In a significant move for the cryptocurrency landscape, United States asset manager Canary Capital has submitted a filing to launch an exchange-traded fund (ETF) dedicated to the Tron blockchain’s native token, TRX. This ETF aims to not only hold spot TRX but also to stake a portion of the tokens – a strategy that is expected to provide added yield. According to CoinMarketCap, TRX currently boasts a market capitalization exceeding $22 billion, highlighting its prominence in the digital currency sphere.

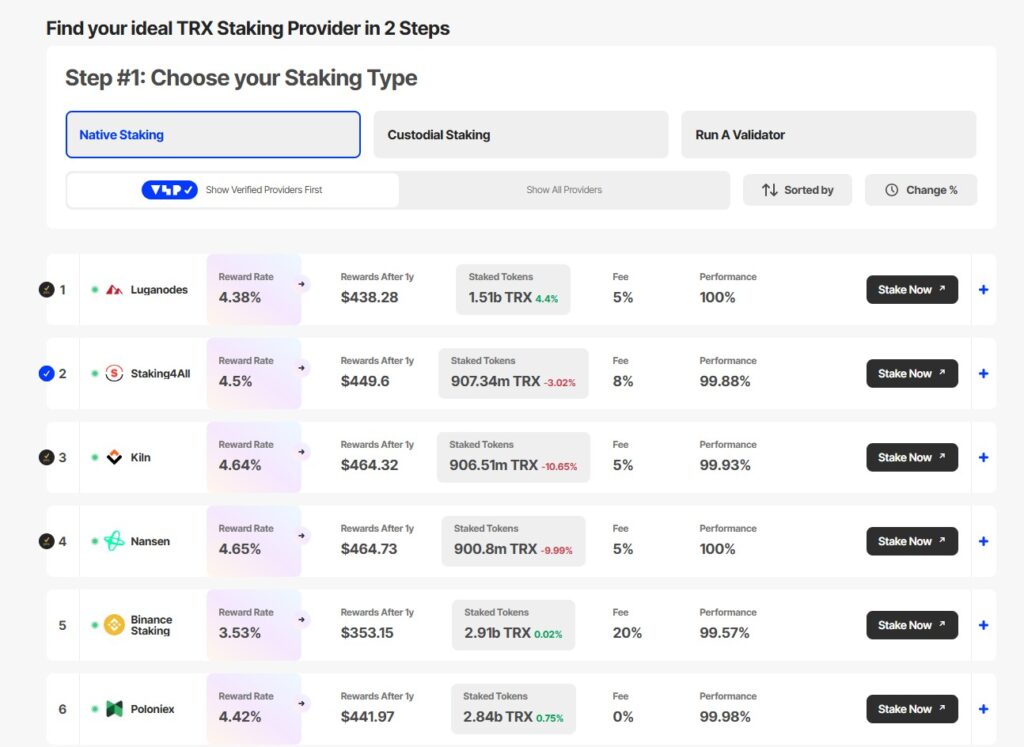

The staked TRX is projected to generate an annual yield of around 4.5%, as reported by Stakingrewards.com, making this ETF particularly noteworthy. Unlike other recently proposed ETFs which have sought permission to integrate staking services only after securing initial approval for their listings, Canary’s application is pushing the envelope by requesting this capability right from the start.

Tron, founded by Justin Sun, operates as a proof-of-stake blockchain network and has garnered attention both for its technological ambitions and its controversies. Notably, Sun’s legal saga with the SEC over allegations of fraudulent activities tied to the TRX token has added a layer of complexity to its reputation. Nonetheless, the interest in alternative cryptocurrencies, or “altcoins,” is evident, as recent years have seen a surge in ETF filings aimed at these digital assets.

“Most crypto ETFs will fail to attract AUM and cost issuers money,” comments crypto researcher Alex Krüger, reflecting skepticism about the acceptance of altcoin ETFs by mainstream investors.

As the regulatory landscape continues to evolve, and amidst an increasing number of crypto ETF filings—ranging from those focusing on core layer-1 tokens to more niche options like memecoins—the market is poised for further developments. Canary’s latest proposal stands out in this wave of interest and presents an intriguing chapter in the ongoing story of cryptocurrency investment products.

