In the ever-evolving landscape of cryptocurrency, Cardano (ADA) has sparked renewed interest with an 8% surge between March 23 and March 25, drawing attention as it approaches the [openai_gpt model=”gpt-4o-mini” prompt=”You are a news reporter covering the cryptocurrency industry. Given the article description, provide an introductory overview of the news in an informative style. AVOID using overly technical terms or details! DO NOT offer recomendations to buy or sell any assets! Analyze from a fact-based perspective and bring in additional research when claims are made. Write this overview with creativity and flair, ensuring it reads like a human-written text and incorporates keywords in a natural way for SEO optimization. Generate HTML-formatted content using only

, and

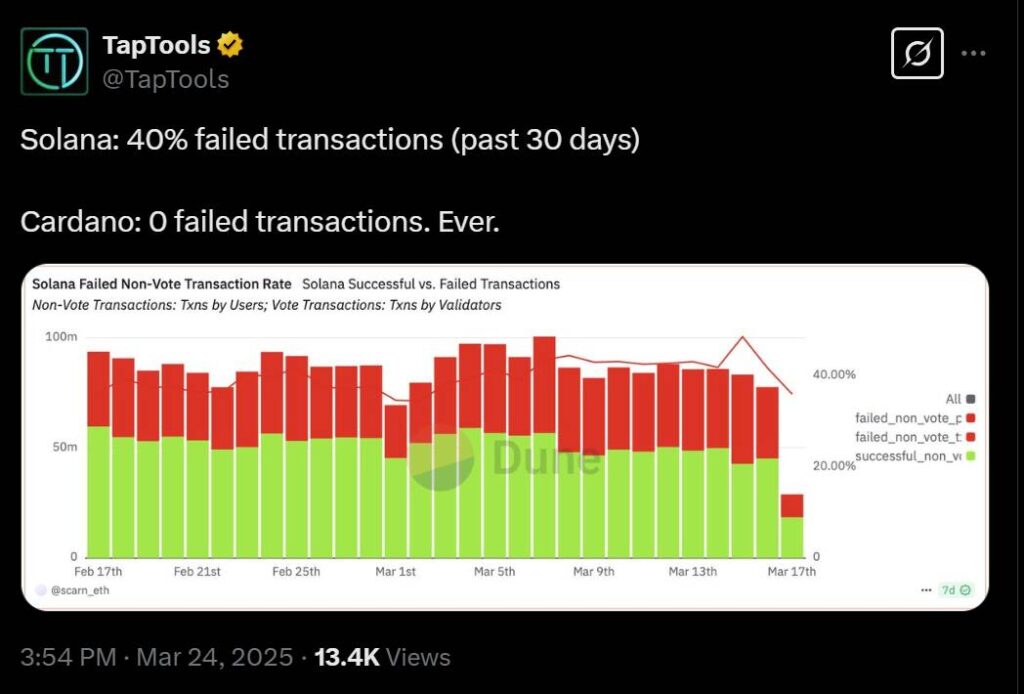

tags. Exclude headings and other HTML tags. DO NOT include a ‘Conclusion’ section! Here is the product description: ‘Cardano (ADA) gained 8% between March 23 and March 25, once again testing the $0.76 resistance level, which has held for over two weeks. Although still far from its March 3 high of $1.18, traders remain optimistic about further gains. Their confidence is driven by the ongoing efforts of founder and CEO Charles Hoskinson to highlight the network’s advantages and ADA’s potential to industry leaders, particularly within traditional finance markets.The ADA price surge on March 3 was triggered by US President Donald Trump, who explicitly mentioned Ether (ETH), XRP (XRP), and Cardano on his official social media accounts as leading candidates for the US Digital Asset reserves. However, the Digital Asset Stockpile executive order signed by Trump on March 7 did not include plans to purchase any altcoins, despite his earlier claims.Trump Jr. and Charles Hoskinson will attend DC Blockchain Summit 2025A fresh wave of bullish speculation for ADA emerged after Donald Trump Jr. was announced as a speaker at the DC Blockchain Summit 2025, a panel moderated by Cardano founder Charles Hoskinson. The two-day event in Washington, D.C., will feature several prominent speakers, including Wyoming Governor Mark Gordon, Majority Whip Tom Emmer, Senator Ted Cruz, Senator Cynthia Lummis, and Bo Hines, Executive Director of the Presidential Council of Advisers for Digital Assets.DC Blockchain Summit 2025 agenda. Source: dcblockchainsummitTrump Jr. is scheduled to speak on March 26 alongside three co-founders of World Liberty Financial, a crypto venture backed by US President Donald Trump. Launched in September 2024, the company has conducted two public token sales, raising a total of $550 million. More recently, on March 24, the project introduced a dollar-pegged stablecoin on Ethereum and BNB Chain, though it is not yet tradable.A significant portion of ADA’s recent gains is likely driven by speculation about a potential collaboration with World Liberty Financial, similar to the $30 million investment from Tron founder Justin Sun or Web3Port platform’s $10 million investment. However, some analysts, including 6MV managing partner Mike Dudas, have criticized Trump’s crypto venture, calling it a “pay-to-play” scheme rather than a true decentralized finance (DeFi) gateway.The potential listing of World Liberty Financial’s USD1 stablecoin on Cardano could be a game changer for the blockchain, generating significant hype around Charles Hoskinson sharing the stage with their representatives. Additionally, despite its relatively low total value locked (TVL) and onchain activity, the Cardano network has outperformed some of its competitors during testing.US digital stockpile and Cardano’s DeFi yield could boost demand for ADAImprovements within Cardano’s DeFi ecosystem and the opportunity to capture outsized yields could also benefit ADA price. Hydra, a layer-2 scalability solution on Cardano, has achieved nearly 1 million transactions per second while running a game. Some users have