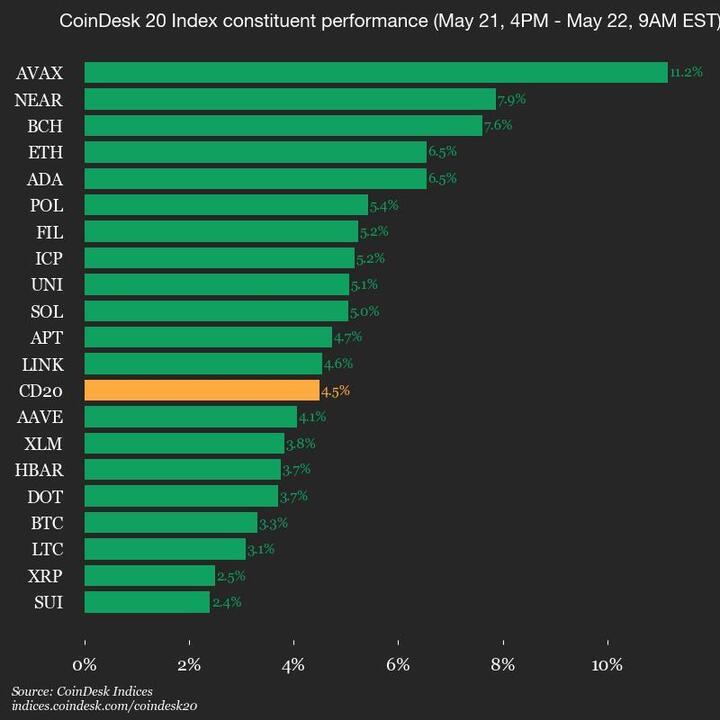

In today’s exciting update from the cryptocurrency market, CoinDesk Indices has released its daily report highlighting the dynamic landscape found within the CoinDesk 20 Index. This index tracks the performance of major cryptocurrencies, and recently, it has seen a notable uptick, trading at 3347.55, reflecting a healthy increase of 4.5% or +143.83 since Wednesday’s close at 4 p.m. ET.

All 20 cryptocurrencies in the index are currently in the green, showcasing a collective upward momentum. Leading the pack are AVAX, which has surged by 11.2%, and NEAR, which is also making waves with a 7.9% gain. Conversely, some assets are growing at a slower pace; SUI and XRP are the laggards today, rising 2.4% and 2.5% respectively.

This broad-based index is actively traded across multiple platforms around the globe, reflecting a diverse and vibrant market landscape.

CoinDesk 20 Index Daily Market Update

The latest performance of the CoinDesk 20 Index highlights significant movements in the cryptocurrency market that could impact investment decisions and overall market sentiment.

- Current Trading Status:

- CoinDesk 20 Index is at 3347.55.

- Index has increased by 4.5% (+143.83 points) since Wednesday 4 p.m. ET.

- Overall Market Performance:

- All 20 assets in the index are currently trading higher.

- Leading Assets:

- AVAX has seen a significant increase of 11.2%.

- NEAR has risen by 7.9%.

- Laggard Assets:

- SUI has seen a modest increase of 2.4%.

- XRP has risen by 2.5%.

- Global Trading:

- The CoinDesk 20 is actively traded on multiple platforms across various regions worldwide.

The performance of these assets can significantly impact investor strategies and sentiment, leading potentially to shifts in portfolio allocations.

Daily Market Dynamics: Analyzing CoinDesk Indices’ Latest Performance

The latest update from CoinDesk Indices shines a spotlight on the fluctuating landscape of the cryptocurrency market, revealing the daily performance metrics of its notable CoinDesk 20 Index. Currently trading at 3347.55, this index showcases an impressive uptick of 4.5% since the previous close, a trend that indicates bullish sentiment across the crypto space. The systematic portrayal of both leaders and laggards provides investors and enthusiasts with insightful information into market trends.

Competitive Advantages and Insights: Compared to similar news sources, CoinDesk Indices maintains a distinct edge by focusing on a broad spectrum of assets, encapsulated in their CoinDesk 20 Index. This inclusive approach allows for a nuanced understanding of market movements across multiple regions and platforms, which can appeal to a diverse audience of traders. Additionally, highlighting specific performers like AVAX and NEAR, both showing significant gains, allows investors to recalibrate their strategies effectively. For those actively engaged in crypto trading, this kind of data could serve as a crucial tool for decision-making.

However, a potential disadvantage lies in the lack of in-depth analysis for the lagging assets such as SUI and XRP. While the focus on daily performance is helpful, it may leave some investors wanting more context about underlying causes. This minimalistic approach could lead to misinterpretations, especially for less experienced traders who are still navigating the complexities of this market.

Target Audience: Opportunities and Challenges: The rich data provided by CoinDesk Indices is particularly beneficial for tech-savvy investors who thrive on real-time information and quick decision-making. Day traders and institutional investors can seize this timely update to solidify positions or diversify their portfolios. Conversely, casual investors or those new to the crypto landscape might find the rapid fluctuations and focus on daily performance overwhelming; they could end up making hasty decisions without fully understanding the broader market dynamics or the specific reasons behind the performance of various assets.

In summary, while the CoinDesk Indices update is a powerful resource for engaged investors looking to navigate the highs and lows of the cryptocurrency market, it could inadvertently complicate the decision-making process for those less versed in the nuances of crypto trading.