The Cboe BZX Exchange is making headlines as it seeks approval from U.S. regulators to list an exchange-traded fund (ETF) that would be backed by Sui (SUI), the native token of the innovative Sui Network. This request was officially submitted on April 8 and is currently awaiting review by the U.S. Securities and Exchange Commission (SEC). If granted approval, this ETF, managed by Canary Capital, would mark a significant milestone as the first fund in the United States to incorporate SUI.

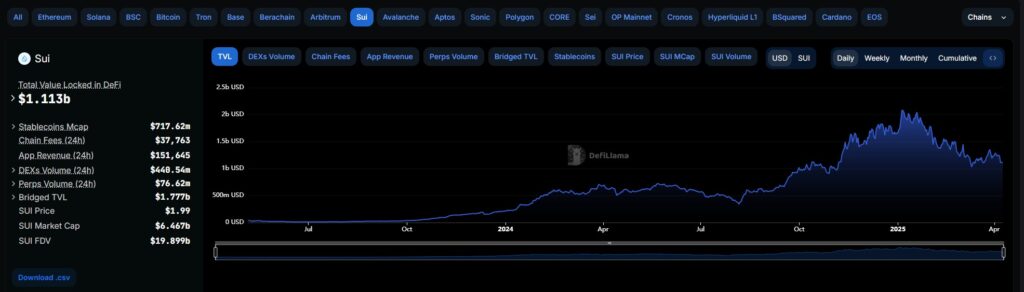

Currently boasting a market capitalization of approximately $6.5 billion, SUI is also notable for its robust ecosystem, having around $1.1 billion in total value locked (TVL) on its platform, as reported by DeFiLlama. Sui Network aims to enhance user onboarding experiences in a manner akin to traditional Web3 applications, utilizing the Move programming language—a smart contract framework derived from Rust.

“There is all this frothy excitement in the market about these ETFs coming, and no one can point to where substantial demand is going to come from,” noted Katalin Tischhauser, head of crypto research at Sygnum Bank, highlighting the mixed sentiment surrounding investor interest in altcoin ETFs.

Canary Capital has been proactive in the cryptocurrency ETF space, having submitted its S-1 regulatory filing for the SUI fund in March. This is not their first foray; they have proposed several other U.S. crypto ETFs, including those focusing on Litecoin (LTC), XRP (XRP), and more. Simultaneously, Cboe BZX has also been busy, filing to list ETFs based on prominent tokens like Solana (SOL), underlining a continuing trend of interest in cryptocurrency investment vehicles.

However, as noted by industry experts, the appetite among investors for altcoin ETFs appears less vigorous compared to the more established cryptocurrencies like Bitcoin (BTC) and Ether (ETH). Despite the burgeoning number of altcoin ETF filings since the beginning of 2024, including funds that feature memecoins such as Dogecoin (DOGE), the road ahead for new listings remains uncertain.

Cboe BZX Exchange Seeks Approval for Sui ETF

The Cboe BZX Exchange is taking a significant step in the cryptocurrency market by requesting regulatory approval to list an ETF backed by Sui (SUI), the token of the Sui Network. Here are the key points related to this development:

- ETF Listing Request: Cboe BZX has filed for an ETF that would be the first in the United States to hold SUI tokens, pending SEC approval.

- Sui Network Background: Sui is a blockchain network that enhances user onboarding experiences and utilizes a smart contract framework known as Move.

- Market Capitalization: SUI has a market capitalization of approximately $6.5 billion, indicating robust interest and investment potential.

- Total Value Locked (TVL): The Sui Network holds around $1.1 billion in total value locked, reflecting its utilization in DeFi applications.

- Asset Management: The ETF will be issued by Canary Capital, which specializes in crypto ETFs and has previously filed for various other crypto funds.

- Industry Trends: The SEC has seen a surge in altcoin ETF filings, including proposed funds for other cryptocurrencies such as Solana (SOL), Litecoin (LTC), and memecoins like Dogecoin (DOGE).

- Market Demand Concerns: Analysts express skepticism regarding the demand for altcoin ETFs, suggesting potential challenges in attracting investors compared to major cryptocurrencies like Bitcoin and Ethereum.

This information might impact readers by highlighting emerging investment opportunities and informing them about the evolving landscape of cryptocurrency ETFs. Understanding these developments could influence investment decisions and awareness of market trends.

Cboe BZX Exchange’s Sui ETF: A Game Changer or a Market Flop?

The recent move by Cboe BZX Exchange to seek regulatory clearance for an ETF backed by the Sui token (SUI) indicates a bold step into a competitive landscape that is increasingly crowded with cryptocurrency ETFs. While this initiative may present an opportunity for investors to diversify their portfolios, it also raises crucial questions about market demand and investor interest in altcoin ETFs versus established cryptocurrencies such as Bitcoin or Ethereum.

Competitive Advantages: One of the significant advantages of this proposed ETF is that it would mark a historic milestone as the first in the U.S. to include SUI. This could potentially attract investors who are keen to capitalize on the growth of innovative blockchain technologies, particularly those like Sui that offer a streamlined onboarding experience for users. Furthermore, with the interest in cryptocurrencies having surged, this ETF could tap into an expanding market segment that is eager for diverse investment vehicles. The size of the Sui Network, with a market cap of approximately $6.5 billion and about $1.1 billion in total value locked, demonstrates a solid foundation that could instill confidence in prospective investors.

Disadvantages and Challenges: However, there are significant challenges that could hinder the ETF’s success. The SEC’s history of cautious scrutiny towards new ETF proposals raises uncertainty about approval timelines and regulatory hurdles. Moreover, insights from industry analysts like Katalin Tischhauser suggest that the market demand for altcoin ETFs may not be as robust as for their Bitcoin or Ethereum counterparts. This could lead to a lack of investor interest, making the ETF more speculative than a reliable investment. If potential buyers are hesitant, Cboe may find itself struggling against established products that have a proven track record.

The Sui ETF could benefit a specific demographic: tech-savvy investors and early adopters who are enthusiastic about blockchain innovations and cryptocurrencies beyond just the giants like BTC or ETH. This group often seeks the next wave of growth opportunities, making them ripe for investment products like the Sui ETF. Conversely, traditional investors, who may prefer the stability and historical performance of Bitcoin and Ethereum, could see the ETF as a risky venture, potentially leading to lower participation rates. Additionally, the nuanced sentiment among investors could create friction for Cboe, particularly if market performance does not align with heightened expectations generated by the ETF’s launch.