The cryptocurrency landscape is buzzing with news as the Cboe BZX exchange recent moves to bolster its offerings with staking capabilities for the Fidelity Ethereum Fund (FETH). In a filing dated March 11, Cboe is seeking the approval of U.S. regulators to implement staking for this popular Ether exchange-traded fund (ETF), which currently holds nearly billion in assets under management.

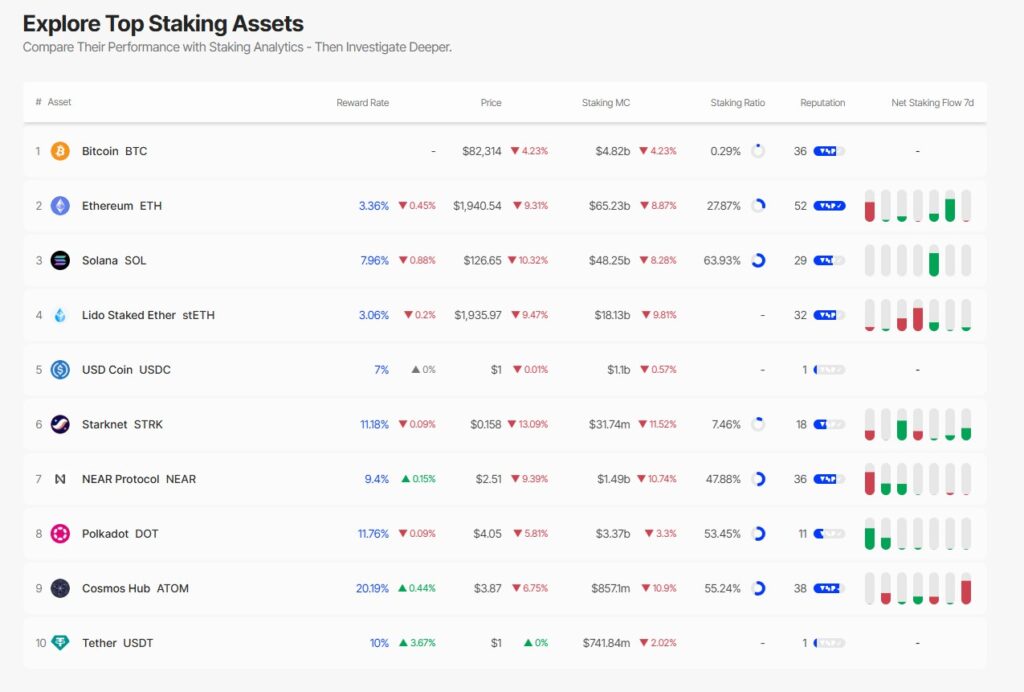

Staking, a process where Ether (ETH) is locked up as collateral with a validator, allows investors to earn rewards on their holdings. As of now, staking Ether yields approximately 3.3% annual percentage rate (APR), providing an enticing opportunity for investors looking to enhance their returns. Cboe’s proposed updates aim to allow Fidelity to stake “all or a portion of the Trust’s ether through one or more trusted staking providers,” thereby potentially increasing the fund’s attractiveness to investors.

“Staking offers a way to earn passive income through cryptocurrency holdings, and integrating this feature into major investment funds reflects a growing acceptance of crypto assets in traditional finance,” says a spokesperson from VettaFi.

Notably, this initiative is not Cboe’s first foray into crypto staking; in February, it had already sought similar permissions for the 21Shares Core Ethereum ETF. The U.S. Securities and Exchange Commission (SEC) holds the power to approve these changes, marking a crucial step in making staking more mainstream in the United States.

The SEC’s recent acknowledgments of numerous cryptocurrency ETF filings suggest a gradual shift in its regulatory approach to digital assets, especially following political changes at the federal level. These moves indicate that traditional financial frameworks are increasingly open to embracing cutting-edge technologies like staking and diverse altcoin investments. Alongside staking, Cboe has also requested permissions for various other changes, including options trading and in-kind redemptions for popular ETFs such as Fidelity’s Bitcoin and Ethereum funds.

