In the world of cryptocurrency, daily fluctuations can tell a compelling story. CoinDesk Indices has released its latest market update, shining a light on the performance of the CoinDesk 20 Index, which currently stands at 4267.12. This marks a notable increase of 0.7% (+27.81) since Monday afternoon, reflecting the ongoing volatility and dynamism of the crypto market.

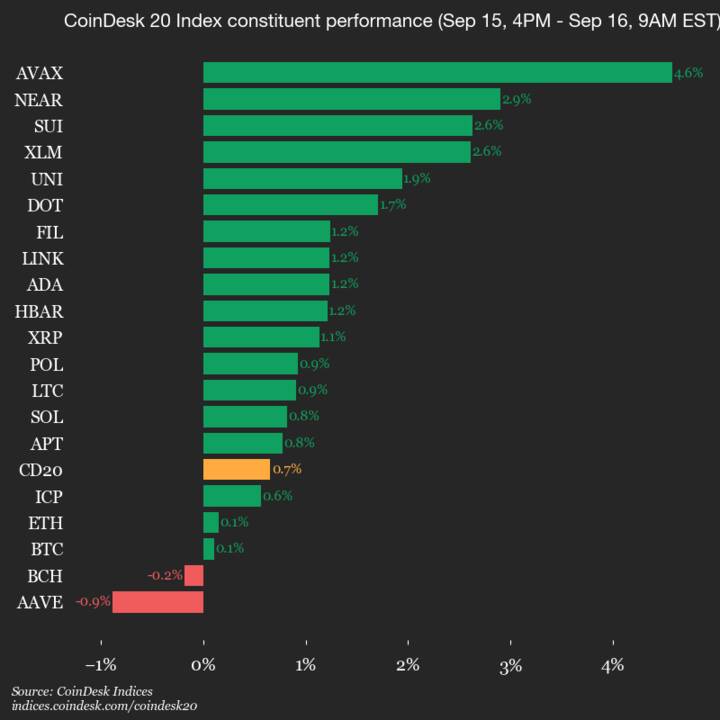

In an encouraging turn of events, a significant majority of the assets in the index are on the rise, with eighteen out of twenty cryptocurrencies trading higher. Among the top performers, AVAX has surged by an impressive 4.6%, while NEAR follows suit with a solid 2.9% gain. These assets are capturing the attention of investors, showcasing their potential amidst a fluctuating market landscape.

However, not every asset is riding this optimistic wave. AAVE has seen a slight decline of 0.9%, and BCH follows with a minor dip of 0.2%, reminding traders that volatility is part of the game in this ever-evolving sector.

The CoinDesk 20 Index serves as a broad-based benchmark, encompassing a variety of cryptocurrencies traded across multiple platforms worldwide, which underscores its significance for market observers and participants alike. As the crypto market continues to evolve, the daily performance of these leading and lagging assets provides valuable insights into overall trends and investor sentiment.

CoinDesk 20 Index Daily Market Update

The following are the key points from the CoinDesk Indices daily market update:

- Current Index Value: The CoinDesk 20 is trading at 4267.12, reflecting a 0.7% increase (+27.81) since 4 p.m. ET on Monday.

- Market Performance: A total of eighteen out of twenty assets in the CoinDesk 20 are trading higher.

- Leaders:

- AVAX: Increased by 4.6%

- NEAR: Increased by 2.9%

- Laggards:

- AAVE: Decreased by 0.9%

- BCH: Decreased by 0.2%

- Global Reach: The CoinDesk 20 is a broad-based index that is traded on multiple platforms across various regions around the world.

The performance of the CoinDesk 20 Index can impact investment decisions, as it reflects the overall market trends in cryptocurrency, influencing both new and seasoned investors.

Daily Market Update: CoinDesk 20 Performance Insights

The latest update from CoinDesk Indices provides a notable glimpse into the daily fluctuations within the cryptocurrency market, specifically focusing on the CoinDesk 20 Index. Currently positioned at 4267.12, this index marks a modest increase of 0.7% as of the latest reporting, showcasing a healthy majority of assets—18 out of 20—trading positively. Highlighted leaders include AVAX, surging by 4.6%, and NEAR, which climbed 2.9%. Conversely, AAVE and BCH are the notable laggards, experiencing slight declines.

When compared with competitive indices such as the Bloomberg Galaxy Crypto Index, CoinDesk 20 shows an appealing breadth across more assets, potentially attracting investors looking for diversity in their crypto portfolio. One of the advantages of the CoinDesk 20 is its wide representation, presenting a balanced view of the market dynamics compared to other indices focusing on fewer cryptocurrencies. This feature can particularly benefit individual investors seeking a broader understanding of market trends and those operating in different geographical markets.

However, the fluctuations in specific assets like AAVE and BCH could signal caution for investors heavily reliant on these currencies, indicating a potential volatility risk. For traders and analysts monitoring daily performance, the slight losses in some currencies could create challenges in forecasting and strategy development. Additionally, while the CoinDesk 20 offers wide-ranging insight, those primarily interested in niche markets may find it less tailored to their specific trading needs, potentially overshadowing smaller assets with less trading volume.

Overall, the insights gained from the CoinDesk 20 can significantly benefit general investors and institutional players looking for reliable market data, whereas those focused on high-risk, high-reward segments may find the index’s broader approach less relevant to their aggressive strategies. The daily updates provide necessary information to adapt swiftly to market changes, but the mixed performance among leading and lagging assets could pose challenges for specific trading tactics.