pointed out that no transactions have ever failed on the Cardano base layer, setting it apart from networks like Solana, which claim scalability but have faced issues.Source: TapToolsCiting data from Dune Analytics, TapTools reported a 40% failure rate on Solana transactions in the 30 days leading into March 17. In contrast, the post claims that “every transaction is validated before hitting the chain” on Cardano’s “eUTXO model.” Despite this criticism, user grekos99 argued on the X social network that most failed transactions on Solana are “typically transactions which are not fully executed because some conditions were not met, for example, slippage.”Related: Trump Media looks to partner with Crypto.com to launch ETFsRegardless of perceptions of Cardano’s unique validation and scalability processes, some of its DeFi applications show potential. For example, Indigo, a non-custodial synthetic asset protocol on Cardano, is currently offering a 28% yield on its stablecoin and 20% on Bitcoin-wrapped deposits. However, part of the difference can be explained by returns being paid in INDY tokens, making them less appealing compared to some of its competitors.The path for ADA to reclaim levels above $1 heavily depends on the Cardano Foundation and Charles Hoskinson’s ability to guide the network’s governance and support for use cases that align with its scalability and decentralization goals. Other catalysts include potential developments in the US government’s Digital Asset stockpile and inflows into Cardano’s DeFi applications, which are currently offering higher yields than most competitors.This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.'”].76 resistance level, which has held steady for over two weeks. This recent uptick comes despite ADA’s distance from its March 3 high of .18, yet traders maintain an optimistic outlook fueled by the efforts of its founder and CEO, Charles Hoskinson.

The surge in ADA’s price on March 3 was notably linked to a mention by former US President Donald Trump, who highlighted Cardano alongside other cryptocurrencies as prime candidates for the proposed United States Digital Asset reserves. However, the subsequent executive order released on March 7 fell short of commitments to purchase altcoins, including ADA, raising questions about the implications of such endorsements.

“The mention of ADA by Trump has certainly invigorated traders’ interest, even if it’s uncertain how directly this will translate into support for the asset.”

Adding to the buzz around Cardano, Donald Trump Jr. is scheduled to speak at the upcoming DC Blockchain Summit 2025, where he will share the stage with Hoskinson. This event includes a range of influential speakers from both the cryptocurrency and political arenas, indicating a growing intersection between the two worlds. The summit could serve as a platform for further discussions on cryptocurrency adoption within traditional finance.

Speculation is rife that ADA’s recent price movement could be linked to potential partnerships with World Liberty Financial, a crypto venture tied to Trump. This company has already conducted significant fundraising to support its endeavors in the digital finance space. Analysts, however, caution that such ventures should be approached critically, with some describing it as a mere “pay-to-play” scenario rather than a genuine advancement for decentralized finance.

“Despite the speculative nature surrounding these partnerships, the real measure of success will be in how Cardano’s governance and DeFi applications continue to evolve.”

On the technical side, Cardano’s DeFi ecosystem is showing promise, particularly with its layer-2 scalability solution, Hydra, which has emerged as a competitive player, boasting impressive transaction performance. Comparatively, data has suggested higher failure rates in network transactions elsewhere, making Cardano’s steady performance even more noteworthy.

