The world of cryptocurrency is expanding rapidly, and bridging assets to Solana is becoming an increasingly popular way to diversify digital portfolios. Solana, known for its quick transaction speeds and efficient smart contract capabilities, offers significant advantages to users, particularly in areas like decentralized applications (DApps), decentralized finance (DeFi), and non-fungible tokens (NFTs). Bridging allows users to transfer their assets from various blockchains to Solana seamlessly, opening up a realm of possibilities in this vibrant ecosystem.

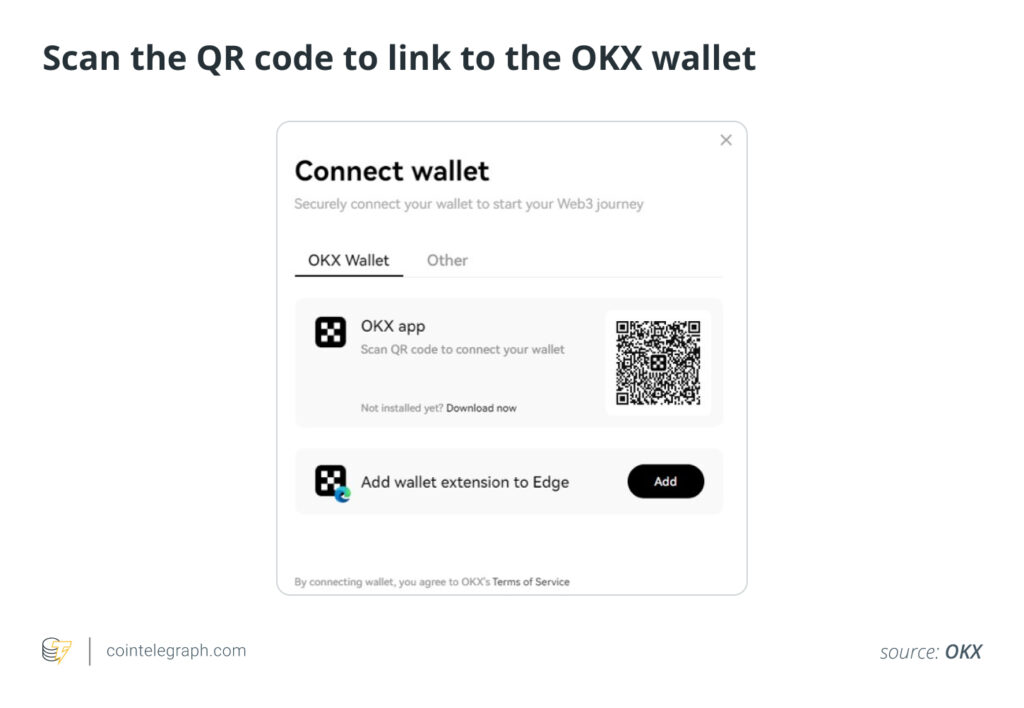

Decentralized platforms such as Portal have risen to the occasion, providing a user-friendly way to bridge assets across multiple blockchains. With just a few clicks, users can connect their wallets and transfer tokens in a matter of minutes. For those who prefer a more familiar interface, centralized platforms like OKX and Binance offer secure alternatives that link directly to their exchange accounts. Regardless of the method chosen, users are encouraged to become acclimated with the bridging process, which involves connecting source and destination wallets, inputting transaction details, and confirming transfers.

“Bridging to Solana doesn’t have to be a stressful experience. With the right resources and guides, anyone can navigate this process safely and efficiently.”

Despite the incredible potential of asset bridging, it also carries certain risks, such as transaction mistakes and security vulnerabilities. However, with detailed guides and step-by-step instructions available, even those unfamiliar with blockchain technology can learn how to bridge to Solana confidently. By leveraging established tools like Wormhole for secure asset transfers and using reputable wallets, users can minimize risks and enhance their crypto journeys.

As the digital asset landscape continues to evolve, understanding the intricacies of bridging between chains is vital for any crypto enthusiast aiming to fully tap into the benefits of Solana’s thriving network. Whether exploring the latest DApps, engaging in DeFi projects, or trading NFTs, bridging assets to Solana opens doors to a dynamic world of digital opportunities.

Bridging Assets to Solana: Key Points

Bridging assets to Solana opens up exciting opportunities for digital asset diversification, ranging from DApps to DeFi. Below are the essential takeaways that can help you navigate the process effectively:

- Diverse Asset Access:

Bridging to Solana allows users to diversify their digital asset portfolio across multiple chains, unlocking Solana’s robust Web3 ecosystem.

- Bridging Platforms:

- Decentralized platforms like Portal enable quick asset transfers between multiple blockchains with user-friendly interfaces.

- Centralized platforms like OKX and Binance serve as safer alternatives for users hesitant about decentralized options.

- Bridging Process Explained:

- Connect your source and destination wallets.

- Input transaction details and confirm the transfer.

- Be prepared for potential fees and wait for confirmation of your transaction.

- Understanding Risks:

Bridging may involve risks such as transaction mistakes or smart contract vulnerabilities. Awareness of these can help you minimize potential losses.

- Step-by-Step Guidance Available:

Utilize resources that provide detailed, illustrated processes for bridging to Solana, making it easier for those less tech-savvy to engage.

- Security Measures:

Researching bridge options, using hardware wallets, and ensuring wallet software is updated can enhance security during asset transfers.

- Regulatory Considerations:

Staying informed about legal and regulatory compliance regarding crosschain activities can protect you from unexpected restrictions.

“Bridging your assets could fundamentally change how you interact with the blockchain ecosystem, allowing you to explore new opportunities and manage your portfolio more effectively.”

Bridging to Solana: Pros, Cons, and Market Dynamics

Bridging assets to Solana represents an exciting advancement within the blockchain landscape, particularly as users look to diversify their digital portfolios. Solutions like Portal transformed the bridging process with efficient interfaces, allowing for quick and seamless transitions between multiple blockchains. Centralized platforms like OKX and Binance also provide accessibility for users hesitant to engage with decentralized mechanisms, thus catering to a broader audience.

Competitive Advantages: The interoperability touted by bridging solutions is a significant advantage. For users exploring Solana’s ecosystem, which is known for its robust DApps, DeFi opportunities, and vibrant NFT marketplace, bridging makes this exploration tenable. Decentralized bridges such as Wormhole and Portal enhance security through locking and minting assets, potentially giving users confidence in their trading and investment strategies. In contrast, centralized exchanges offer a familiar user experience with quicker onboarding processes, appealing to less tech-savvy individuals.

Disadvantages: Each method of bridging has its own drawbacks. Decentralized platforms, while innovative, can be intimidating due to the risks associated with smart contract vulnerabilities and transaction errors, which are more pronounced in a decentralized setup. Furthermore, the complex steps required for a successful transfer might deter casual users. On the other hand, centralized exchanges can pose risks regarding user privacy and custody over assets, ultimately raising concerns for users keen on maintaining control over their cryptocurrencies.

Bridging solutions primarily benefit crypto enthusiasts actively looking to maximize their investment opportunities. Users eager to leverage Solana’s potential for trading or staking can find these platforms invaluable. Conversely, users new to digital assets or those concerned about security may feel overwhelmed by the technical aspects or deterred by the centralized control inherent in some solutions. Additionally, as the regulatory landscape continues to evolve, bridging platforms must tread carefully, as shifting regulations could complicate their operational capabilities and limit user access.