In an intriguing development within the cryptocurrency realm, securities exchange Cboe BZX is seeking the green light from US regulators to implement staking into its Fidelity Ethereum Fund (FETH), a highly regarded Ether exchange-traded fund (ETF). This request, detailed in a filing on March 11, underscores Cboe’s ongoing efforts to enhance the appeal and functionality of its Ether funds traded in the US market.

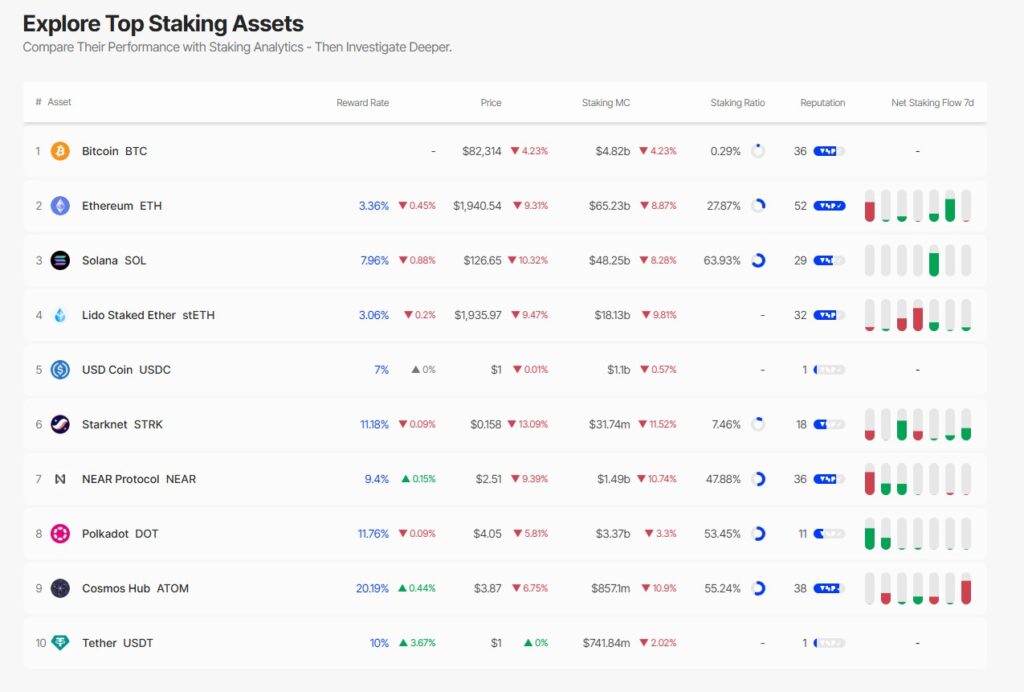

The proposed rule change would enable the Fidelity Ethereum Fund to “stake, or cause to be staked,” portions of its ether holdings through trusted staking providers. Staking is a process that allows Ether holders to lock up their cryptocurrency as collateral with a validator, thereby earning rewards in exchange—currently estimated at about 3.3% annual percentage rate (APR) as indicated by Staking Rewards. The Fidelity Ethereum Fund is noteworthy not only for its staking potential but also for its impressive standing, boasting nearly billion in assets under management, as highlighted by VettaFi.

“Cboe’s filing marks its latest attempt to support staking for Ether funds traded on its US exchange, reflecting a shift in the regulatory climate for cryptocurrency ETFs.”

Cboe BZX Seeks Permission for Staking in Fidelity’s Ether ETF

The recent filing by Cboe BZX to allow staking in Fidelity’s Ether ETF could significantly impact both the cryptocurrency market and investors. Here are the key points:

- Cboe BZX’s initiative: Cboe is seeking regulatory permission to incorporate staking into the Fidelity Ethereum Fund (FETH).

- Popularity of Fidelity Ethereum Fund: The FETH is one of the most popular Ether ETFs, boasting nearly billion in assets under management.

- Staking benefits: Staking Ether could enhance returns by rewarding investors who post ETH as collateral, currently yielding approximately 3.3% APR.

- Regulatory landscape: The US Securities and Exchange Commission (SEC) must approve these proposed rule changes, indicating a potential shift in regulatory attitude towards cryptocurrencies.

- Impact of staking mechanism: Should the proposal be approved, investors could see improved returns from their investments in Ether ETFs.

- Broader implications: The SEC’s acknowledgment of multiple exchange filings may suggest a more favorable regulatory environment for crypto investments moving forward.

- Other proposals: Cboe is also pursuing additions to various ETFs, including those related to XRP and potential in-kind redemptions for Bitcoin and ETH ETFs.

The evolving regulatory framework and innovations like staking can significantly enhance investment strategies in the cryptocurrency space.

Staking with Fidelity’s Ethereum ETF: A Game Changer in the Crypto Market?

The recent move by Cboe BZX to incorporate staking within Fidelity’s Ethereum ETF presents an intriguing development in the rapidly evolving landscape of cryptocurrency exchange-traded funds (ETFs). With the SEC’s potential approval, this initiative could provide unique competitive advantages over other Ether ETFs and crypto products currently available.

Firstly, the prospect of staking could significantly enhance returns for investors. Currently, traditional investment vehicles offer limited yield potential, often hovering around a modest 1–2% at best. In contrast, the anticipated yield of approximately 3.3% APR for staked Ether introduces a level of attractiveness that could lure more institutional and retail investors to the Fidelity Ethereum Fund (FETH). The nearly billion in assets under management already emphasizes its popularity, and adding staking could further solidify its market position, especially compared to other Ether ETFs like the 21Shares Core Ethereum ETF which does not yet have such features.

However, this initiative could also present challenges. The regulatory landscape for cryptocurrency is notoriously complex, and the SEC’s approval process introduces an element of uncertainty. Any delay or denial can hinder Cboe’s goal of enhancing the fund’s appeal before competitors capitalize on the trend. Moreover, raised stakes—both literally and figuratively—could deter risk-averse investors who may be wary of added complexities that come with staking.

There are also broader implications for the crypto investment ecosystem. If Cboe successfully implements this staking feature, it may pressure other funds to adopt similar strategies in a bid to remain competitive, potentially leading to a wider acceptance and adoption of staking within the ETF framework. Conversely, failure to secure the necessary regulatory approval could put Cboe and Fidelity on the back foot, allowing other players in the market to advance their staking options unchallenged.

In summary, while the proposed integration of staking could bolster Fidelity’s ETF by attracting a broader audience seeking enhanced returns, it also risks complicating the investment landscape. Investors eager to explore innovative financial products may reap the benefits, yet those wary of regulatory hurdles and market fluctuations could find themselves facing additional challenges in navigating this new terrain.