the diverse applications of cryptocurrency beyond traditional investments. The combined expertise of Bailey and Nakamoto, along with their entry into public markets, could reshape how investors view Bitcoin as a viable asset class.

David Bailey’s Bitcoin Treasury Merger with KindlyMD

Key points regarding the merger between David Bailey’s Bitcoin-native holding company Nakamoto and KindlyMD to establish a Bitcoin Treasury:

- Merger Announcement:

- David Bailey’s Nakamoto is merging with KindlyMD to launch a Bitcoin Treasury.

- The merger signals a strategic move within the cryptocurrency industry aimed at enhancing investment opportunities.

- Investment Scale:

- The new venture is backed by a $300 million investment initiative.

- This significant capital infusion could lead to increased market confidence in Bitcoin as a legitimate investment.

- David Bailey’s Background:

- Bailey has experience as a cryptocurrency advisor to former President Trump.

- His prominent background may lend credibility to the new firm and attract potential investors.

- Market Implications:

- The establishment of a Bitcoin Treasury could deepen institutional investment in cryptocurrencies.

- As more traditional companies venture into crypto holdings, this could impact the average investor’s confidence and interest in Bitcoin.

- Potential Reader Impact:

- Investors may consider diversifying into Bitcoin or related assets as new firms like Nakamoto emerge.

- Public communication regarding the merger could lead to increased Bitcoin market volatility, affecting existing holdings.

David Bailey’s Bitcoin Merger: A Game Changer or a Risky Gamble?

The recent merger between David Bailey’s Bitcoin-native holding company, Nakamoto, and KindlyMD® is making waves in the cryptocurrency and investment landscape. With a bold plan to launch a Bitcoin Treasury valued at $300 million, this move could position Bailey as a leading figure in the digital currency arena. This merger not only expands Nakamoto’s footprint in the ever-growing Bitcoin market but also aims to pioneer innovative investment strategies that leverage the potential of digital assets.

One of the competitive advantages of this merger is its association with David Bailey, a notable figure who has previously served as a crypto advisor to former President Trump. His political connection may attract institutional investors who are cautious about entering the cryptocurrency space. This merger aims to present a sense of legitimacy and confidence to those wary of Bitcoin’s volatility, potentially benefiting seasoned investors who prefer a structured approach to cryptocurrency.

However, there are challenges and risks associated with this ambitious venture. The cryptocurrency market is notoriously unpredictable, and coupling a $300 million investment with a relatively nascent firm raises eyebrows. Additionally, regulatory scrutiny in the rapidly evolving cryptocurrency landscape could pose obstacles, creating uncertainty for new investors. This combination of volatility and regulatory risk may create problems for more risk-averse individuals or institutions considering exposure to the digital currency market.

Moreover, while the merger promises exciting opportunities, it could also lead to fragmentation within the crypto investment space if Nakamoto fails to deliver on its ambitious goals. Mainstream cryptocurrency platforms like Coinbase and Binance already have established market positions; thus, Nakamoto will need to clearly distinguish itself to gain a significant market share. The potential for confusion or lack of trust among investors could hinder growth aspirations.

In summary, David Bailey’s merger with KindlyMD® is poised to attract both interest and skepticism, presenting unique opportunities for those willing to navigate the complexities of Bitcoin investment, while simultaneously creating hurdles for those lacking confidence in this volatile sector.