The cryptocurrency industry, which has gained immense popularity, is also facing serious challenges as reports of scams and fraudulent activities continue to surface. Recently, authorities have taken action against crypto ATM operators who are allegedly exploiting vulnerable seniors. In a notable case, the District of Columbia has filed a lawsuit against a crypto ATM operator, citing the exploitation of residents in the area.

Furthermore, various local news outlets, including WJLA and Seehafer News, have highlighted ongoing concerns in different states, where residents are falling victim to scams involving cryptocurrency ATMs. Particularly alarming is the surge of these scams in Idaho, where reports have increasingly pointed to senior citizens being targeted for their financial assets.

In response to these troubling trends, the Idaho Attorney General has taken a firm stand by suing Athena Bitcoin, a company accused of imposing hidden fees on unsuspecting ATM users. This legal action underscores a growing awareness and urgency among regulators to protect consumers from predatory practices linked to cryptocurrency transactions.

“As the cryptocurrency market evolves, so too do the tactics employed by scammers, highlighting the need for constant vigilance among consumers,”

A thorough understanding of these developments is crucial for anyone engaging in the cryptocurrency space, especially as the boundaries of legality and ethics continue to blur. The ongoing legal battles and consumer protection efforts illustrate the complex landscape that both users and regulators navigate in this rapidly changing financial environment.

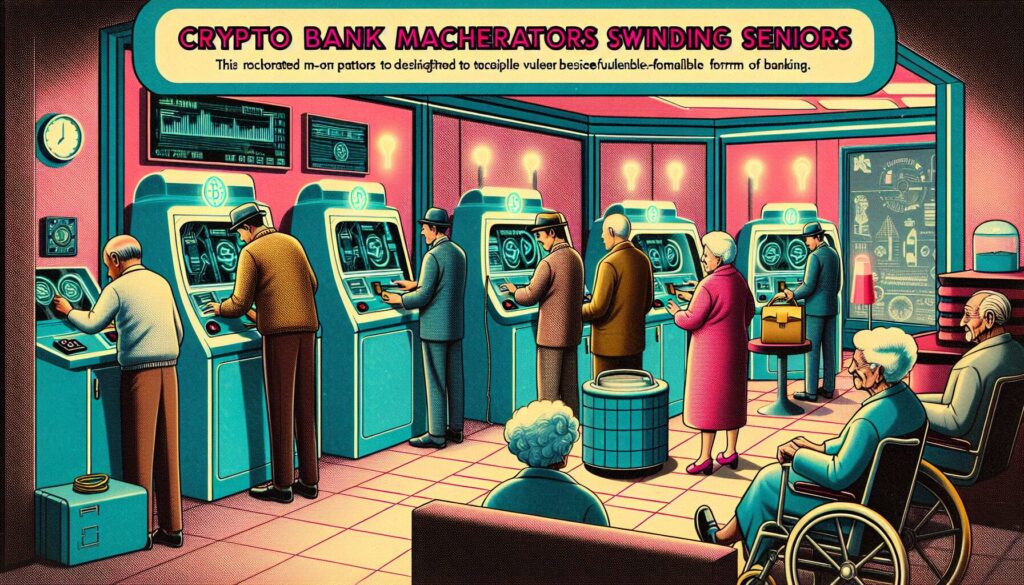

Crypto Bank Machine Operators Swindle Seniors

Key points related to recent incidents of cryptocurrency ATM scams targeting seniors and residents:

- Scam Tactics: Many operators exploit vulnerabilities of older residents through misleading information and hidden fees.

- Legal Actions: The American Prospect reports on a lawsuit against a crypto ATM operator, highlighting the need for regulation.

- Ongoing Scams: Local police departments are warning residents about the rise of scams, particularly affecting seniors.

- Location-Based Issues: States like Idaho are experiencing a surge in these scams, prompting investigations and legal action.

- Consumer Protection: Lawsuits, such as the one against Athena Bitcoin, emphasize the need for accountability in cryptocurrency transactions.

These scams are not just financial losses but also a breach of trust that can significantly impact the victims’ mental well-being.

Analysis of Cryptocurrency ATM Scams Impacting Seniors

Recent news highlights the alarming trend of scams involving cryptocurrency ATM operators preying on vulnerable populations, particularly seniors. The American Prospect reported on a lawsuit against a crypto ATM operator accused of exploiting residents, emphasizing the troubling nature of these operations that often target those less familiar with digital currencies.

In comparison, WJLA’s coverage of Manitowoc police addressing ongoing scams reveals a broader issue affecting various communities. Similar incidents in Idaho, as reported by KBOI, showcase a disturbing surge in fraudulent activity, indicating that this phenomenon is not localized but rather a nationwide crisis. The investigation into Athena Bitcoin’s alleged hidden fees demonstrates an aggressive legal response to protect consumers, which is a competitive advantage for regulatory bodies seeking to instill trust in the rapidly evolving crypto landscape.

However, this chaotic environment also poses challenges for legitimate crypto businesses striving to gain credibility. The negative press surrounding scams can lead to public skepticism and hesitance to engage with cryptocurrency, hampering innovation and growth in the sector. Seniors, in particular, may find themselves increasingly vulnerable as they navigate the complexities of digital finance without adequate education or support.

In light of these developments, educational initiatives aimed at informing seniors about cryptocurrency risks could be beneficial. Conversely, the information overload could overwhelm some, potentially leading to more confusion and fear regarding investing in new technologies. The impact of these scams extends beyond individual losses; it could also hinder the overall acceptance and integration of cryptocurrency within financial systems.