As the cryptocurrency community monitors the shifting tides, ADA appears to be at a pivotal junction, with its future price movements likely hinging on continued developments within its ecosystem and broader market dynamics. With discussions surrounding the US digital asset stockpile and the potential for higher yields in DeFi offerings, the upcoming weeks might be crucial for ADA as it vies to reclaim higher price levels.

Key Insights on Cardano (ADA) and Its Market Dynamics

Cardano, a prominent cryptocurrency, has recently shown significant movements and developments. Below are some critical points to consider regarding ADA’s potential impacts on investors and the broader market:

- Price Movement:

- ADA gained 8% from March 23 to March 25, testing the resistance level at [openai_gpt model=”gpt-4o-mini” prompt=”Based on the article content, generate a list of key points in an HTML format using Bold, UL/OL. Focus solely on the most important aspects, and describe how they might be related or impact the readers life if at all. Begin with a title using

HTML tag in this format: ‘

Title Goes Here

‘. Use only

,

,

,

- , and

.tags. DO NOT include a ‘Conclusion’ section! Here is the topic description: ‘Cardano (ADA) gained 8% between March 23 and March 25, once again testing the $0.76 resistance level, which has held for over two weeks. Although still far from its March 3 high of $1.18, traders remain optimistic about further gains. Their confidence is driven by the ongoing efforts of founder and CEO Charles Hoskinson to highlight the network’s advantages and ADA’s potential to industry leaders, particularly within traditional finance markets.The ADA price surge on March 3 was triggered by US President Donald Trump, who explicitly mentioned Ether (ETH), XRP (XRP), and Cardano on his official social media accounts as leading candidates for the US Digital Asset reserves. However, the Digital Asset Stockpile executive order signed by Trump on March 7 did not include plans to purchase any altcoins, despite his earlier claims.Trump Jr. and Charles Hoskinson will attend DC Blockchain Summit 2025A fresh wave of bullish speculation for ADA emerged after Donald Trump Jr. was announced as a speaker at the DC Blockchain Summit 2025, a panel moderated by Cardano founder Charles Hoskinson. The two-day event in Washington, D.C., will feature several prominent speakers, including Wyoming Governor Mark Gordon, Majority Whip Tom Emmer, Senator Ted Cruz, Senator Cynthia Lummis, and Bo Hines, Executive Director of the Presidential Council of Advisers for Digital Assets.DC Blockchain Summit 2025 agenda. Source: dcblockchainsummitTrump Jr. is scheduled to speak on March 26 alongside three co-founders of World Liberty Financial, a crypto venture backed by US President Donald Trump. Launched in September 2024, the company has conducted two public token sales, raising a total of $550 million. More recently, on March 24, the project introduced a dollar-pegged stablecoin on Ethereum and BNB Chain, though it is not yet tradable.A significant portion of ADA’s recent gains is likely driven by speculation about a potential collaboration with World Liberty Financial, similar to the $30 million investment from Tron founder Justin Sun or Web3Port platform’s $10 million investment. However, some analysts, including 6MV managing partner Mike Dudas, have criticized Trump’s crypto venture, calling it a “pay-to-play” scheme rather than a true decentralized finance (DeFi) gateway.The potential listing of World Liberty Financial’s USD1 stablecoin on Cardano could be a game changer for the blockchain, generating significant hype around Charles Hoskinson sharing the stage with their representatives. Additionally, despite its relatively low total value locked (TVL) and onchain activity, the Cardano network has outperformed some of its competitors during testing.US digital stockpile and Cardano’s DeFi yield could boost demand for ADAImprovements within Cardano’s DeFi ecosystem and the opportunity to capture outsized yields could also benefit ADA price. Hydra, a layer-2 scalability solution on Cardano, has achieved nearly 1 million transactions per second while running a game. Some users have pointed out that no transactions have ever failed on the Cardano base layer, setting it apart from networks like Solana, which claim scalability but have faced issues.Source: TapToolsCiting data from Dune Analytics, TapTools reported a 40% failure rate on Solana transactions in the 30 days leading into March 17. In contrast, the post claims that “every transaction is validated before hitting the chain” on Cardano’s “eUTXO model.” Despite this criticism, user grekos99 argued on the X social network that most failed transactions on Solana are “typically transactions which are not fully executed because some conditions were not met, for example, slippage.”Related: Trump Media looks to partner with Crypto.com to launch ETFsRegardless of perceptions of Cardano’s unique validation and scalability processes, some of its DeFi applications show potential. For example, Indigo, a non-custodial synthetic asset protocol on Cardano, is currently offering a 28% yield on its stablecoin and 20% on Bitcoin-wrapped deposits. However, part of the difference can be explained by returns being paid in INDY tokens, making them less appealing compared to some of its competitors.The path for ADA to reclaim levels above $1 heavily depends on the Cardano Foundation and Charles Hoskinson’s ability to guide the network’s governance and support for use cases that align with its scalability and decentralization goals. Other catalysts include potential developments in the US government’s Digital Asset stockpile and inflows into Cardano’s DeFi applications, which are currently offering higher yields than most competitors.This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.'”].76

