The cryptocurrency landscape is buzzing with noteworthy developments as the Cboe BZX exchange is seeking approval from US regulators to integrate staking capabilities into Fidelity’s popular Ether exchange-traded fund (ETF). This move comes in light of a recent filing dated March 11 and marks Cboe’s determined effort to enhance the offerings of its Ether funds listed on its US exchange.

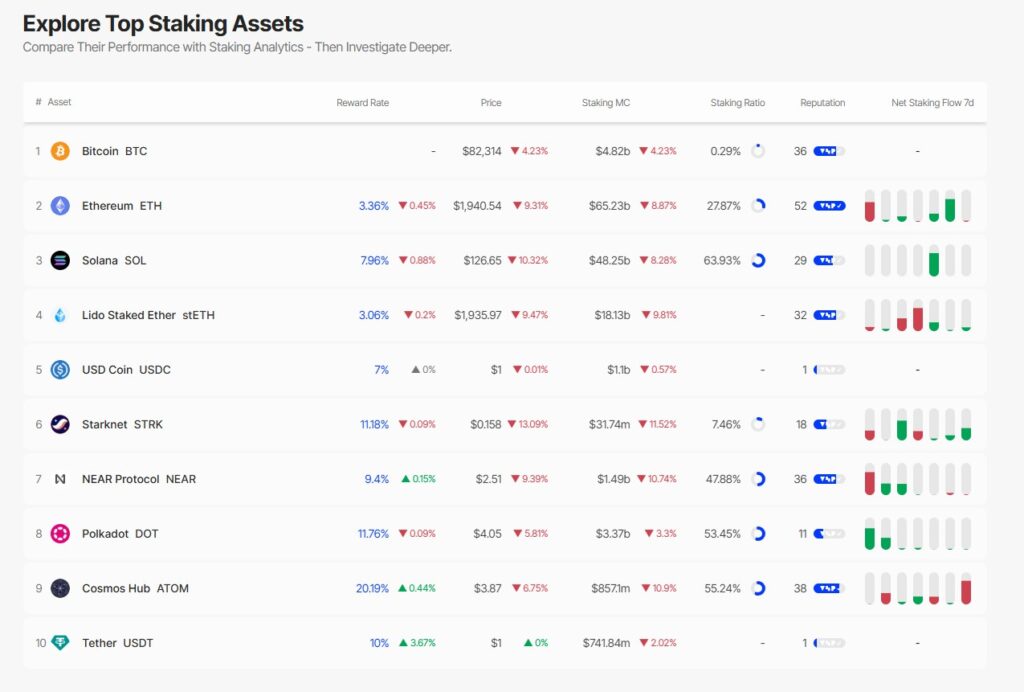

Staking, a process that allows cryptocurrency holders to earn rewards by locking up their assets, could significantly boost the Fidelity Ethereum Fund (FETH), which currently manages nearly billion in assets. According to the filing, Cboe proposes that the Fidelity Ethereum Fund be able to stake its Ether through reputable staking providers, a strategy aimed at enhancing returns for investors. Currently, staking Ether yields approximately 3.3% annual percentage rate (APR), a figure highlighted by research from Staking Rewards.

“Staking Ether enhances returns and involves posting ETH as collateral with a validator in exchange for rewards.”

This initiative follows Cboe’s previous request to add similar staking features to another Ether ETF, the 21Shares Core Ethereum ETF. There appears to be a growing acceptance within the regulatory framework, as evidenced by the SEC’s acknowledgment of over a dozen cryptocurrency ETF-related filings since February, pointing toward a potentially more favorable stance on various crypto advancements.

As the SEC weighs Cboe’s proposed rule changes, they also clarify their long-term view on cryptocurrency, indicating an evolution in the regulatory environment since the administration of former President Donald Trump. In addition to the staking initiative, Cboe has expressed interest in several other filings, including those related to in-kind redemptions for both Bitcoin and Ether ETFs, as well as XRP ETFs from Canary and WisdomTree.

With these emerging strategies and regulatory considerations, the cryptocurrency market remains a dynamic space for innovation and investment strategies, reflecting a notable shift in how traditional financial mechanisms are beginning to integrate with digital assets.

Cboe BZX Seeks Regulatory Approval for Staking in Ether ETF

The recent filing by Cboe BZX to include staking in Fidelity’s Ether ETF could significantly impact the cryptocurrency landscape and investors. Here are the key points to consider:

- Cboe BZX Filing: Cboe BZX has filed a request with US regulators, aiming to incorporate staking into Fidelity’s Ethereum exchange-traded fund (ETF).

- Staking Benefits: Staking Ether allows investors to earn rewards by posting ETH as collateral with a validator, enhancing potential returns.

- Fidelity Ethereum Fund (FETH): This ETF is one of the most popular options in the market, boasting nearly billion in assets under management.

- Current Staking Yields: As of March 11, staking Ether yields approximately 3.3% APR, which could attract more investors seeking passive income.

- SEC’s Role: The US Securities and Exchange Commission (SEC) must approve the proposed rule change before staking can take place, indicating regulatory hurdles may influence the timeline.

- Broader Industry Implications: Cboe has also filed requests related to other cryptocurrencies and ETFs, reflecting a trend towards more integrated and flexible crypto investment opportunities.

- Changing Regulatory Landscape: The SEC’s recent acknowledgments suggest a potential shift in the regulatory environment, which may foster greater acceptance of cryptocurrency products.

This evolving situation could impact individual investors’ strategies, making Ethereum staking an attractive option for those looking to capitalize on yield-generating opportunities in the crypto space.

Cboe BZX Makes Waves with New Fidelity ETF Staking Initiative

The latest filing from Cboe BZX for permission to integrate staking features into Fidelity’s Ether exchange-traded fund (ETF) signals a significant shift in the cryptocurrency investment landscape. As one of the largest exchanges seeking to enhance the value of digital asset investments, Cboe’s move could potentially set it apart from competitors in the growing ETF market.

Competitive Advantages: By allowing staking, Cboe not only increases the investment appeal of the Fidelity Ethereum Fund (FETH) but also taps into a growing trend where investors are looking for additional sources of yield from their crypto holdings. With staking yields hovering at around 3.3% APR, users could see enhanced returns, making FETH an attractive option compared to other cryptocurrencies that lack similar staking capabilities. Furthermore, this advancement underscores Cboe’s commitment to innovation, which can resonate positively with tech-savvy investors and institutions alike.

Competitive Disadvantages: However, the proposal isn’t without its challenges. The crux of the issue lies with the US Securities and Exchange Commission (SEC), which must approve these rule changes before staking can officially commence. The regulatory landscape around crypto ETFs remains highly fluid, and delays or rejections from the SEC could hinder Cboe’s strategic goals, allowing competitors to jump ahead with their own offerings or staking features. Additionally, there’s the risk of market volatility affecting both the attractiveness of staking rewards and overall fund performance.

This initiative could benefit individual retail investors and institutions looking to diversify their portfolios with products that offer potential for passive income through staking. On the flip side, traditional investment strategies that prioritize low-risk profiles may face challenges as clients increasingly seek return-maximizing strategies. For other exchanges and investment firms, Cboe’s bold move could spark a competitive race to upgrade their offerings, which might create pressure to innovate quickly or risk being left behind.