In the fast-paced world of cryptocurrency, significant developments are unfolding as Coinbase, one of the leading exchanges, revealed it was targeted by a $20 million extortion attempt on May 15. Cybercriminals orchestrated the plot by recruiting support agents abroad to leak user data, aiming to exploit it for social engineering scams. Although the breach impacted less than 1% of Coinbase’s monthly active users, the financial repercussions for the exchange could soar between $180 million and $400 million, as the company has pledged to compensate all victims affected by phishing attacks.

Interestingly, despite this serious incident, investor sentiment remains largely optimistic. According to CoinMarketCap’s Fear & Greed Index, which measures the emotional state of cryptocurrency investors, the market sits firmly in the “Greed” territory, over 69. This enduring confidence is further demonstrated by Coinbase’s record net outflow of over $1 billion in Bitcoin on May 9, marking the highest withdrawal figure for 2025 to date. Analysts speculate that such outflows could indicate a supply shock, potentially driving Bitcoin purchases higher.

“Institutional appetite for Bitcoin is accelerating,” remarked André Dragosch, head of European research at Bitwise, following the unprecedented Bitcoin withdrawals.

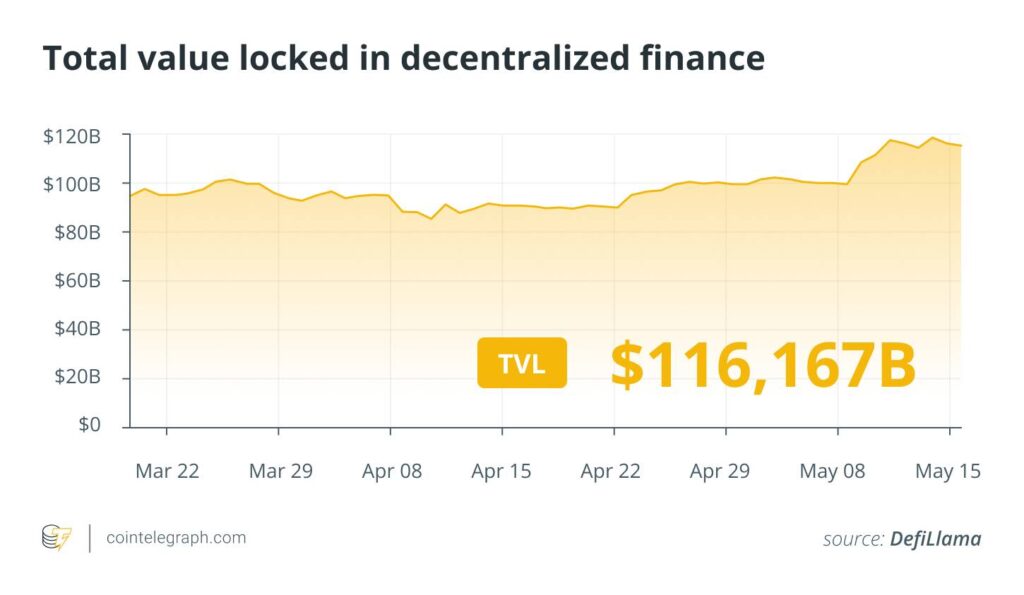

Meanwhile, Aave, a decentralized finance protocol, has reached a remarkable milestone with over $40 billion in total value locked, underscoring its dominance in the lending space. On the regulatory front, the U.S. Securities and Exchange Commission’s decision to postpone its proposal for a Solana exchange-traded fund (ETF) has piqued interest. This delay follows a broader trend of mixed feelings surrounding ETF approvals, with market players now closely watching the outcomes for Polkadot and XRP in the coming weeks.

In the wake of these developments, the excitement is palpable across the cryptocurrency landscape, suggesting a vibrant and evolving future for digital assets.

