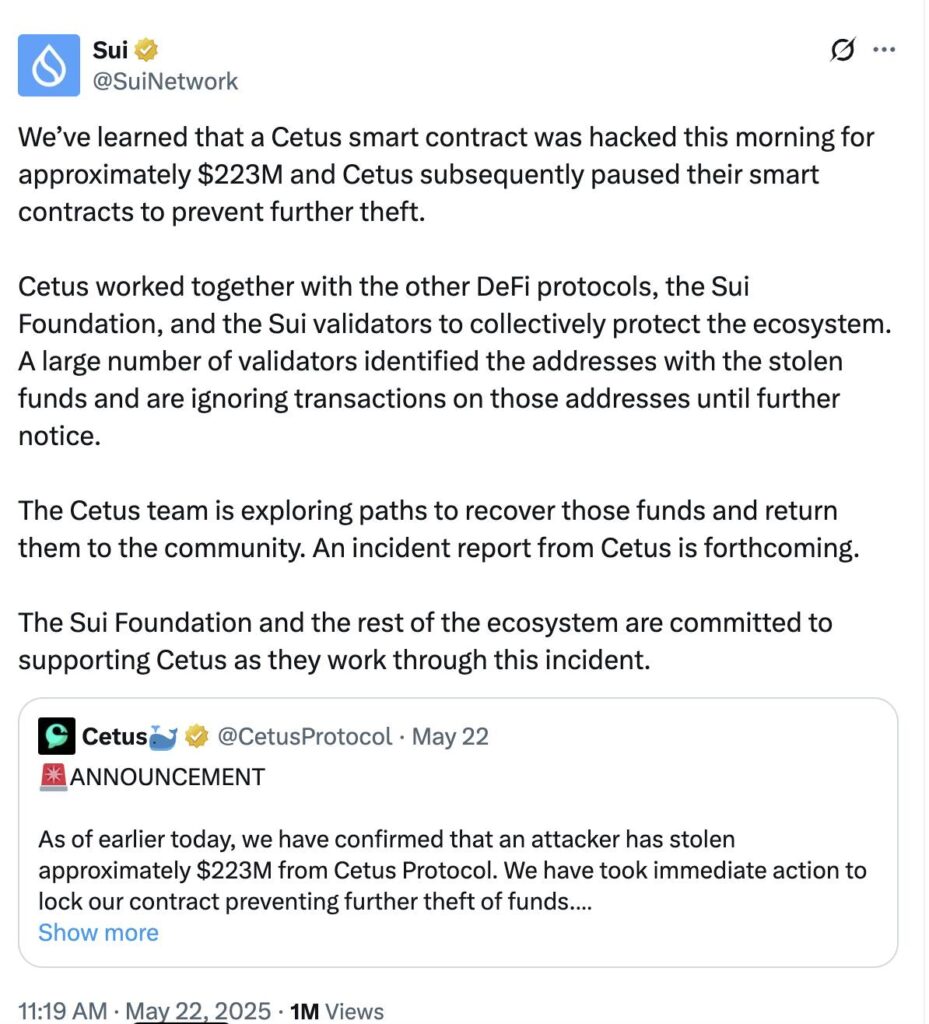

In a significant incident that underscores the ongoing security challenges in the cryptocurrency landscape, Dedaub, a blockchain security firm, has released a post-mortem analysis following a major hack of the Cetus decentralized exchange. This exploit, which occurred on May 22, resulted in a staggering loss of $223 million, highlighting vulnerabilities in automated market maker (AMM) protocols that have raised alarms within the crypto community.

The report pinpointed the attack’s root cause as a flaw in the liquidity parameters used by the Cetus platform. Hackers manipulated a critical check known as the most significant bits (MSB) check, enabling them to drastically alter values associated with liquidity, allowing for the establishment of enormous positions with minimal token input. Dedaub’s researchers emphasized that this weakness led to the draining of liquidity pools valued in the hundreds of millions of dollars.

“This allowed them to add massive liquidity positions with just one unit of token input, subsequently draining pools collectively containing hundreds of millions of dollars worth of tokens,”

As the dust settled, the response to the crisis raised eyebrows within the community. Validators on the Sui network acted swiftly to freeze a significant portion of the stolen assets, amounting to $163 million. While this action provided a level of immediate security, it ignited debates over the principles of decentralization, with some industry advocates criticizing the intervention as a move toward centralization of authority within the blockchain environment.

