In a surprising move that has sent ripples through the cryptocurrency community, President Donald Trump recently highlighted Cardano’s ADA token as part of the United States’ strategic crypto reserve. This announcement, made on March 2, was further elaborated on in an executive order released on March 6, which emphasized the inclusion of altcoins, specifically mentioning the Digital Asset Stockpile (DAS) to be managed under the oversight of the Treasury. The decision has drawn mixed reactions, with some celebrating the regulatory validation of ADA, while others raise eyebrows over its placement in this federal digital asset portfolio.

Cardano, established in 2017, is recognized as one of the earliest smart contract platforms, setting itself apart with a unique research-driven approach and a delegated proof-of-stake mechanism. Its ecosystem promotes decentralized governance through its Project Catalyst, an initiative that democratically allocates funds from transaction fees to community proposals. Many proponents argue that ADA’s utility in governance and transaction fees—features that distinguish it from many venture capital-backed cryptocurrencies—reinforces its selection for the DAS.

“Cardano’s ambition as a smart contract platform is captured by its unique governance model, providing real voting power to ADA holders,” stated a source familiar with the operational dynamics of the platform.

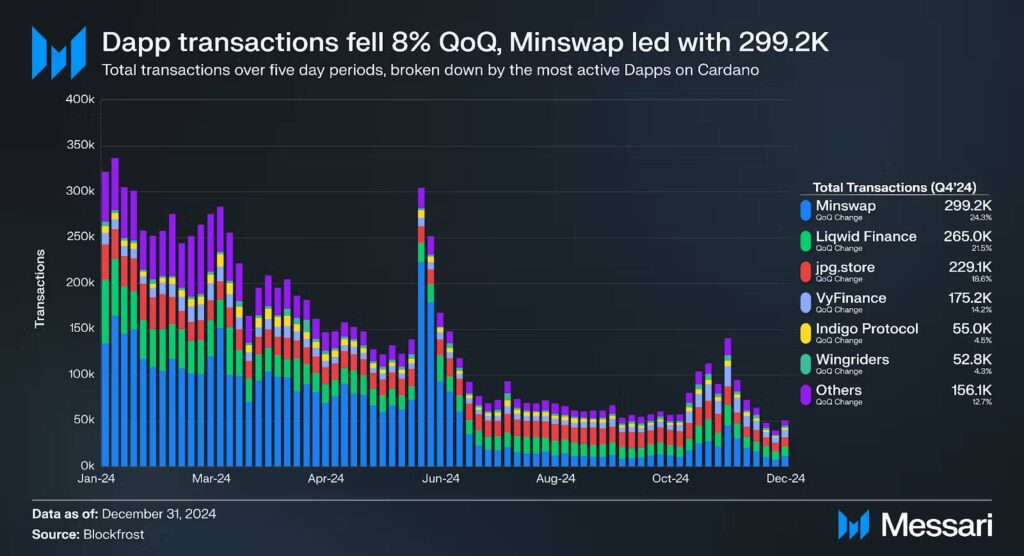

Yet, as Cardano makes headlines, its actual usage statistics paint a more cautious picture. Recent reports indicate that while it boasts a capped supply of 45 billion tokens, the blockchain’s activity levels lag notably behind more established rivals like Ethereum. For instance, during the last quarter, Cardano averaged just 71,500 daily transactions compared to Ethereum’s impressive figures. Its low developer count and minimal market share in stablecoins and DeFi further amplify concerns about the long-term value and robustness of ADA in a government-managed asset portfolio.

According to data, Cardano’s annualized real staking yield sits at a mere 0.7%, and a stark 73% decline in DApp activity from the previous quarter highlights worrying trends that could impact its credibility as a strategic asset. As conversations swirl about whether ADA holds enough merit to justify its inclusion in the DAS, emerging projects exploring Cardano’s compatibility with Bitcoin could potentially breathe new life into its ecosystem, paving the way for greater adoption.

David Nage, a venture capital portfolio manager, remarked, “For ADA to make sense in a national reserve, it must first foster development and create a lasting narrative that resonates with users.”

As Cardano navigates these turbulent waters, the broader cryptocurrency community watches intently, pondering whether ADA’s incorporation into a national strategy could bolster its relevance, or if its lackluster performance might hinder progress. The coming months will be pivotal in determining the token’s fate and the strategic direction of digital assets under government stewardship.

