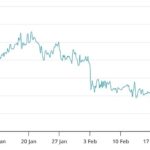

The cryptocurrency industry is buzzing following a significant security breach at Bybit, the world’s second-largest cryptocurrency exchange. An attacker reportedly exploited security protocols during a routine transfer, leading to an estimated loss of .5 billion and triggering a wave of panic among users. With Bybit managing around billion in customer assets, this incident not only raised alarms about the platform’s security measures but also highlighted broader vulnerabilities within the crypto space.

“One of the primary reasons for this and past breaches stems from human error rather than flaws in the underlying blockchain technology.”

Initial investigations indicated that the breach involved a custom-built security implementation using Gnosis Safe, a multi-signature wallet. The attacker managed to deploy malicious code that transformed what should have been a secure transfer into an altered contract. As a result, users rushed to withdraw funds, with approximately 350,000 withdrawal requests flooding the platform.

Despite the substantial sum lost, it is noteworthy that this breach constitutes less than 0.01% of the overall cryptocurrency market capitalization, emphasizing how the industry has matured to handle such operational challenges. Bybit has reassured its customers that unrecovered funds will be covered through reserves or loans, reflecting its evolving response strategy.

“Human error remains the primary vulnerability, often arising from mismanagement of private keys or vulnerability to social engineering attacks.”

Research over the last decade shows a consistent trend: breaches in the cryptocurrency sector are predominantly driven by human missteps rather than technical faults. For instance, in 2024 alone, roughly .2 billion was reported stolen, with many breaches occurring due to organizations failing to adopt established security measures or refusing to accept responsibility for their systems.

To bolster security in this evolving landscape, the need for a more human-centric approach has become evident. Security systems must not only focus on technical defenses but should also account for everyday human errors. This includes integrating behavioral monitoring to detect anomalies and creating a security framework that anticipates potential vulnerabilities.

“The cryptocurrency sector must transition from overly simplistic security measures to more robust, multi-factor authentication systems that recognize the inevitability of human error.”

For users, investing in hardware wallets is recommended as a protective measure, although many still prioritize convenience over security. As the industry continues to navigate these challenges, it is clear that the future of cryptocurrency security lies in a balanced approach—one that addresses both technological and human elements, fostering a more secure digital financial ecosystem.

Key Points on Bybit’s Security Breach and Human-Centric Security Solutions

This section outlines the significant aspects of the Bybit security breach and its implications for the wider cryptocurrency community and individual users.

- Bybit Breach Overview

- Bybit experienced a security breach involving .5 billion, attributed to a vulnerability during a routine wallet transfer.

- This incident triggered around 350,000 withdrawal requests from users seeking to secure their funds.

- While significant, the loss was less than 0.01% of the total cryptocurrency market capitalization.

- Human Error as a Primary Vulnerability

- Historical patterns show that human error, not technical flaws, is often the main factor in security breaches.

- Mismanagement of private keys and social engineering remain prevalent security threats.

- Need for Human-Centric Security Solutions

- Current security investments heavily favor technology over addressing human factors in security breaches.

- Organizations often fail to acknowledge their security responsibilities, creating blind spots for attackers.

- The shift towards a human-centric security framework is necessary to mitigate vulnerabilities effectively.

- Actionable Steps for Comprehensive Security

- Encouraging the use of hardware wallets among individual users to enhance personal security.

- Exchanges should implement tiered authorization systems and context-sensitive security education.

- Organizations must clearly define security responsibilities to avoid undermining their efforts.

- Evolution of Cryptocurrency Security

- The industry must prioritize adapting proven security methods from traditional finance to address vulnerabilities.

- Future systems should anticipate human mistakes and integrate behavioral anomaly detection for suspicious activities.

“The key to effective cryptosecurity lies not in eliminating all human error but in designing systems that remain secure despite inevitable human mistakes.”

Bybit’s Security Breach: Implications for the Cryptocurrency Landscape

The recent incident at Bybit, the second-largest cryptocurrency exchange globally, highlights critical shortcomings within the cybersecurity framework of the digital asset sector. This breach, which resulted in substantial capital at stake and prompted an avalanche of withdrawal requests, isn’t just a Bybit problem; it’s reflective of pervasive issues within the cryptocurrency ecosystem. Many exchanges and organizations share similar vulnerabilities, primarily rooted in human error rather than technical failures. As the industry grapples with these challenges, Bybit’s incident offers a pivotal lesson for both competitors and consumers.

Competitive Advantages and Disadvantages

Bybit’s rapid response to the security breach — including assurances of reimbursement for unrecovered funds — demonstrates its commitment to maintaining customer trust. This proactive communication strategy may appeal to potential customers wary of trusting their assets to exchanges with less established reputations. However, Bybit’s reliance on a customized security solution also raises alarms, as it reflects a broader trend across crypto exchanges where unique systems often lead to overlooked vulnerabilities. This adherence to bespoke security protocols could deter users who favor platforms employing widely accepted, foundational cybersecurity measures.

In contrast, competitors who prioritize standardized security frameworks may find themselves in a more favorable position when appealing to security-conscious consumers. For instance, platforms integrating time-tested multi-factor authentication and risk mitigation strategies might not only avert similar breaches but also build stronger reputations amongst users concerned about the safety of their assets. Nevertheless, their reliance on conventional systems might come at the cost of innovation and speed, something that crypto enthusiasts often value.

Who Stands to Gain or Lose?

In the aftermath of this breach, institutional players within the crypto space could see a dramatic shift in user sentiment, leading to increased scrutiny of security practices. Users who have been swayed by the allure of decentralization and autonomy might reassess their trust in the system, potentially gravitating toward platforms that emphasize robust, human-centric security measures. Conversely, exchanges that continue to rely on traditional security methods without adapting to the evolving landscape may find themselves at risk of losing market share as customers seek platforms that are not only innovative but also secure.

Additionally, regulatory bodies could capitalize on Bybit’s incident to push for more stringent security standards across the sector. However, if new regulations impose excessive constraints, they might hinder innovation, creating a dichotomy in the industry between risk-averse entities and those willing to push boundaries at the cost of security. The balance between innovation and safeguarding users will be a crucial area of exploration and debate moving forward.

As the cryptocurrency sector evolves, the Bybit incident serves as a crucial reminder: addressing human factors in security is not just an option but a necessity. Both organizations and users must recognize that human errors contribute significantly to breaches, advocating for a paradigm shift that prioritizes security measures resilient to such fallibilities. In this rapidly changing landscape, the organizations willing to embrace this shift will likely emerge stronger, reinforcing their status as leaders in a more secure digital financial ecosystem.