Cetus Protocol, the leading decentralized exchange (DEX) on the Sui blockchain, has made headlines by securing a significant loan from the Sui Foundation. This financial assistance aims to fully compensate users who fell victim to a staggering $223 million exploit just last week, which rocked the DeFi landscape. The funds will specifically address the bridged assets, separate from the frozen assets pending an on-chain community vote.

In a recent post on X, Cetus expressed optimism about the recovery process, stating, “Using our cash and token treasuries, we are now in a position to fully cover the stolen assets currently off-chain if the locked funds are recovered through the upcoming community vote.” This commitment underscores their strategy to leverage both existing treasuries and the newly acquired loan to support affected users.

“These are extraordinary measures taken to protect the Sui community,”

the Sui Foundation affirmed, noting that a complete recovery could be achievable with community backing. The exploit involved a sophisticated manipulation of spoof tokens, such as BULLA, exploiting vulnerabilities in price mechanisms that ultimately led to the draining of liquidity pools, including SUI and USDC.

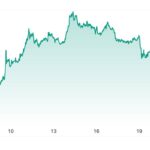

During this tumultuous period, over $162 million in tokens were frozen on-chain, while other assets were diverted through various channels. The incident led to a multipronged response from Cetus, including the pausing of its smart contracts and an immediate investigation into the breach. Following the exploit, the governance token CETUS experienced a significant dip in value, dropping nearly 40%, amidst growing concerns regarding the security of protocols within Sui’s DeFi ecosystem.

With the recent loan secured from the Sui Foundation, Cetus is poised to start reimbursing users right away, offering a glimmer of hope in a challenging recovery effort.

Cetus Protocol Recovery Plan

The following key points outline the recent developments regarding the Cetus Protocol and its impact on the users and the Sui community:

- Loan from Sui Foundation: Cetus Protocol has secured a loan from the Sui Foundation to facilitate reimbursements for users affected by the exploit.

- Full Compensation: The loan aims to cover the full compensation for bridged assets lost in the $223 million exploit.

- Community Involvement: Recovery depends on an upcoming on-chain governance proposal for utilizing frozen funds.

- Impact on Users: The reimbursement plan directly impacts affected users by offering the possibility of regaining their lost assets.

- Security Measures: Extraordinary measures have been taken to protect the Sui community, highlighting a focus on user safety and trust.

- Market Reaction: The exploit led to a nearly 40% drop in the governance token CETUS, affecting investor confidence in the protocol.

- Ongoing Investigation: Cetus has paused smart contracts and initiated an investigation into the exploit tactics, maintaining transparency with the community.

- Active Attacker: The attacker still holds a significant amount of assets, creating ongoing security concerns within the ecosystem.

The Sui Foundation’s support emphasizes the importance of community collaboration in recovery efforts.

Cetus Protocol’s Recovery Plan: Navigating the Aftermath of the $223 Million Exploit

The recent exploit on Cetus Protocol, the leading decentralized exchange within the Sui blockchain ecosystem, has put a spotlight on the delicate nature of DeFi platforms. As the dust begins to settle, Cetus has taken a noteworthy step by securing a loan from the Sui Foundation to facilitate the reimbursement of affected users. This strategic move places Cetus in a unique position among other DeFi platforms that have faced similar crises, offering distinct advantages while also illuminating potential challenges.

Competitive Advantages: Unlike many platforms that falter when facing security breaches, Cetus’s initiative to proactively secure funding showcases a commendable commitment to user trust and retention. This financial backing from the Sui Foundation is pivotal; it not only assures users of immediate compensation but also displays community confidence in the protocol’s recovery efforts. Additionally, by addressing the situation head-on and implementing a governance proposal for the use of frozen funds, Cetus is promoting user engagement and community involvement, which could forge a stronger bond with its user base.

Comparatively, other exchanges have struggled during exploit situations, often delaying compensation or failing to secure funding, which has led to diminished user trust and trading activity. Cetus’s rapid response, thus, positions it favorably amongst competitors by fostering a sense of security and reliability within a volatile market.

Competitive Disadvantages: However, this recovery plan is not without its hurdles. The dependence on a governance proposal for the release of frozen funds might pose a risk if the community does not approve or if the proposal faces lengthy debates. Moreover, while Cetus has been proactive, the significant drop in its governance token (CETUS) value demonstrates the potential for loss in stakeholder confidence. If the reimbursement process encounters delays or complications, it could exacerbate concerns regarding security and operational efficacy, ultimately impacting user retention.

This news could either stabilize or destabilize the Sui DeFi community. For current users, the swift action taken by Cetus indicates a dedication to protecting their investments, potentially retaining loyal users amid the volatility. Conversely, prospective users or those evaluating the safety of DEX platforms might view the incident and recovery efforts skeptically, questioning the security and reliability of the Sui blockchain as a whole. In an ecosystem where trust is invaluable, the success of Cetus’s recovery strategy will likely influence not only its own standing but also the broader perceptions of decentralized finance options on the Sui platform.