In a striking turn of events within the world of cryptocurrencies, Burwick Law, a legal firm specializing in crypto-related matters, is raising alarms over Metaplex’s recent decision regarding the unclaimed Solana (SOL) tokens associated with its non-fungible token (NFT) platform. This move has not only drawn attention but also sparked serious concerns about potential litigation if Metaplex proceeds with its plan to sweep these unclaimed funds into its treasury, rather than returning them to the NFT holders.

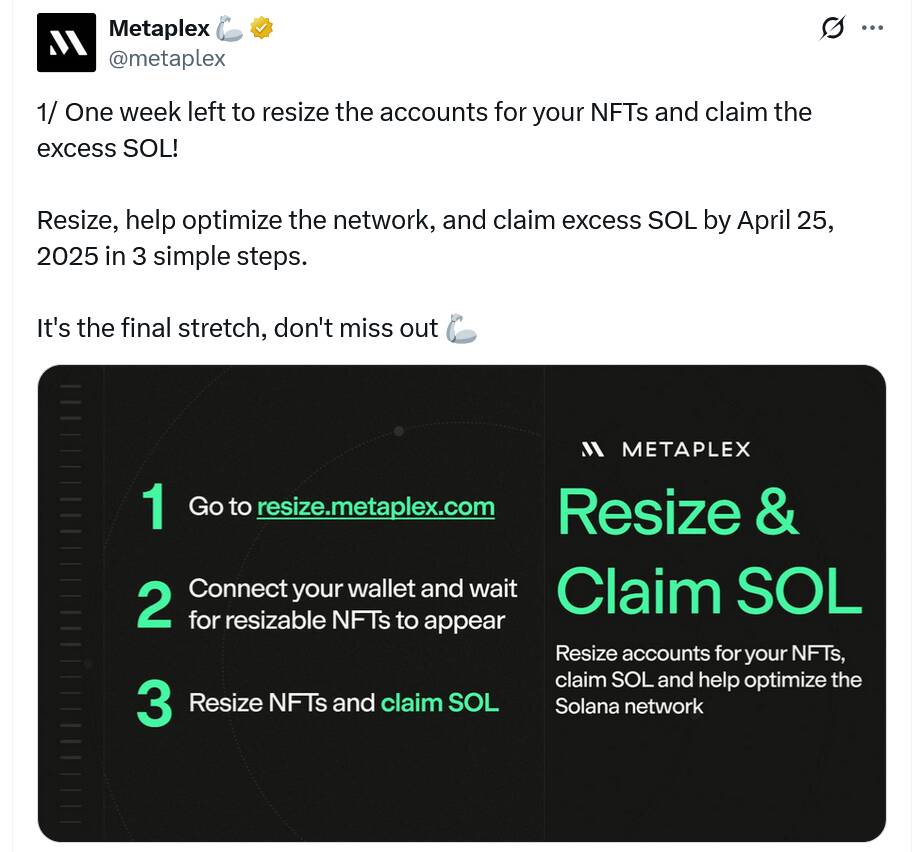

Last year, Metaplex introduced an innovative way to optimize on-chain storage for certain NFTs, allowing users to resize their NFTs and claim a small amount of SOL in the process. A deadline of April 25 was set for holders of Metaplex Token Metadata (TM) NFTs to take action, with the stipulation that any unclaimed SOL would be automatically reallocated to the Metaplex DAO. As of recent reports, out of a potential 54,000 SOL at stake—worth over $6.5 million at current market prices—only a small fraction has been claimed, further intensifying the situation.

Burwick Law has voiced strong criticism of this plan, claiming that many NFT collectors were not adequately informed about the possibility of their SOL being swept away. In an open letter directed at both Metaplex and the Solana community, the firm expressed that such actions could undermine the essential trust that is foundational to the cryptocurrency ecosystem. They argued that if protocols are allowed to alter the terms of agreements retroactively, it poses a serious threat to the very principles that underpin decentralized finance.

“Code is law only works when the rules are clear and immutable,” Burwick noted, emphasizing the need for transparency in crypto agreements.

