In a thought-provoking appearance at the Digital Asset Summit in New York, Cathie Wood, CEO of ARK Invest, shared her insights on the potential economic challenges facing the United States. With an emphasis on the risks stemming from former President Donald Trump’s tariff policies, Wood suggested that the White House might be underestimating the chances of a looming recession. During her virtual address on March 18, she pointed out that while Treasury Secretary Scott Bessent appears unfazed by a recession, a slowdown in the velocity of money, which typically signals reduced spending and investment, is a growing concern.

“We think the velocity of money is slowing down dramatically,” Wood expressed, emphasizing her belief that the current landscape could lead to more flexible tax cuts and monetary policies from both the president and the Federal Reserve.

As market watchers speculate, investors on platforms like Polymarket are betting on an end to the Fed’s quantitative tightening program by May, with growing anticipation of interest rate cuts later in the year. According to CME Group’s Fed Fund futures, there is a nearly 65% chance of lower rates by the Fed’s June meeting. This evolving financial landscape has implications far beyond traditional markets, especially as ARK Invest remains committed to the cryptocurrency sector.

Wood noted, “Long-term innovation wins as we go through these trials and tribulations,” highlighting the resilience of crypto despite recent market corrections.

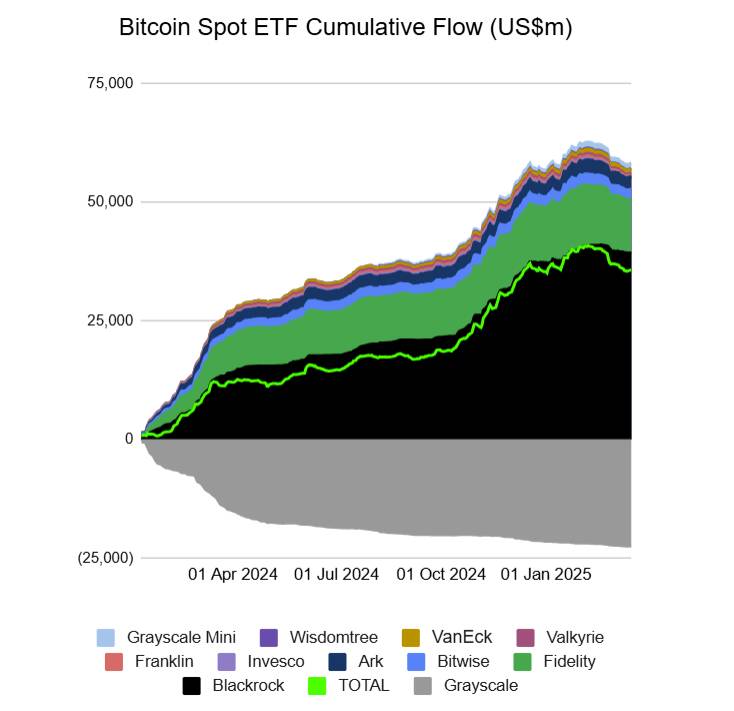

With its spot Bitcoin exchange-traded fund (ETF) approved just earlier this year, ARK continues to position itself as a significant player in the digital asset space. Although there have been observed sell-offs in Bitcoin ETFs recently, Wood insisted that the overall trend showcases a commitment from investors to hold their positions. As regulations become more favorable, she sees institutions increasingly recognizing the importance of including crypto assets in their portfolios, a shift that may well pivot investment strategies for the long haul.

“We’ve built out positions in more than just the big three,” Wood reiterated, referring to Bitcoin, Ether, and Solana, indicative of ARK’s diverse investment approach.

As the cryptocurrency industry continues to evolve amidst economic uncertainties, Wood’s insights reflect a forward-thinking strategy rooted in long-term growth potential, signaling ARK Invest’s confidence in the future of digital assets.

Impact of Economic Policies on the US Economy and Cryptocurrency Investments

The current economic landscape, influenced by various factors including tariff policies and monetary actions, is causing concern among investors and experts. Here are the key points highlighting Cathie Wood’s insights and their implications:

-

Recession Risks Underestimated:

- Cathie Wood believes the White House is failing to recognize the recession risks from tariff policies.

- This oversight may eventually lead to necessary pro-growth measures from the government and the Federal Reserve.

-

Velocity of Money Decline:

- Wood highlights a significant slowdown in the velocity of money, indicating reduced spending and investment.

- A decline in the velocity of money often correlates with recessionary conditions, impacting consumer and business behavior.

-

Potential Monetary Policy Changes:

- If a recession occurs, it may provide the government and Fed with more flexibility to implement tax cuts and adjust monetary policy.

- Increased expectations for rate cuts by the Fed could reshape investment strategies.

-

Focus on Long-term Innovation:

- Despite market corrections, Cathie Wood emphasizes the importance of long-term innovations in investment strategies.

- ARK Invest continues to support cryptocurrency investments, seeing long-term potential despite current market volatility.

-

Institutional Interest in Cryptocurrency:

- Favorable regulations are encouraging institutions to consider cryptocurrency as a serious asset class.

- As institutions become more involved, they recognize the need to provide exposure to clients in this emerging market.

Cathie Wood’s Perspective: “Long-term innovation wins as we go through these trials and tribulations,” implying that despite short-term uncertainties, the investment landscape in technology and crypto remains promising.

Cathie Wood’s Economic Predictions: A Double-Edged Sword for Investors

Cathie Wood, CEO of ARK Invest, has recently voiced her concerns regarding the potential economic downturn in the U.S. sparked by tariff policies under the Trump administration. This stance presents both opportunities and risks for investors navigating the ever-changing economic landscape. While Wood’s insights may be seen as brimming with foresight, they also echo sentiments shared by some market analysts, yet diverge when considering the broader implications for various investor classes.

Competitive Advantages: Wood’s analysis highlights a significant concern regarding the slowing velocity of money, an indicator often associated with a recession. This perspective could resonate with cautious investors who are risk-averse and prioritize preserving capital during turbulent times. Moreover, her belief that economic challenges might compel the Federal Reserve and the White House to adopt more pro-growth policies may appeal to long-term investors looking for eventual rebounds in the market. The emphasis on the long-term value of innovation, especially in the cryptocurrency space, positions ARK as a forward-thinking entity committed to transformative investments.

Competitive Disadvantages: On the flip side, Wood’s predictions come amid a climate where not all analysts share her urgency regarding a recession. This divergence in viewpoints could create confusion among retail investors, especially those not well-versed in macroeconomic indicators. Furthermore, while the approval of ARK’s Bitcoin ETF positions the firm favorably within the crypto investment space, heavy outflows from spot Bitcoin ETFs indicate a potential lack of confidence among certain investor segments. This volatility could deter more conservative clients who prefer stable, predictable returns.

As Wood champions the cause of institutional acceptance of cryptocurrency, she may inadvertently pose challenges for traditional investors who might find it difficult to reconcile this new asset class with established investing principles. Investors who are apprehensive about the steep learning curve associated with cryptocurrencies could encounter difficulties in adapting to this rapidly evolving marketplace.

In a nutshell, while Wood’s insights and ARK Invest’s innovative strategies might strongly benefit risk-tolerant investors and those seeking long-term growth opportunities, they could simultaneously create hesitation among conservative investors fearing economic instability and market volatility. Navigating these nuances will be pivotal for investors looking to position themselves strategically in both traditional and crypto markets.