The world of cryptocurrency is buzzing with excitement as the Chicago Mercantile Exchange (CME) Group gears up to launch XRP futures contracts on May 19. This announcement, made on April 24, introduces two contract options for investors: the micro-sized futures, comprising 2,500 XRP, and the standard contracts, which represent 50,000 XRP. Notably, all futures contracts for XRP will be cash-settled, marking a significant milestone in the evolution of cryptocurrency financial products.

“The introduction of these futures contracts signifies a growing trend towards institutional acceptance of cryptocurrencies,” an industry expert noted.

This move comes after a brief period of speculation, as the CME had hinted at launching XRP futures in January 2025, only to later retract the related page on its website. Such fluctuations in communication underscore the dynamic nature of the crypto market. The CME Group is not alone in this venture, as they recently debuted Solana (SOL) futures in March, further expanding the range of available digital asset products.

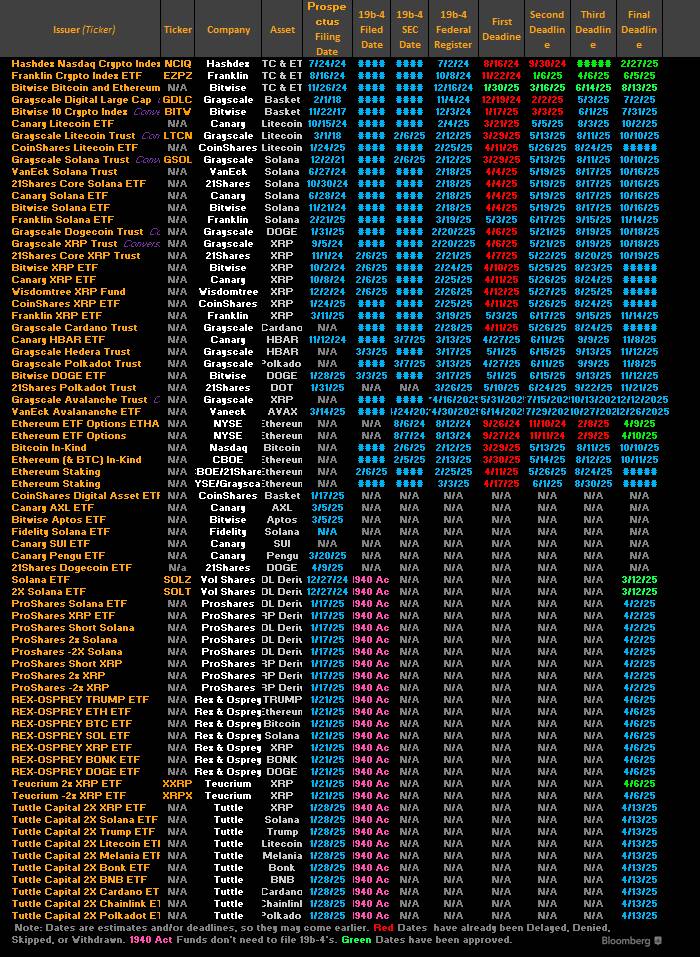

The surge in cryptocurrency-related financial offerings reflects a broader market trend, with over 70 applications for crypto exchange-traded funds (ETFs) currently awaiting review by the U.S. Securities and Exchange Commission (SEC). Among the noteworthy applications is one from asset manager Canary Capital for a staked Tron (TRX) ETF, proposed to yield approximately 4.5% from staking efforts.

“With everything from XRP to Doge in line for potential ETFs, the upcoming year promises to be eventful for the cryptocurrency landscape,” remarked Bloomberg ETF analyst Eric Balchunas, highlighting the expansive nature of these market developments.

Additionally, the recent collaboration between Crypto.com and the Trump Media and Technology Group to launch an ETF tracking U.S. crypto projects signifies a rising institutional interest and a clear move towards legitimizing digital assets. Set to trade under the banner of Truth.Fi, this new ETF aims to capitalize on emerging opportunities within the crypto space.

As the cryptocurrency market continues to mature, events like the launch of XRP futures and the influx of ETF applications illustrate that digital assets are increasingly being embraced by traditional financial institutions—and that the journey is just beginning.

XRP Futures and the Growing Crypto Market

Recent developments in the cryptocurrency market, particularly regarding the Chicago Mercantile Exchange (CME) Group, signify a crucial moment for investors and the broader financial landscape.

- XRP Futures Contracts Launch:

- XRP futures contracts will be available starting May 19.

- Investors can choose between micro-sized contracts (2,500 XRP) or standard contracts (50,000 XRP).

- All contracts are cash-settled, affecting how profits and losses are realized.

- Institutional Acceptance of Cryptocurrencies:

- The launch reflects a growing institutional interest in cryptocurrencies.

- More crypto-focused financial products are entering the market, indicating a shift in investor sentiment.

- Upcoming Products and Initiatives:

- Solana (SOL) futures recently debuted, showcasing a trend towards more altcoin offerings.

- A proposed staked Tron (TRX) ETF aims to offer liquidity while generating yield.

- A future ETF tracking US crypto projects is in collaboration with Trump Media and Technology Group.

- Regulatory Landscape:

- Over 70 cryptocurrency ETF applications are pending review by the SEC, highlighting the demand for regulated investment vehicles.

- The outcome of these applications could significantly impact market accessibility and investor participation.

“Everything from XRP, Litecoin, and Solana to Penguins, Doge, 2x Melania, and everything in between. Gonna be a wild year.” – Eric Balchunas

The developments mentioned could greatly impact readers interested in cryptocurrency investments, signaling potential opportunities and risks associated with the evolving market landscape.

CME Group’s XRP Futures: A New Frontier in Crypto Trading

The recent introduction of XRP futures on the Chicago Mercantile Exchange (CME) marks a pivotal moment for cryptocurrency trading, reflecting a growing trend among financial institutions to embrace digital assets. This innovative move positions CME as a competitive player in the evolving landscape of crypto derivatives, potentially drawing both seasoned investors and newcomers alike.

Competitive Advantages: The availability of both micro-sized contracts for 2,500 XRP and larger standard contracts of 50,000 XRP allows a wide range of investors to participate, catering to diverse trading strategies and risk appetites. This adaptability could draw retail investors who may have been hesitant to engage with larger quantities. Additionally, cash-settled contracts eliminate the need for physical delivery, simplifying the trading process and making it more appealing to institutional traders who prioritize operational efficiency.

Furthermore, CME’s timing aligns with a notable surge in alternative financial products like Solana futures and the array of ETF applications awaiting regulatory approval. This synchronized launch indicates a robust demand for crypto-related investments and could position CME as a go-to venue for advanced trading strategies among institutional players. The institutional acceptance signifies a maturation of the crypto space, setting the stage for future innovations and growth.

Disadvantages: On the flip side, CME’s foray into XRP futures comes with risks. Regulatory scrutiny remains a significant concern, especially given the challenges faced by other cryptocurrencies in gaining compliance. Should regulatory bodies react unfavorably, it could stifle trading volumes, negatively impacting liquidity and investor confidence. The volatility associated with digital assets like XRP could also deter more risk-averse investors, who may prefer traditional investments with lower price fluctuations.

This development could greatly benefit institutional investors seeking to diversify their portfolios with crypto derivatives, offering them a regulated environment to explore these assets. Conversely, this might pose challenges for smaller exchanges struggling to keep pace with the services offered by CME. The competitive landscape could lean in favor of larger firms, intensifying pressure on smaller players and potentially leading to consolidation within the sector.