The cryptocurrency landscape is buzzing with excitement as the Cboe BZX Exchange has made a significant move by filing to list a proposed Fidelity exchange-traded fund (ETF) that aims to hold Solana (SOL). This request comes as part of a series of filings with the US Securities and Exchange Commission (SEC), which must approve the proposal before any trading can begin on this promising new fund. The growing interest in Solana is evident, as other asset managers, including Franklin Templeton, have also put forth similar applications for spot SOL ETFs.

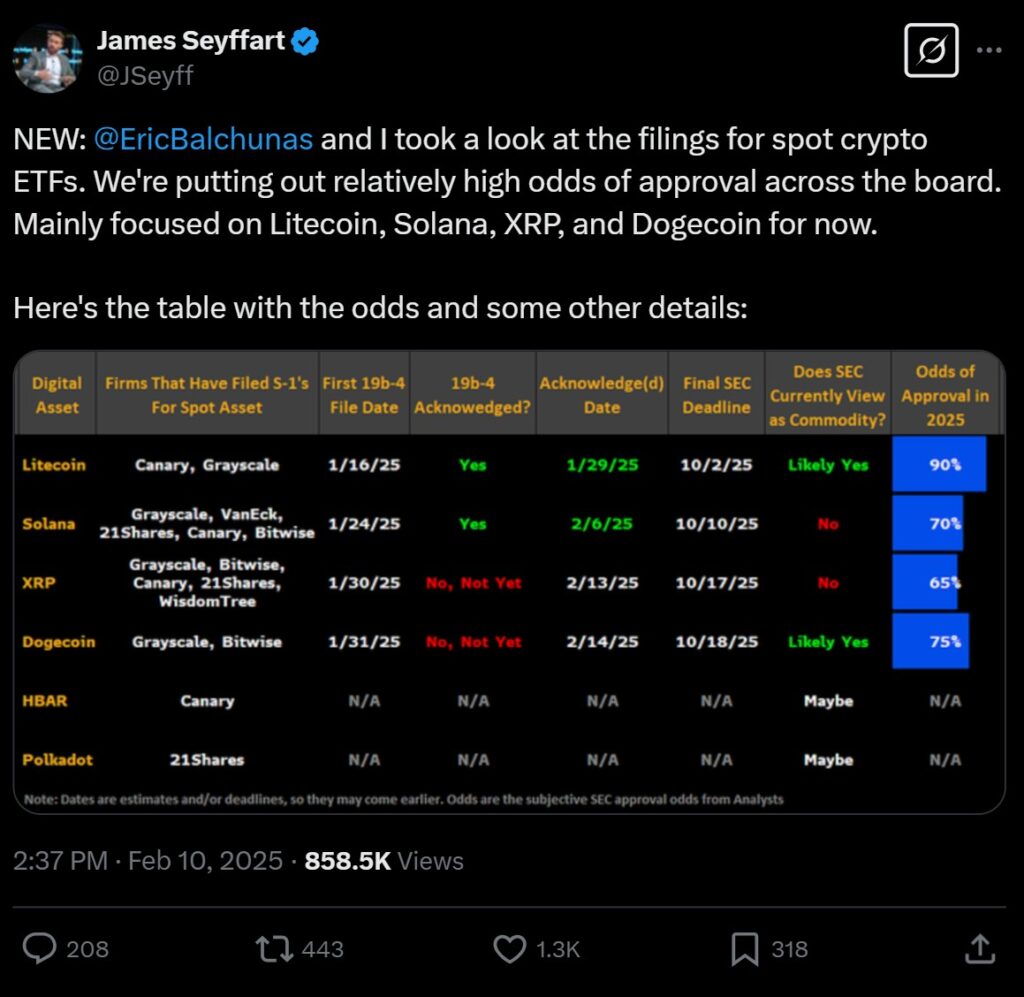

Cboe’s latest filing follows the launch of the Volatility Shares Solana ETFs, which provide investors with a gateway into Solana’s fast-evolving market. Particularly noteworthy is the Volatility Shares 2X Solana ETF, offering a leveraged approach to tracking SOL’s performance. According to analysts at Bloomberg Intelligence, the likelihood of US regulators approving a spot SOL ETF within this calendar year stands at an encouraging 70%. This optimism is bolstered by recent initiatives from the Chicago Mercantile Exchange (CME), which has introduced SOL futures contracts, signaling readiness for an expanded market for Solana ETFs.

“More than a dozen asset managers are now vying for SEC approval to launch altcoin ETFs, reflecting a broader trend toward legitimizing cryptocurrency investments in traditional financial markets.”

