In a recent discussion at the Solana Accelerate event in New York, Cathie Wood, CEO of ARK Invest, shared insightful perspectives on the evolving landscape of cryptocurrency and the role of exchange-traded funds (ETFs) in the future. Wood believes that regardless of the growing adoption of crypto wallets, ETFs will continue to hold significant value in the economy. She highlighted the complexities often associated with crypto wallets, describing them as “an insurance policy” against potential issues in the traditional financial system.

Wood emphasized that for many consumers, the allure of ETFs lies in their simplicity. “They just wanna push a button,” she noted, suggesting that ETFs serve as an accessible entry point for those interested in cryptocurrency without navigating the intricacies of wallets.

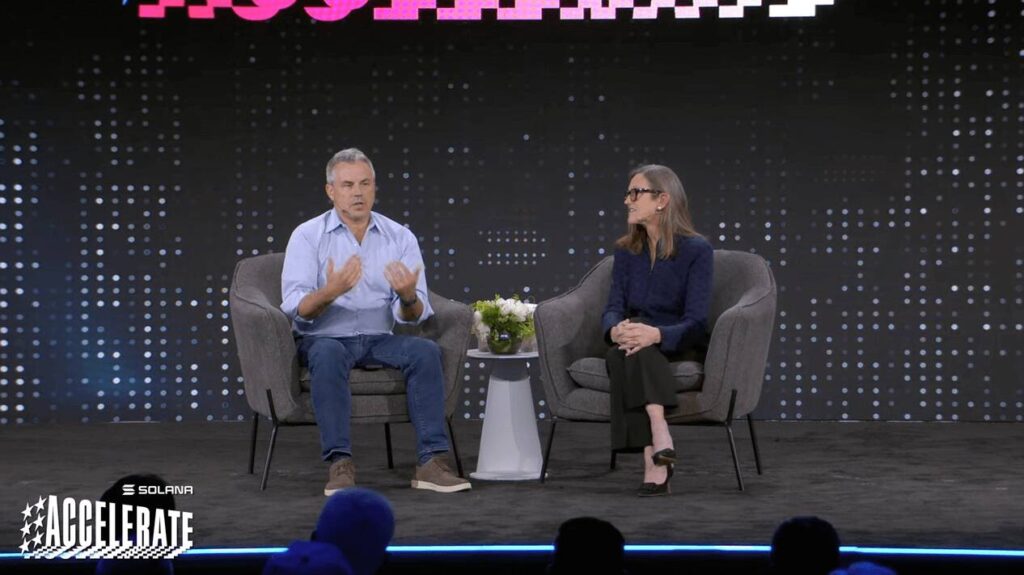

“ETFs for those who want the convenience, I don’t think, will lose a lot of their luster,” Wood explained during her conversation with ETF analyst Eric Balchunas.

Recent data from Bitbo indicates that there are around 200 million active Bitcoin wallets globally, while a report from Farside reveals that US-based spot Bitcoin ETFs have experienced an impressive inflow of approximately $44.49 billion since their introduction in January 2024. Meanwhile, spot Ether ETFs, which launched in July 2024, amassed about $2.77 billion, although their performance didn’t meet initial expectations due to regulatory challenges related to staking.

Wood views Ether as a pivotal entry point for new investors aiming to better understand smart contracts before exploring other cryptocurrencies like Solana. “So they might start in the smart contract world with Ether… I think they will get there,” she remarked, illustrating her optimism about the potential growth and adoption of cryptocurrencies.

Addressing market sentiments, Wood also referenced the impact of the Official Trump memecoin, which was launched on the Solana network earlier this year. She suggested that the mixed reception of this cryptocurrency could deter some institutional investors, particularly older demographics. This sentiment echoes a broader trend in which Bitcoin remains the more straightforward and widely understood option for traditional investors.

“I think they might be a little turned off by what happened with the Trump memecoin,” she stated, reflecting on the volatility that followed its launch.

As ARK Invest continues to analyze market trends, Wood hinted at a forthcoming update on Solana’s price target and noted an increase in ARK’s “bull case” Bitcoin price prediction from $1.5 million to $2.4 million by 2030, fueled by growing institutional interest and Bitcoin’s reputation as “digital gold.”