Critics voiced concerns over the potential erosion of decentralization, claiming that such actions alter the fundamental ethos of blockchain technology. Posts on social media platforms reflected sentiments that the move by Sui validators could shift the network towards a more centralized, permissioned database model, contradicting the foundational principles many cryptocurrency projects champion.

This incident, along with others in the evolving Web3 sector, places a spotlight on the necessity for robust security measures. As hacks continue to plague the crypto industry, executives are calling for preemptive strategies to safeguard users before regulatory bodies enforce stricter controls. The Cetus hack serves as a stark reminder of the delicate balance between innovation and security in the rapidly changing world of digital assets.

Cetus Decentralized Exchange Hack Analysis

The post-mortem report released by Dedaub highlights critical vulnerabilities in the Cetus decentralized exchange hack and its implications for the cryptocurrency industry.

- Root Cause of the Hack:

- The hack was primarily due to an exploit of the liquidity parameters in Cetus’s automated market maker (AMM).

- A flaw in the most significant bits (MSB) check allowed hackers to manipulate values, resulting in significant financial losses.

- Financial Impact:

- On May 22, the Cetus exchange was hacked, leading to $223 million in user losses within just 24 hours.

- Cetus and the Sui Foundation managed to freeze $163 million of the stolen assets immediately after the incident.

- Community Reactions:

- The decision to freeze the stolen funds sparked controversy and accusations of centralization within the crypto community.

- Critics argue that this intervention undermines the foundational principles of decentralization in blockchain technology.

- Industry Implications:

- Executives in the crypto sector emphasize the need for improved cybersecurity measures to protect users and meet potential regulatory requirements.

- The trend of hacks raises concerns for investors and users about the stability and security of their funds in decentralized platforms.

“Sui validators are actively censoring transactions across the blockchain, completely undermining the principles of decentralization.” – Community Feedback

This information underscores the pressing need for enhanced security protocols in Web3 projects, encouraging readers to be more cautious about where they invest and to advocate for accountability in decentralized platforms.

Analyzing the Impact of the Cetus Exchange Hack on the Decentralized Finance Landscape

The recent vulnerability exposure reported by Dedaub regarding the Cetus decentralized exchange hack has reignited concerns about security flaws in the crypto sector. The hack, which led to an astounding $223 million loss, highlights a critical vulnerability tied to the liquidity parameters within the automated market maker (AMM) framework. Such incidents, where cyber exploits lead to massive financial repercussions, serve as stark reminders of the inherent risks in decentralized finance (DeFi).

The key competitive advantage of this news lies in the spotlight it shone on the urgent need for improved cybersecurity measures within the Web3 and crypto ecosystems. As industry players grapple with regulatory scrutiny, this incident serves as a wake-up call, urging firms to bolster their security protocols before regulators step in with enforced regulations. Security firms like Dedaub that specialize in identifying these vulnerabilities stand to gain notoriety and credibility, potentially increasing their market share among DeFi projects eager to avoid the pitfalls seen with Cetus.

However, the hack also reveals significant disadvantages for decentralization advocates. The immediate freezing of stolen assets by Sui network validators raised a ruckus in the community, igniting fierce debates regarding centralization versus decentralization. Critics argue that interventions like these undermine the foundational principles of DeFi, pushing the narrative that even decentralized networks can fall prey to centralized control. This could deter potential users who favor the decentralization ethos, leading to reluctance in adopting certain platforms that appear to easily abandon these values during times of crisis.

The implications of such news could resonate across various stakeholders in the crypto industry. For developers and DeFi projects, heightened awareness around security flaws may prompt increased investment in rigorous auditing processes—a potential boon for cybersecurity companies. Conversely, for users who prioritize autonomy and decentralization, this shift towards central oversight by validators might precipitate a crisis of confidence that discourages participation in the ecosystem, potentially stalling its growth and innovation.

In summary, while the Cetus hack catalyzes important discussions about security and regulatory compliance in the DeFi space, it also exposes divides within the community about the balance between innovation and security, ultimately affecting user trust and participation in this rapidly evolving landscape.