The legal team at Burwick has proposed an alternative approach, suggesting that Metaplex pause its sweeping plan and consider directly refunding the SOL to current NFT holders, while retaining a small portion for network maintenance. This compromise, they argue, would not only safeguard user interests but also demonstrate that the Solana community can effectively self-regulate without the need for legal intervention.

As Metaplex navigates these murky waters, the focus remains on how it will respond to Burwick’s concerns and the potential legal ramifications of its current strategy. Given the rapid developments in the crypto landscape, many are watching closely to see how this situation unfolds and what it could mean for the future of NFT governance and community trust.

Concerns Over Metaplex’s Unclaimed Solana Funds Plan

The recent plans by Metaplex to sweep unclaimed Solana (SOL) tokens into its treasury have raised significant concerns from legal experts and the community. Here are the key points to understand:

- Metaplex’s Intent:

- Metaplex discovered a method to reduce onchain storage for NFTs, allowing holders to claim SOL.

- A deadline of April 25 was set for NFT holders to resize and claim SOL; after this date, unclaimed SOL would be redirected to the Metaplex DAO.

- Legal Risks:

- Burwick Law warns that the plan may violate consumer protection laws and could lead to litigation.

- If found guilty of unjust enrichment, victims might be entitled to restitution.

- Community Response:

- Burwick Law highlighted that many NFT collectors are concerned about the lack of clear communication regarding the plan.

- The criticism emphasizes that the plan undermines trust and the foundational principles of cryptocurrency.

- Alternative Suggestion:

- Burwick proposed that Metaplex pause its plans and return unclaimed SOL directly to current NFT holders, maintaining a small share for network maintenance.

- This approach aims to preserve user trust while ensuring DAO funding and avoiding legal complications.

- Current Situation:

- Over 54,000 SOL tokens are still unclaimed, amounting to more than $6.5 million.

- Metaplex has yet to publicly respond to these critiques.

“If a protocol can rewrite yesterday’s deal tomorrow, the promise of decentralised permanence rings hollow.” – Burwick Law

Understanding these factors is crucial for NFT holders, investors, and the broader cryptocurrency community, as it may affect trust, investments, and the potential for future litigation in the space.

The Controversy Surrounding Metaplex’s SOL Sweep: A Deviation from Crypto Principles

In a climate where decentralized principles are king, Metaplex’s recent proposal to redirect unclaimed Solana (SOL) into its treasury has ignited strong criticism from the legal sector, specifically from the crypto law firm Burwick Law. This controversy raises significant questions about trust in the blockchain ecosystem. Burwick’s stance highlights key competitive advantages and downfalls for Metaplex in the burgeoning world of NFTs and DeFi.

Competitive Advantages: Metaplex has already established itself as a leading NFT platform on the Solana blockchain, offering a streamlined process for resizing NFTs which garnered substantial user interest. This unique feature allows users to reclaim portions of SOL, demonstrating Metaplex’s commitment to leveraging its technological capabilities. Furthermore, it is positioning itself to utilize unclaimed funds for community initiatives, which could potentially strengthen its DAO governance and ecosystem support.

Competitive Disadvantages: The suggested plan to sweep unclaimed funds raises serious ethical and legal concerns. Critics argue that it undermines the essential premise of decentralization by arguably reinterpreting the rules after the fact, a point strongly emphasized by Burwick. By failing to return SOL to investors, Metaplex risks alienating its user base, eroding trust and leading to potential litigation, which could mar its reputation. Additionally, the lack of a clear, proactive communication strategy raises alarms, signaling a potential disconnect from a community that prides itself on transparency.

This unfolding drama could be particularly detrimental for current NFT holders who were unaware of the implications of the sweep. Many fear financial loss if the sweep proceeds, which could prompt them to explore alternatives within the NFT landscape. Conversely, crypto investors who value transparency and user rights may benefit from Burwick’s advocacy, as his call for a pause could lead to a resolution that respects the community’s interests while enhancing Metaplex’s accountability.

Ultimately, the fallout from this situation could foster a broader discourse about consumer rights, asset management, and the responsibilities of DeFi platforms. Companies in this space may need to grapple with the ramifications of regulatory scrutiny and consumer trust, navigating the intricate balance between innovation and responsibility.