Coinbase Cyberattack and Market Reactions

The recent cyberattack on Coinbase has significant implications for the cryptocurrency market, even with only a small fraction of users affected. Here are the key points:

- Extortion Attempt:

- Coinbase faced a $20 million extortion attempt involving the leakage of user data by external actors.

- Less than 1% of monthly users were affected, with no critical data compromised (passwords, private keys, funds).

- Financial Impact:

- Coinbase’s remediation costs could range from $180 million to $400 million to compensate victims.

- The company offered a reward for information on the attackers, emphasizing a proactive approach to security.

- Investor Sentiment:

- Despite the attack, investor confidence remains high, with the Fear & Greed Index staying in the “Greed” zone above 69.

- Over $1 billion in Bitcoin was withdrawn on May 9, indicating strong institutional interest.

- Market Conditions:

- Recent geopolitical events (e.g., US-China tariff reduction) boost overall market sentiment and risk appetite.

- Analysts predict potential supply shocks in Bitcoin, leading to price rallies due to increased withdrawals.

- DeFi Developments:

- Aave reached a total value locked (TVL) of over $40 billion, demonstrating growth in decentralized finance.

- Key ETF decisions from the SEC could impact institutional adoption of cryptocurrencies like Solana.

- Starknet Progress:

- Starknet achieved “Stage 1” decentralization, becoming a leading zero-knowledge rollup network, which could enhance its appeal to investors.

The events surrounding Coinbase’s cyberattack and subsequent market phenomena demonstrate the interconnectedness of security, investor sentiment, and regulatory developments in the cryptocurrency landscape. Keeping informed about these changes can help readers make educated investment decisions and stay ahead in a rapidly evolving market.

Coinbase’s Cybersecurity Challenges and Market Impact

On May 15, Coinbase’s revelation of a $20 million extortion attempt unveiled a sobering reality for the world’s third-largest cryptocurrency exchange. While the breach affected less than 1% of its user base, the potential financial fallout is substantial, with remediation costs anticipated to soar between $180 million and $400 million. This situation presents a mixed bag of competitive advantages and disadvantages in the rapidly evolving crypto landscape.

Comparatively, Coinbase’s proactive stance in promising to reimburse phishing attack victims may bolster trust among its remaining user base, appealing to investors who value security. In contrast, other exchanges, such as Binance and Kraken, have also faced security breaches but met them with varied transparency and customer support responses. Successful crisis management could enhance Coinbase’s reputation, positioning it as a more customer-centric choice amidst stiff competition.

However, Coinbase’s situation raises broader concerns about security across the industry. The news could shatter the confidence of potential new users who might hesitate to engage with platforms perceived as vulnerable. For instance, rival exchanges with stronger security protocols could gain traction among cautious investors looking for safer options after hearing about Coinbase’s troubles. As cyber threats continue to loom large in the digital asset space, exchanges will need to heighten their security measures to maintain or boost customer trust.

Moreover, Coinbase’s substantial Bitcoin outflows indicate robust investor demand, suggesting that long-term cryptocurrency enthusiasts remain optimistic despite recent security incidents. This trend could capitalize on the anticipated supply shock in the market, injecting momentum into Bitcoin’s price recovery. Institutional investors, particularly those looking to minimize risk, may react differently, weighing the implications of Coinbase’s breach against the backdrop of expanding Bitcoin adoption and future regulatory frameworks.

Furthermore, while Coinbase faces financial fallout from this incident, its offer of a $20 million reward for information leading to the attackers’ arrest reveals a commitment to rectifying the situation. However, this decision might spark discussions regarding the effectiveness and ethical implications of incentivizing vigilantism in cybersecurity. As the crypto market evolves, the ramifications of this incident may extend beyond Coinbase, potentially influencing the operational standards and expectations for security across all digital exchanges.

In summary, Coinbase’s cybersecurity dilemma serves as a critical case study within the cryptocurrency realm. While it presents an opportunity for competitors to assert themselves, it also highlights the need for enhanced security measures that could reshape user engagement and investor confidence going forward.