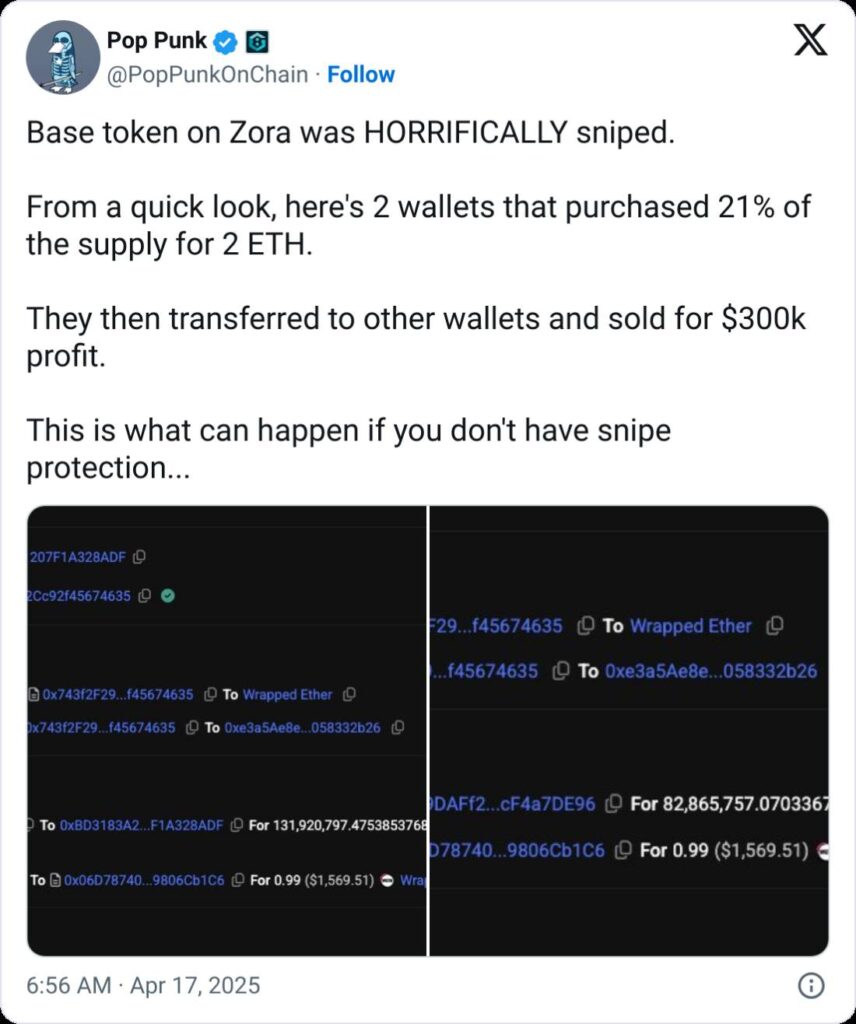

In recent news, the cryptocurrency exchange Coinbase has sought to clarify its position regarding the “Base is for everyone” token, which has sparked significant controversy following its meteoric rise and rapid decline. Initially promoted by Base—a blockchain network developed by Coinbase—the token reached an impressive market capitalization of $17.1 million within just an hour of its launch. However, it subsequently plummeted by nearly 90% in a matter of minutes, showcasing the volatile nature of the crypto market.

A spokesperson for Coinbase was quick to distance the network from the controversial token, asserting, “Base did not launch a token,” and emphasized that the project was merely a product of Zora, a platform that allows users to convert posts into tradable tokens. This clarification pointed to a legal disclaimer on the token’s page, which outlined that users should not expect profits or any ongoing development to enhance its value.

“Any credibility this chain had is now gone,” commented one user on X, reflecting the discontent among community members.

The aftermath of the token’s launch saw mixed reactions from industry insiders. Some criticized the execution of the idea, calling it a “terrible” move for the sector. Others recognized potential within the concept of linking content to blockchain but expressed dissatisfaction with how it was handled initially. Jesse Pollack, the creator of Base, defended the innovation by stating that efforts to put internet content on the blockchain could pave the way for a new economy where creators could benefit from their work.

