Central banks across the globe are gradually exploring the integration of blockchain technology into their operations, driven by the evolving dynamics of the financial landscape. With 134 jurisdictions now investigating or piloting central bank digital currencies (CBDCs), a significant leap from just 35 in 2020, the shift towards digital finance is rapidly gaining momentum. This trend reflects a broader movement within the financial industry to tokenize various forms of money, from money-market funds to bank deposits.

The inquiry into blockchain’s potential is not merely a trend; it represents a fundamental shift in how financial institutions might operate. Recent advancements suggest that if banks fail to adapt by moving tokenized deposits across both public blockchains and private ledgers, they risk becoming obsolete. Central banks are now confronting critical questions regarding the functionality of traditional monetary operations, like open-market purchases, within a framework where reserves and government bonds might evolve into smart tokens.

“Tokenized monetary policy” is emerging as a concept where central banks can manage liabilities and assets via programmable tokens on distributed-ledger platforms, presenting a glimpse into a more streamlined and efficient financial future.

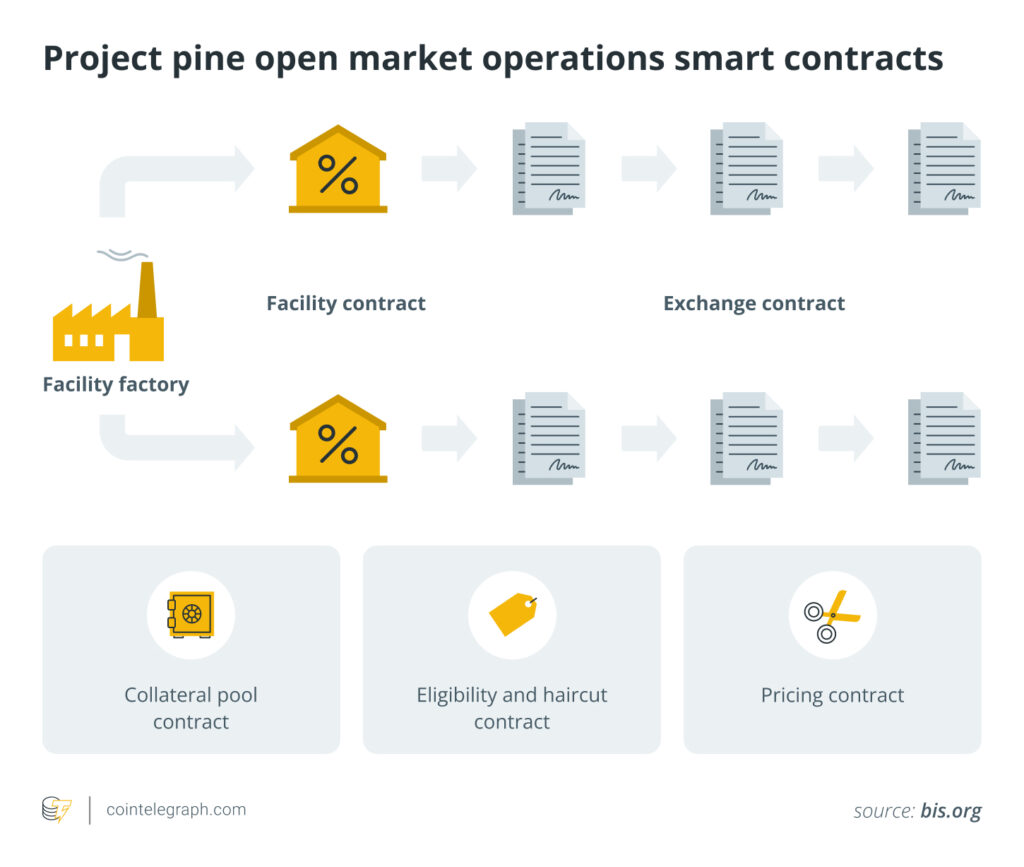

Projects such as Project Pine and the Bank of England’s wholesale CBDC sandbox indicate that central banks are serious about testing these innovations. These initiatives explore the viability of smart contracts in executing monetary policy, potentially transforming operations that traditionally relied on human oversight and extended processing times. By conducting simulated financial scenarios, these projects demonstrate the capability of a tokenized system to execute complex operations rapidly and automatically, showcasing a new paradigm in central banking.

