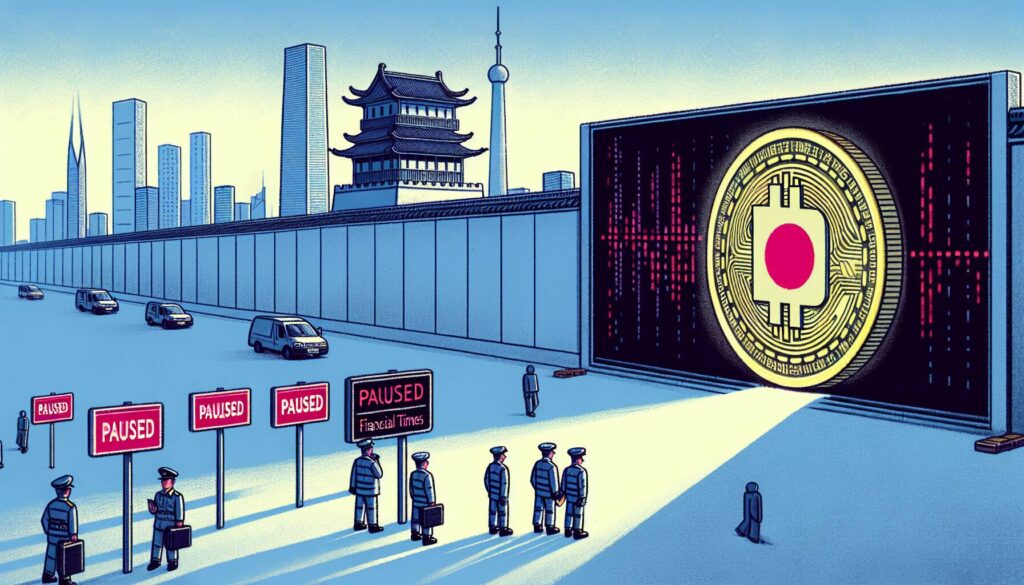

In a surprising turn of events, major Chinese tech companies are hitting the brakes on their stablecoin plans following a recent intervention by Beijing. This decisive action from the Chinese government is aimed at regulating the issuance of stablecoins, especially in the bustling financial hub of Hong Kong.

Beijing’s move has significant implications for the burgeoning digital finance landscape, as it not only curtails the ambitions of the country’s leading tech firms but also fosters an increased interest in alternative financial solutions. With the spotlight now on decentralized projects like the SUBBD Token, the tech community is shifting its focus toward innovative Web3 platforms that align with the new regulatory environment.

As China seeks to position the Renminbi (RMB) within the global stablecoin conversation, the regulatory restrictions put in place are reshaping the digital asset landscape, prompting organizations to adapt and explore new avenues for growth.

This dynamic shift in policy highlights the delicate balance between innovation and regulation, as stakeholders across the financial technology space navigate these new waters. The ripple effects of these developments will surely be felt both in Hong Kong and beyond, as the region continues to evolve as a critical player in the future of digital finance.

Chinese Tech Giants Pause Stablecoin Plans

The recent developments surrounding stablecoins in China highlight significant shifts in the financial landscape.

- Chinese Government Intervention:

- Beijing has stepped in to halt the issuance of stablecoins by local tech giants.

- This move could impact the future of cryptocurrency and digital finance in China.

- Effect on Hong Kong’s Financial Market:

- The ban on stablecoins may alter Hong Kong’s position as a financial hub.

- This could have implications for business operations and investments in the region.

- Rise of Decentralized Projects:

- The stablecoin ban has sparked increased interest in decentralized Web3 projects.

- Investors may turn to alternatives like SUBBD Token for stability and growth.

- Global Implications for the RMB:

- China aims to position the RMB within the stablecoin market, impacting global trade.

- This strategy could affect international financial dynamics and currency exchanges.

Chinese Tech Giants Halt Stablecoin Initiatives Amid Regulatory Pressures

Recent developments indicate a significant shift in the trajectory of stablecoin projects spearheaded by major Chinese tech companies. Following regulatory interventions from Beijing, these giants have been compelled to freeze their stablecoin initiatives, a move that reflects the government’s tightening grip on digital currency frameworks.

Competitive Advantages: This abrupt pause in stablecoin endeavors may inadvertently benefit decentralized finance (DeFi) projects that advocate for a more autonomous financial ecosystem. As consumers and investors grow wary of centralized control, interest in alternative solutions, such as decentralized stablecoins and Web3 initiatives, is surging. For instance, projects like the SUBBD Token are gaining traction as users seek remnants of financial sovereignty and innovation beyond traditional frameworks.

Disadvantages: The halt on stablecoin issuance poses potential drawbacks for the tech giants themselves, who miss out on an opportunity to harness an emerging market that promises high demand and profitability. Additionally, their inaction could lead to a perception of hesitance or vulnerability in the face of regulatory scrutiny, which could stifle investor confidence and slow down innovation within their respective ecosystems.

Beneficiaries and Challenges: This regulatory environment opens the door for smaller, nimble startups that can swiftly adapt to the evolving landscape without the burdens of bureaucratic oversight. Such startups may thrive as they align more closely with the ethos of decentralization and autonomy. However, traditional financial institutions and stakeholders in the broader market may face challenges as the tension between regulatory bodies and tech innovators heightens, potentially leading to a fragmented landscape that complicates standardization and customer trust.