Moreover, a second token linked to Base’s promotion of an upcoming event also suffered a similar fate, having peaked just below $1 million before swiftly losing value. As the drama unfolds, the incident serves as a reminder of the challenges and unpredictable nature facing projects in the fast-paced world of cryptocurrency.

Coinbase and the Controversial “Base is for Everyone” Token

The recent backlash surrounding the launch of the “Base is for Everyone” token has significant implications for both the crypto community and individual investors. Here are the key points:

- Launch and Value Fluctuation:

- The token reached a peak market capitalization of $17.1 million shortly after its launch.

- It experienced a sharp decline, dropping nearly 90% in value, settling around $1.9 million.

- The token saw a slight recovery, trading at approximately $7.7 million at the time of publication.

- Coinbase’s Response:

- A Coinbase spokeswoman clarified that Base did not officially launch the token and disassociated the network from it.

- Legal disclaimers on the token’s Zora page warn users not to expect profits or returns from the token.

- Community Backlash:

- Critics claimed that the token’s creation damaged Base’s credibility, suggesting a major trust issue in the crypto space.

- Experts expressed that the execution was poor despite the underlying idea having potential, indicating a need for better communication and strategy.

- Potential Implications for Investors:

- Misleading launches could deter investors from engaging with legitimate projects due to increased skepticism.

- Community sentiment can shift rapidly, impacting the perceived value and future prospects of crypto networks.

- Future of Content-Based Tokens:

- Base creator Jesse Pollack defended the concept of tokenizing content, seeing it as a potential new economy for creators.

- This idea raises questions about the sustainability and governance of such tokens in an already volatile market.

“Any credibility this chain had is now gone.”

Coinbase’s Base Faces Backlash Over Memecoin Launch

The recent events surrounding Coinbase’s decentralized blockchain network, Base, reveal a tumultuous relationship with memecoins that has drawn significant public scrutiny. Following the launch of the memecoin “Base is for everyone,” which saw a staggering rise to $17.1 million in market capitalization before plummeting nearly 90%, Coinbase quickly moved to clarify its stance. A spokesperson emphasized that Base did not officially release this token, highlighting the disconnection between the project and its speculative implications. This instance brings to mind other similar cases in the crypto sector where platforms have distanced themselves from controversial tokens, often in an attempt to mitigate reputational damage.

On one hand, the backlash faced by Base could be viewed as a double-edged sword. The exposure and subsequent skepticism towards the memecoin highlight the volatile nature of the crypto market, which can both attract and deter users. Competitors like Binance and Kraken, for instance, benefit from their distinct positioning against less regulated meme tokens by promoting a more trustworthy trading environment. On the flip side, the quick-fire trading and speculations linked to memecoins often divert user interest from more stable projects, posing challenges for exchanges trying to maintain a reputable brand image.

The involvement of Base in this memecoin trend might kindle interest among a segment of crypto users keen on the novelty of content-backed tokens. However, it also carries the inherent risk of alienating more serious investors who see such strategies as gimmicky and detrimental to the broader market’s integrity. For these individuals, the swift rise and fall of such tokens might reinforce a sentiment that cryptocurrencies are merely tools for profit-making rather than the innovative financial solutions they were initially designed to be.

Furthermore, Base’s pledge to allocate funds generated from fees for grants to its developers reflects a commitment to long-term initiatives, an aspect that could potentially earn the praise of thoughtful investors. Yet, this goodwill may not outweigh the immediate concerns voiced by critics of the memecoin launch, who claim that it undermines the credibility of the platform itself. This ongoing situation could finalize the shift in user trust towards those projects that prioritize genuine utility over speculative trading.

In summary, while Base’s foray into the world of memecoins may attract a certain demographic excited by its risks, it also has the potential to deter more serious participants from engaging with its platform. The careful balance between innovative ideas and market expectations will play a crucial role in determining the future trajectory of Base and similar projects in the increasingly competitive landscape of crypto exchanges.