However, the path to adopting tokenized monetary policy is marred by challenges, including interoperability between blockchains, legal ambiguities regarding data validity, and the balance between privacy and transparency. As central banks navigate these hurdles, their ongoing research signals a cautious yet determined approach towards innovating monetary frameworks.

“The future of tokenized monetary policy will likely unfold in carefully staged phases, balancing innovation with financial stability.”

While the full implications of tokenization remain uncertain, the potential for enhanced operational efficiency and responsiveness in monetary policy is clear. As central banks analyze successful pilots and adapt their strategies, the financial sector is poised for change, offering both opportunities and complexities as it moves towards the inevitable digital frontier.

Why are Central Banks Looking at Blockchains?

Key points on the examination of blockchains by central banks:

- Shift in Financial Systems: Central banks are exploring blockchains as the money-making machine is being rewritten as code.

- CBDC Research: 134 jurisdictions are studying or piloting a central bank digital currency (CBDC), a significant increase from 35 in 2020.

- Commercial Bank Concerns: Commercial banks warn that failure to move tokenized deposits across blockchains could leave them behind.

- Tokenized Monetary Policy:

- Assets and liabilities as programmable tokens on distributed-ledger platforms.

- Execution of monetary functions through smart contracts, improving efficiency.

- Project Pine:

- A research initiative to test how central banks could manage monetary policy using digital tokens.

- Simulations show potential for automatic adaptations to market conditions.

- Practical Challenges: Facing interoperability, legal finality, cyber resilience, and privacy vs transparency in moving to tokenized systems.

- Phased Adoption Approach: Central banks plan a gradual transition to tokenized monetary policy, ensuring financial stability while integrating innovation.

These developments could significantly affect how monetary policy operates, impacting economic stability and the efficiency of financial transactions in readers’ daily lives.

Exploring the Future of Central Bank Digital Currencies: A Comparative Insight

The increasing focus on blockchain technology by central banks marks a pivotal shift in the global financial landscape. Central banks, traditionally resistant to drastic changes, now recognize the potential of central bank digital currencies (CBDCs) and their ability to reshape monetary policy frameworks. This transition is evidenced by numerous pilots, including projects from the Bank of England and the Monetary Authority of Singapore, which highlight the operational efficiencies gained through tokenization.

In comparison to conventional financial systems, the integration of smart contracts and decentralized ledgers enables real-time settlement and transparency, drastically reducing latency and enhancing operational resilience. For example, Project Pine showcases programmable monetary policies that promise faster execution of transactions and fewer manual interventions. This contrasts sharply with older systems reliant on batch processing and human oversight, which can introduce risk and delay.

However, while these developments have clear advantages, they also present unique challenges. Interoperability remains a significant concern; while projects are underway to bridge different blockchain ecosystems, the risk of fragmentation looms large. Legal recognition of digital tokens also poses hurdles. The existing legal frameworks in many jurisdictions still classify tokens as mere transaction evidence, limiting their acceptance as secure assets within the traditional financial system.

These technological advances may benefit not only the central banks themselves but also commercial institutions engaging with tokenized assets. Banks like HSBC are already experimenting with tokenized deposits, indicating that those who adapt early can gain a competitive edge. Conversely, institutions that resist these changes might find themselves marginalized, lacking the capacity to efficiently process transactions in a rapidly evolving market environment.

Moreover, the complexities of privacy versus transparency in blockchain will significantly affect consumer trust. The need for regulatory compliance could conflict with individuals’ desires for anonymity, presenting a dual-edged sword. Central banks and digital currency projects must carefully navigate these waters to foster acceptance and ensure stability.

Ultimately, as central banks around the globe embark on this transformative journey, the choices they make in balancing innovation with stability will define the future of monetary policy. The path is fraught with pitfalls and challenges, but innovative protocols like those seen in Project Pine and similar initiatives lay the groundwork for a more responsive and efficient economic environment.