In the latest market update provided by CoinDesk Indices, the spotlight shines on the performance of the leading assets within the CoinDesk 20 Index. As of the most recent figures, the CoinDesk 20 is currently trading at 2780.05, reflecting a modest increase of 0.4% or +9.87, since 4 p.m. ET on Monday. This uptick points to a slightly optimistic market trend, with nine out of the twenty assets displaying gains.

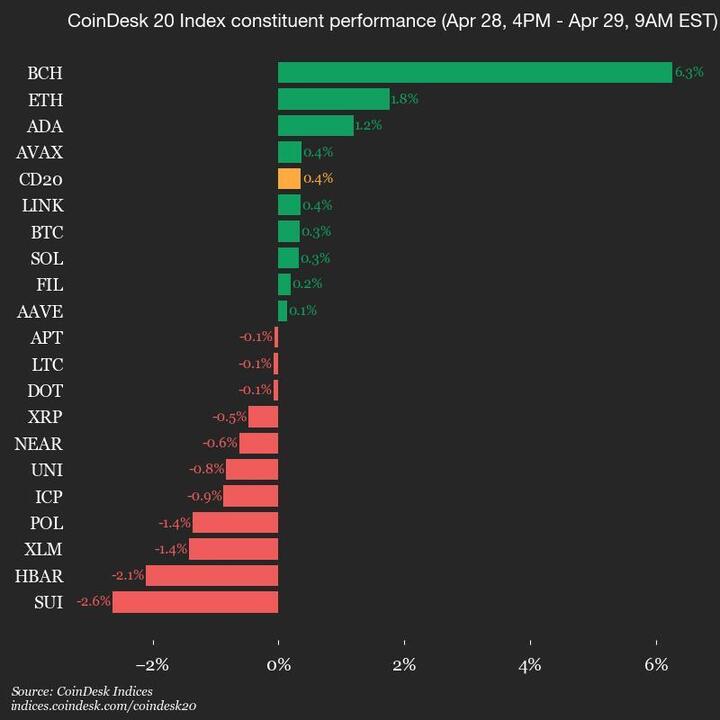

Among the standout performers, Bitcoin Cash (BCH) leads the charge with an impressive rise of 6.3%. Ethereum (ETH) also shows strength, climbing 1.8%. Conversely, not all assets are thriving; some, like SUI and HBAR, are experiencing setbacks, having dipped by 2.6% and 2.1% respectively. This divergence in performance highlights the dynamic nature of the cryptocurrency market, where the fortunes of various assets can shift quickly.

The CoinDesk 20 Index represents a broad spectrum of digital currencies actively traded across multiple platforms globally.

As the cryptocurrency landscape continues to evolve, investors and enthusiasts alike are keeping a close eye on these fluctuations, seeking insights into market trends and asset performance. With a careful balance of leaders and laggards, the CoinDesk 20 Index serves as a barometer for the ever-changing world of digital assets.

CoinDesk 20 Daily Market Update

This market update summarizes the latest performance of the CoinDesk 20 Index, providing insights into cryptocurrency trading dynamics.

- Current Index Value: The CoinDesk 20 is trading at 2780.05, reflecting a positive movement of 0.4% (+9.87) since the last update.

- Market Trends: Out of 20 assets, nine are trading higher, indicating a generally positive sentiment in the market.

- Top Performers:

- BCH (Bitcoin Cash): Increased by 6.3%, showcasing strong performance.

- ETH (Ethereum): Gained 1.8%, maintaining its position as a key player in the market.

- Underperformers:

- SUI: Decreased by 2.6%, reflecting a downward trend.

- HBAR (Hedera): Fell by 2.1%, indicating potential concerns among traders.

- Global Trading Landscape: The CoinDesk 20 operates on multiple platforms across several regions, impacting trading accessibility and market diversity.

Understanding the movements of significant cryptocurrencies like BCH and ETH can help investors make informed decisions, while recognizing laggards like SUI and HBAR may influence risk management strategies in their portfolios.

Market Update: CoinDesk 20 Index Performance Analysis

The latest update from CoinDesk Indices showcases the dynamic nature of the cryptocurrency market with its daily report on the CoinDesk 20 Index. Currently standing at **2780.05**, with a modest increase of **0.4% (+9.87)**, this index offers a panoramic view of market trends, spotlighting both the promising assets and those struggling to keep pace.

In recent comparisons, CoinDesk’s updates are akin to other market reports from platforms like CoinGecko and CoinMarketCap, both of which provide similar snapshots of crypto assets. However, CoinDesk has carved a niche by capturing more nuanced data, like specific movements of individual assets within its index. The current leaders, **BCH** (up **6.3%**) and **ETH** (up **1.8%**), demonstrate robust performance, suggesting bullish sentiment. On the flip side, **SUI** and **HBAR** are notable laggards, experiencing declines of **2.6%** and **2.1%**, respectively, which could pose concerns for slightly risk-averse investors.

This timely update from CoinDesk could be particularly beneficial for traders and investors looking for a comprehensive understanding of market behavior before diving into trades. Those with a vested interest in **BCH** and **ETH** might feel encouraged by their upward momentum, foreseeing potential for gains in the short term. Conversely, the decline of **SUI** and **HBAR** signals caution; investors aligned with those assets might need to reassess their portfolios to mitigate losses.

Moreover, for market analysts, the insights provided through the CoinDesk 20 Index allow for a deeper dive into asset performance across diverse trading platforms globally. This comprehensive understanding can help in strategic decision-making. However, the volatility displayed by lagging assets may deter conservative investors looking for stable options in a traditionally high-risk market.

In the ever-evolving landscape of cryptocurrency, the CoinDesk 20’s updates are vital. They not only inform current traders but also extend an olive branch to the more hesitant crowd contemplating entry into the market. However, the diverse array of performance shown within the index poses both opportunity and risk—one that investors must navigate with care.