In a bold move that highlights Coinbase’s ambition in the cryptocurrency market, CEO Brian Armstrong has announced that the company will continue to explore merger and acquisition (M&A) opportunities following its recent acquisition of the crypto derivatives platform, Deribit. Speaking on Bloomberg Television on May 14, Armstrong emphasized that Coinbase’s robust financial position, boasting $9.9 billion in liquid resources, gives it a strong foundation to pursue further growth through strategic acquisitions.

On May 8, Coinbase revealed the groundbreaking deal to acquire Deribit, which is valued at a staggering $2.9 billion, comprising $700 million in cash and stock options. This acquisition marks a significant milestone, positioning Coinbase as a formidable player in the lucrative crypto derivatives arena and enhancing its global scaling efforts. Armstrong shared his vision for the future, indicating a keen interest in international companies that share Coinbase’s ethos and can expedite its product development.

“Part of the benefit of being a public company is, you have a liquid currency to do that,” Armstrong stated, implying that the company’s public status offers it unique advantages in the competitive landscape.

Despite the enthusiasm surrounding potential acquisitions, Armstrong remained tight-lipped about speculations regarding a possible merger with Circle, a well-known stablecoin issuer and partner. This follows recent news that Ripple, another fintech giant, reportedly made a $5 billion bid to acquire Circle, which was ultimately declined.

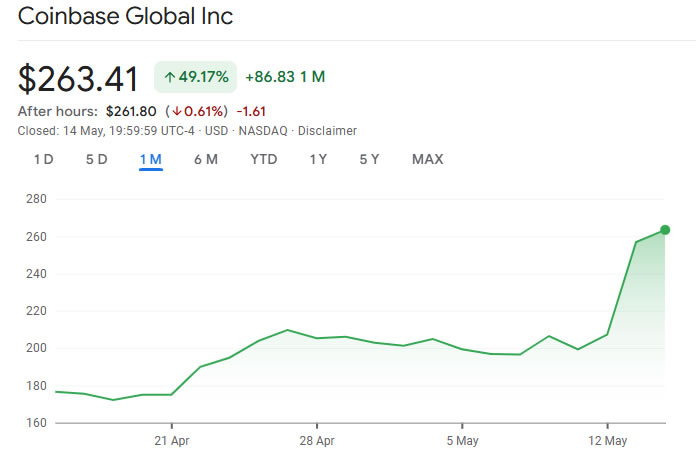

On the stock market front, Coinbase is gearing up to become the first cryptocurrency firm to be included in the prestigious S&P 500 index on May 19, which may enhance its visibility to a broader investor base. Following the dual announcements surrounding the acquisition and index inclusion, Coinbase shares experienced a surge, climbing by 2.5% to reach $263 in after-hours trading. This impressive rally has seen the stock rise over 30% since the start of May and nearly a whopping 50% in the last month alone, reflecting investor optimism about the company’s future.

As Coinbase charts its course through the evolving landscape of cryptocurrency, Armstrong’s strategic focus on expansion through acquisitions may well redefine its place within the financial ecosystem.

Coinbase CEO on Future M&A Opportunities

Here are the key points regarding Coinbase’s recent activities and future plans:

- Acquisition of Deribit:

- Coinbase acquired the crypto derivatives platform Deribit for $2.9 billion.

- The transaction included $700 million in cash and 11 million shares of Coinbase stock.

- This acquisition is the largest in the crypto industry to date.

- Continuation of M&A Activities:

- CEO Brian Armstrong expressed interest in pursuing more merger and acquisition opportunities.

- Coinbase has a solid financial position with a balance sheet exceeding $9.9 billion.

- Armstrong emphasized looking for the right opportunities, particularly in international markets.

- Impact on Business Growth:

- The acquisition of Deribit allows Coinbase to expand into the lucrative crypto derivatives market.

- Enhancement of Coinbase’s product development and global growth potential is anticipated.

- Inclusion in the S&P 500:

- Coinbase will become the first cryptocurrency firm to join the S&P 500 index on May 19.

- This membership may provide broader exposure to investors and enhance market presence.

- Post-announcement, Coinbase stock (COIN) surged over 30% in early May and continued to rise significantly.

- Overall Market Trends:

- The announcements signal a growing interest and potential profitability in the crypto derivatives market.

- Investors should consider the implications of Coinbase’s growth strategy on their investment decisions.

These developments indicate a shifting landscape in the cryptocurrency market, presenting both opportunities and risks for investors.

Coinbase’s Acquisition Strategy: Analyzing Competitive Advantages and Market Impact

With Coinbase making waves in the cryptocurrency world through its recent acquisition of Deribit, the largest crypto derivatives platform buyout yet, its strategic maneuvers reveal both exciting prospects and potential challenges within the evolving financial landscape. CEO Brian Armstrong’s insistence on exploring mergers and acquisitions clearly indicates a proactive approach to strengthen Coinbase’s market position. By leveraging a solid balance sheet that boasted nearly $10 billion in reserves at the end of Q1, Coinbase is uniquely positioned among its competitors, allowing for aggressive scaling into the lucrative derivatives market.

However, while Coinbase’s ambitious expansion may position it favorably, the competitive landscape has its pitfalls. Similar firms like Binance and Kraken have also been eyeing the derivatives market, albeit with different operational strategies and regulatory considerations. Coinbase’s public status offers it liquidity advantages, letting it utilize stock as part of acquisition deals, which is a significant edge. Conversely, this public image also subjects Coinbase to greater scrutiny, particularly from regulators—a factor that could hinder agile decision-making compared to its private competitors.

Coinbase’s stock surge—30% over the past month following two pivotal announcements—demonstrates a positive market sentiment and potential backing from passive investors if it successfully joins the elite S&P 500 index. This not only enhances its visibility but could also attract institutional investors who are drawn in by the company’s robust financials. However, this momentum might create inflated expectations among shareholders, opening up the risk of volatility if future acquisitions or underlying business conditions do not meet those expectations.

For cryptocurrency traders and investors, Coinbase’s strength and growth trajectory could translate to a more robust trading environment with enhanced product offerings. However, these aggressive acquisitions may result in a more complex user experience as the platform integrates new functionalities and navigates the challenge of harmonizing diverse trading tools. Additionally, the acquisition path raises questions about potential antitrust issues down the line—especially as the industry faces criticism regarding monopolistic tendencies.

In stark contrast, competitors like Ripple, which recently attempted a substantial offer for Circle, have shown a different approach—focusing on precise strategic targets rather than broad scoping like Coinbase. This difference presents an opportunity for Ripple to position itself in niche markets that may be underserved. However, it might mean that Ripple misses out on larger synergistic benefits that potentially come from broader acquisitions, as exhibited by Coinbase.

In conclusion, while Coinbase’s roadmap for growth through acquisitions sets it apart in the crowded cryptocurrency arena, its journey is laden with both promise and peril. Stakeholders, be they investors or users, will need to stay informed about these developments as regulatory environments continuously shift and influence the future of digital asset trading. The competitive landscape is dynamic, and each company’s strategy will play a critical role in shaping their forthcoming trajectories.