Canary Capital’s Proposed TRX ETF: Key Insights

This article discusses the filing by Canary Capital to launch an ETF focused on the TRX token, highlighting its potential impact on investments and the cryptocurrency market.

- ETF Introduction for TRX: Canary Capital aims to list an ETF that will hold TRX and stake a portion of the tokens for additional yield.

- Market Capitalization: The TRX token boasts a market capitalization of over $22 billion, indicating its significance in the crypto market.

- Staking Yield: Staking TRX provides an annualized yield of approximately 4.5%, which could attract investors seeking passive income.

- Unique Staking Request: Unlike other ETFs that seek staking permission post-listing, Canary’s proposal is unique in requesting it upfront, potentially setting a new precedent.

- Regulatory Landscape: The ETF filing comes amid a surge of crypto ETF applications, reflecting growing interest but also regulatory uncertainties in the market.

- Justin Sun’s Controversy: The background of Tron’s founder, Justin Sun, and his pending legal issues with the SEC might influence investor perceptions and the ETF’s acceptance.

- ETF Market Skepticism: Some analysts believe that non-core cryptocurrency ETFs may struggle to attract significant investment, questioning their viability.

Impact on Reader’s Life: Readers interested in cryptocurrency investment should consider the implications of ETF developments on their investment strategy, especially regarding risk assessment related to regulatory issues, market acceptance, and potential yields from staking.

Canary Capital’s Quest for a TRX ETF: A Look into the Altcoin Market

In an intriguing move, Canary Capital has initiated regulatory proceedings to launch an exchange-traded fund (ETF) centered around TRON’s native token, TRX. This step stands out among a wave of similar ETF filings that have surged following regulatory acknowledgment of alternative cryptocurrencies. While the ambition to create a fund that both holds and stakes TRX is commendable, it also poses unique challenges and opportunities in a rapidly evolving market.

One of the primary competitive advantages of Canary’s proposed ETF is its incorporation of staking capabilities from the outset. This is a strategy that has yet to be attempted by other U.S. ETFs focusing on cryptocurrencies. The potential yield of approximately 4.5% from staking TRX could attract a niche group of investors looking for passive income through their crypto assets. This approach not only positions the fund as a pioneer in the staking ETF market but also allows investors to benefit from both price appreciation and earnings generation.

However, the challenges are significant. The legal implications surrounding TRON, especially with the SEC’s recent lawsuit against its founder Justin Sun for alleged fraudulent activities, cast a shadow over the appeal of TRX. Investors may perceive the regulatory scrutiny as a risk factor, which could hinder institutional investment and affect the ETF’s market traction. This creates a dual-edged sword; while the staking feature is enticing, the legal uncertainties surrounding the asset could deter potential investors who are wary of regulatory backlash.

Additionally, the broader landscape presents both competitive threats and market serendipitous opportunities for Canary Capital. While some entities are targeting well-established cryptocurrencies like Ethereum and Bitcoin, which are more appealing to traditional investors, Canary’s focus on less mainstream altcoins may prove to be either a grave miscalculation or a visionary move. Analysts have expressed skepticism about the appetite for ETFs focused on non-core cryptocurrencies, suggesting that they might struggle to attract significant assets under management (AUM). If this sentiment prevails, Canary Capital could face an uphill battle in persuading investors of TRX’s viability.

This scenario could benefit retail and adventurous investors who are keen on diversifying into less traditional crypto assets with potential high returns from staking. Conversely, institutions and conservative investors may find themselves grappling with the volatile nature of altcoins like TRX, especially in light of ongoing regulatory concerns. The mixed reception for similar crypto products indicates a risky environment, and Canary’s ETF could either blaze a trail or become a cautionary tale.

In summary, Canary Capital’s venture into launching a TRX ETF highlights a moment of bold innovation amid a cautious regulatory landscape. As the altcoin market continues to evolve, the balance between embracing new opportunities and navigating regulatory challenges will be pivotal in dictating the fund’s long-term attractiveness to investors.