- Despite this increase, its value remains substantially below the March 3 peak of .18.

- Influence of Political Figures:

- US President Donald Trump mentioned Cardano as a candidate for the US Digital Asset reserves, leading to initial price spikes.

- Trump Jr.’s participation at the DC Blockchain Summit 2025 alongside Charles Hoskinson could enhance Cardano’s visibility and credibility.

- Speculation and Investment:

- Speculative interest in ADA appears to be driven by potential collaborations, such as partnerships with World Liberty Financial.

- Recent investments in crypto ventures have raised concerns about the authenticity of these projects, with some experts labeling them as “pay-to-play” schemes.

- Technological Advancements:

- Cardano’s layer-2 solution, Hydra, boasts nearly 1 million transactions per second, showcasing its scalability.

- Unlike some competitors, Cardano’s base layer has never recorded transaction failures, enhancing its reliability.

- DeFi Ecosystem Growth:

- Innovations in Cardano’s DeFi space might generate higher demand for ADA, particularly with potential higher yields.

- Current offerings include significant returns through DeFi applications, like Indigo, despite some complications with yield formats.

- Future Outlook:

- The success of ADA above the mark hinges on the governance and vision curated by the Cardano Foundation and Charles Hoskinson.

- Future developments concerning the US Digital Asset stockpile and demand for Cardano’s DeFi applications could be pivotal for price recovery.

This information is intended for general purposes and should not be interpreted as investment advice.

Comparative Analysis of Cardano (ADA) and Recent Market Trends

Cardano (ADA) has recently captured significant attention with an 8% price increase, as it flirts with long-held resistance levels. This surge can be attributed to a combination of factors, including notable endorsements from political figures and strategic developments within its ecosystem. However, how does this position Cardano against its competitors, especially as the digital currency landscape becomes more crowded?

Competitive Advantages: Cardano’s ongoing improvements in its decentralized finance (DeFi) ecosystem set it apart from its rivals like Solana and Ethereum. Its layer-2 scalability solution, Hydra, boasts an impressive transaction throughput, promising nearly 1 million transactions per second without failures. This reliability could potentially lure users seeking stability in a volatile crypto market. Moreover, collaborations, such as the potential integration with World Liberty Financial, could generate significant interest from investors, particularly given the financial ties to influential political figures.

Furthermore, Cardano’s unique eUTXO model allows for every transaction to be validated before reaching the chain, creating a stark contrast with the transaction failures seen on networks like Solana, which has faced a 40% transaction failure rate. Such reliability could be a selling point for both new and existing users looking for a dependable platform.

Competitive Disadvantages: Despite its strengths, Cardano still faces challenges that could undermine its reach. Primarily, it is significantly below its March high of .18, indicating potential hesitance among traders and investors. There’s a risk that overly optimistic speculation around ADA’s price movements might lead to disappointment if it fails to maintain momentum. Additionally, though its DeFi yields appear attractive on paper, many of these returns are paid in INDY tokens, which could diminish their allure compared to other stablecoin returns in the market.

Moreover, the criticisms from analysts regarding the Trump-backed crypto ventures may outweigh the brand’s appeal among the more purist segments of the crypto community. The notion of “pay-to-play” can deter serious investments that could have otherwise flowed into Cardano.

Impacts on Stakeholders: Current Cardano supporters and investors could stand to benefit from the potential price rally as ADA continues to gain traction. DeFi enthusiasts might find the developments in Cardano’s ecosystem a valuable opportunity for yield-seeking investment. However, for those in the crypto space who advocate for decentralized finance’s true essence, the rising influence of traditional finance and politically-aligned ventures could pose problems. This juxtaposition may create friction between innovation-driven users and ADA’s evolving market dynamics.

As Charles Hoskinson navigates the future of Cardano, how well he balances the network’s foundational goals with external pressures will be pivotal to ADA’s trajectory in the cutthroat world of digital currencies.