As interest in cryptocurrency continues to grow, Cboe’s advancements highlight the intersection of innovative financial solutions and digital assets, paving the way for a more robust investment landscape. It remains to be seen how regulatory bodies will respond, but the momentum in the crypto space is certainly building.

Cboe BZX Seeks Permission for Staking in Fidelity’s Ether ETF

The recent developments regarding Cboe BZX’s filing for staking permissions in Fidelity’s Ether ETF could have meaningful implications for investors and the cryptocurrency market as a whole.

- Cboe BZX Filing

- Cboe has filed with US regulators to incorporate staking into the Fidelity Ethereum Fund (FETH).

- This move is part of Cboe’s ongoing efforts to support staking for Ether funds traded on its exchange.

- Staking Potential

- Staking Ether allows investors to earn approximately 3.3% APR in ETH as rewards by posting their ETH as collateral with validators.

- Such returns can enhance the overall profitability of holding Ether, thereby impacting investors’ decision-making processes.

- Fidelity Ethereum Fund Overview

- FETH is one of the most popular Ether ETFs, with nearly billion in assets under management.

- The introduction of staking could attract even more investors, increasing demand and potentially driving up prices.

- Regulatory Environment

- The US Securities and Exchange Commission (SEC) must approve Cboe’s proposed rule changes before staking can be implemented.

- The SEC’s recent acknowledgments of multiple cryptocurrency ETF filings indicate a potentially more favorable regulatory environment.

- Broader Implications for Cryptocurrency ETFs

- Aside from the FETH, Cboe is looking to incorporate staking in other ETFs, such as the 21Shares Core Ethereum ETF.

- Changes could enhance liquidity and the applicability of cryptocurrency assets in traditional finance.

The ongoing developments in the ETF landscape, particularly regarding staking mechanisms, can significantly influence investment strategies and the adoption of cryptocurrencies in mainstream finance.

Cboe BZX Pushes for Staking in Fidelity’s Ether ETF: A Game Changer in Crypto Investments?

The recent bid by Cboe BZX to integrate staking into Fidelity’s Ether exchange-traded fund (ETF) promises to shake up the current landscape of cryptocurrency investments. This move potentially places Fidelity’s Ethereum Fund (FETH) in a favorable position compared to other popular ETFs like 21Shares Core Ethereum ETF, which is also eyeing the advantages that staking can offer. With nearly billion in assets under management, FETH stands out as a leading option for investors looking to diversify their portfolios into digital assets with potentially lucrative returns.

The Competitive Edge: By allowing staking, Cboe is positioning Fidelity’s Ethereum Fund to enhance returns significantly – a crucial attraction amid a somewhat volatile market. With current staking rewards hovering around 3.3% APR, this innovation not only draws more attention to Ether-related investments but also helps solidify Fidelity’s reputation as a forward-thinking player in the ETF arena. Given the growing acceptance of cryptocurrency ETFs in recent regulatory filings, this could represent a substantial opportunity for attracting a broader institutional clientele and retail investors keen on maximizing their returns through staking.

Potential Challenges: However, this proposal isn’t without its challenges. Regulatory approval remains a critical hurdle. The SEC’s stance has been cautious; while it has begun to acknowledge more cryptocurrency ETF proposals, there’s no guarantee that staking will gain the green light. This uncertainty could lead to delays or complicate investment strategies for those considering the Fidelity Ethereum Fund. Additionally, the complexities of staking mechanics may deter less experienced investors who prefer straightforward investment vehicles.

Who stands to gain or lose here? Institutional investors looking for innovative ways to maximize their yield might find fidelity’s proposed offerings particularly advantageous. In contrast, traditionalists wary of investing in crypto could find these developments unsettling, fueling concerns about regulatory compliance and the inherent risks of digital asset volatility. As the crypto landscape continues to evolve, players like Fidelity could either set a precedent for success or face setbacks if the regulatory environment becomes more stringent.