The flurry of activity extends beyond Solana, as various exchanges are pushing to introduce ETFs for other cryptocurrencies, such as Litecoin, XRP, and even popular meme coins. This evolving regulatory environment comes on the heels of significant shifts in the SEC’s approach towards cryptocurrency oversight, especially following the changes in presidential administration. With the SEC previously engaged in extensive litigation against crypto firms, the recent emphasis on fostering innovation suggests a potential for a vibrant future for cryptocurrency-based investments.

Cboe BZX Exchange’s Request for Fidelity’s Solana ETF

The Cboe BZX Exchange is seeking permission to list a proposed ETF containing Solana (SOL) that could significantly impact both the cryptocurrency market and investors interested in altcoins. Here are the key points regarding this development:

- Cboe BZX Exchange Filing: The exchange has filed a request with the US Securities and Exchange Commission (SEC) to list a Fidelity ETF that will hold Solana (SOL).

- Regulatory Approval Required: The SEC’s approval is crucial for trading to begin, impacting investors’ access to SOL through traditional financial markets.

- Recent Trend in ETF Filings: This filing follows a surge in applications for ETFs holding SOL and other cryptocurrencies, indicating growing interest and potential market acceptance.

- Previous SOL ETFs Launched: The Volatility Shares has launched ETFs using futures to track SOL, marking the first offerings of their kind for US investors.

- Analysts’ Predictions: Bloomberg Intelligence analysts estimate a 70% chance of SEC approval for a spot SOL ETF in the current year, suggesting a positive sentiment in the market.

- Increasing Interest from Asset Managers: Other firms, including Grayscale and VanEck, are also seeking permission to list their own spot SOL ETFs, enhancing competition and options for investors.

- New Financial Instruments: The launch of SOL futures contracts by the Chicago Mercantile Exchange (CME) could be a precursor to ETF approvals, further legitimizing SOL in the eyes of traditional investors.

- Broader Cryptocurrency ETF Landscape: Over a dozen asset managers are looking to launch altcoin ETFs, reflecting a diversification in investment opportunities within the cryptocurrency space.

Experts believe that the SEC’s evolving stance towards cryptocurrency regulations could open up significant opportunities for investors, particularly as new products become available in mainstream markets.

Spot Solana ETFs: A Competitive Landscape of Opportunities and Challenges

The recent move by Cboe BZX Exchange to seek approval for a Fidelity-sponsored exchange-traded fund (ETF) focused on Solana (SOL) marks a significant step in the expanding landscape of cryptocurrency investment vehicles. This proposal is poised against a backdrop of increasing market interest, underscored by previous filings from major asset managers like Franklin Templeton, Grayscale, and VanEck, all of which adds competitive tension to the field.

Competitive Advantages: The Cboe filing stands out in several ways. Firstly, it represents a growing acceptance of crypto within traditional finance, positioning Solana as a prime player among digital assets. With a sound foundation built by the existing Volatility Shares Solana ETFs, the Fidelity proposal could attract larger institutional investments, leveraging Fidelity’s established reputation and extensive client base. Furthermore, market analysts speculate a 70% likelihood of SEC approval this year, which could enhance investor confidence and stimulate interest in Solana as a robust contender in the crypto investment space.

Conversely, the proliferation of other spot SOL ETF filings introduces additional competitive dynamics. While these filings signal healthy market interest, they also risk fragmentation, where investors may struggle to choose between various offerings. This scenario could dilute the impact of any single ETF and complicate marketing strategies for asset managers.

Challenges Ahead: Notably, the potential for regulatory hurdles remains a significant concern. The SEC’s previous hesitance towards cryptocurrency products, especially under the Biden administration, sends a reminder that the landscape can shift rapidly. Approval delays or rejections could pose financial setbacks for sponsors and impact market sentiment negatively. Additionally, as the SEC is reviewing numerous filings for altcoin ETFs, the attention might be spread too thin, meaning that not all applicants will achieve timely results.

This environment offers substantial opportunities, yet it can also generate confusion among retail investors. It could create a scenario where hesitant investors opt for more traditional asset classes instead, consequently stunting the growth potential of Solana-focused investments. Such dynamics could benefit seasoned institutional investors who are typically more comfortable navigating regulatory complexities but might leave new, inexperienced retail investors feeling overwhelmed and disengaged.

In summary, while the Cboe BZX Exchange’s proposition for a Fidelity Solana ETF symbolizes promising innovation within the ETF market, various competitive forces and regulatory elements could shape both its opportunity and the surrounding ecosystem. As the competition intensifies, a clear differentiation strategy will be paramount for asset managers wanting to capture and retain investor interest amidst the evolving crypto ETF landscape.