Key Insights on Cardano’s Inclusion in the US Digital Asset Stockpile

Here are the critical points regarding Cardano’s ADA token being included in the US strategic crypto reserve:

- Presidential Mention: President Donald Trump mentioned Cardano’s ADA token as part of the US strategic crypto reserve on March 2.

- Executive Order Clarity: On March 6, an executive order specified that altcoins, including ADA, would be managed under the Digital Asset Stockpile (DAS) by the Treasury.

- Community Reactions:

- Surprise and criticism emerged from the crypto community regarding ADA’s inclusion, emphasizing concerns over its long-term utility.

- Loyal investors support ADA despite criticisms regarding its performance.

- ADA’s Fundamentals:

- Launched in 2017, Cardano uses a research-driven design with a delegated proof-of-stake mechanism.

- ADA supports network fees, staking, and governance, aiming for decentralized management through Project Catalyst.

- Current Performance Indicators:

- Processing an average of 71,500 daily transactions, which is significantly lower compared to Ethereum’s activity.

- Quarterly fees of .8 million contrast sharply with Ethereum’s 2 million, raising questions about ADA’s long-term viability.

- The stake yield is low at approximately 0.7%, compared to Ethereum’s 2.73%.

- Developer Activity: Cardano ranks 12th among blockchains with 449 developers, indicating a need for more robust development to drive innovation.

- Concerns About Growth:

- Cardano’s DeFi ecosystem is underdeveloped, representing only 0.3% of the total DeFi sector.

- A decline in daily DApp transactions signals potential stagnation in Cardano’s growth.

- Arguments For and Against Inclusion:

- The case for ADA’s inclusion lacks clarity compared to leading platforms like Ethereum and Solana.

- However, ADA’s capped supply and focus on decentralization offer unique advantages for future adoption.

- Future Potential: Projects exploring interoperability with Bitcoin could unlock new opportunities for Cardano, potentially increasing its relevance.

“The Cardano ecosystem needs to find and support developers to create products that millions enjoy. Then, they need storytellers to build mass audiences.” – David Nage

Cardano’s Future in the US Digital Asset Stockpile: Advantages and Challenges

The recent announcement of President Donald Trump mentioning Cardano’s ADA token for inclusion in the US strategic crypto reserve has stirred significant interest and skepticism across the crypto arena. One of ADA’s compelling competitive advantages lies in its unique research-driven approach to blockchain development and its utilization of a delegated proof-of-stake mechanism. This stands in contrast to the more traditional models seen in popular cryptocurrencies like Bitcoin and Ethereum, potentially attracting investors interested in innovative technologies that prioritize sustainability.

Another notable factor favoring Cardano is the decentralized governance structure, highlighted by its Project Catalyst initiative. This program democratizes funding decisions, allowing ADA holders to influence the direction and projects funded within the ecosystem. As the cryptocurrency landscape shifts towards community-driven initiatives, Cardano’s model may resonate well with users who prioritize transparency and decentralization.

However, despite these strengths, Cardano faces significant hurdles. The stark comparison between its transaction fees and staking yields against competitors like Ethereum raises valid concerns among investors. For instance, while Ethereum’s transaction fees reached a staggering 2 million in the last quarter, Cardano reported only .8 million. Additionally, Cardano’s staking yield appears underwhelming compared to Ethereum’s 2.73%, potentially deterring yield-focused investors.

The fundamental issue seems to be Cardano’s low platform activity and adoption rates. With daily transactions averaging just 71,500 and a steep 73% decline in DApp transactions from the previous quarter, it becomes crucial to question whether ADA’s potential merits inclusion in a government-managed portfolio. In an ecosystem where dynamics are constantly evolving, the lagging development activity—recording only 449 developers—further exacerbates its position in a competitive market that prizes innovation and growth.

This situation could spell both opportunity and challenge for investors or businesses eager to engage with Cardano. On one hand, those focused on long-term growth and advocating for decentralized governance may find the potential rewards alluring, particularly if new projects catalyze adoption. Conversely, businesses requiring robust infrastructure and high activity levels might confront difficulties, especially if they base their operations on ADA in its current state.

Lastly, the prospect of integration with Bitcoin-related platforms hints at new avenues for growth and could boost ADA’s relevance significantly. However, until such innovations manifest and translate into tangible ecosystem activity, skepticism might dominate the narratives surrounding ADA’s viability in a strategically managed portfolio.