Cathie Wood on the Future of Crypto ETFs

Key insights from Cathie Wood regarding the role of crypto ETFs and wallets in the evolving financial landscape:

- ETFs as a Stepping Stone:

- Wood believes crypto ETFs will continue to thrive, providing a user-friendly alternative to complex wallets.

- ETFs offer a simple, frictionless way for consumers to engage with cryptocurrencies.

- Wallets as Insurance Policies:

- Wallets serve as an insurance policy for users in the event of failures in traditional financial systems.

- Consumers may initially prefer the convenience of ETFs over learning to use wallets.

- Current Trends in Bitcoin and Ether ETFs:

- Significant inflows into US-based spot Bitcoin ETFs indicate strong consumer interest, with $44.49 billion recorded since launch.

- Spot Ether ETFs have not performed as well as expected due to regulatory limitations on staking.

- Smart Contracts Familiarization:

- Wood sees Ether as a gateway for newcomers to learn about smart contracts before exploring other cryptocurrencies.

- This familiarity may increase interest in tokens like Solana (SOL) as users expand their knowledge.

- Impact of Memecoins:

- The launch of the Official Trump memecoin on Solana has created skepticism among institutional investors.

- Incidents like this may deter older and more conservative investors from entering the cryptocurrency market.

- Long-Term Bitcoin Price Expectations:

- ARK Invest raised its bullish Bitcoin price target significantly, reflecting confidence that institutional adoption will drive value.

- Price targets suggest confidence that Bitcoin will solidify its status as ‘digital gold’ by 2030.

Wood’s commentary serves as a guide for investors navigating the complexities of cryptocurrency investment, highlighting the importance of convenience, education, and market sentiment.

ARK Invest’s Cathie Wood on the Enduring Appeal of Crypto ETFs

Cathie Wood, CEO of ARK Invest, recently highlighted the pivotal role that crypto exchange-traded funds (ETFs) are expected to play in the financial landscape over the next ten years. According to Wood, the complex nature of crypto wallets—perceived as cumbersome for average consumers—reinforces the relevance of ETFs. This perspective positions ETFs as user-friendly entry points for investors wary of the technicalities involved in direct wallet management.

When comparing ARK’s stance to other market narratives, it’s evident that while crypto wallet adoption continues to grow, the ongoing inflows into US-based Bitcoin ETFs—totaling $44.49 billion since their inception—demonstrate a sustained appeal for simpler investment mechanisms. Other analysts may argue that direct investment through wallets fosters a deeper engagement with the cryptocurrency ecosystem, creating potential drawbacks for ETFs by limiting user interaction with digital assets. This could be seen as a disadvantage for ETFs, which may attract more passive investors rather than those looking to actively engage with crypto technology.

Investors, particularly institutional clients, could benefit greatly from Wood’s insights as they navigate this evolving landscape. On one hand, traditional financial institutions may feel reassured by the stability offered by ETFs as a conservative approach to entering the crypto market. Yet, on the other hand, Wood’s comments about the lukewarm reception of Ether ETFs due to SEC restrictions on staking could pose challenges. The uncertainty surrounding regulation and consumer behavior could make potential institutional investors hesitant, especially those with a conservative outlook. These uncertainties could complicate their entry into the broader cryptocurrency sector.

Moreover, Wood’s remarks about the detrimental impact that controversial launches, like the memecoin associated with Donald Trump on the Solana network, could further dissuade institutional investors from exploring emerging altcoins. This creates a dichotomy in investor perception: while Bitcoin maintains its reputation as “digital gold” and continues to drive significant ETF inflows, other cryptocurrencies may suffer reputational damage, ultimately raising questions about the future viability of alternative digital assets.

In summary, Wood’s insights cast a spotlight on the competitive landscape of crypto investment, showcasing that while ETFs may thrive due to their simplicity, the intricacies of wallet adoption and regulatory concerns remain pertinent challenges. These dynamics will undoubtedly influence both retail and institutional investment strategies as the cryptocurrency market evolves.