The world of cryptocurrency investment continues to evolve, and one of the key features driving market dynamics is the concept of crypto exchange-traded products (ETPs). A recent trend has emerged regarding crypto ETP outflows, which occurs when more money exits these products than enters them, indicating a prevalent willingness among investors to sell rather than buy. This shift can offer important insights into the sentiment surrounding the digital asset ecosystem.

“ETPs provide investors with exposure to cryptocurrencies without the complications of direct ownership.”

Crypto ETPs, which include exchange-traded funds (ETFs), exchange-traded commodities (ETCs), and exchange-traded notes (ETNs), allow investors—particularly institutions—to engage with cryptocurrencies within a more traditional financial framework. As of early 2025, Bitcoin ETPs spearhead this market, offering a familiar venue for traditional investors to dip their toes into the intriguing world of digital assets.

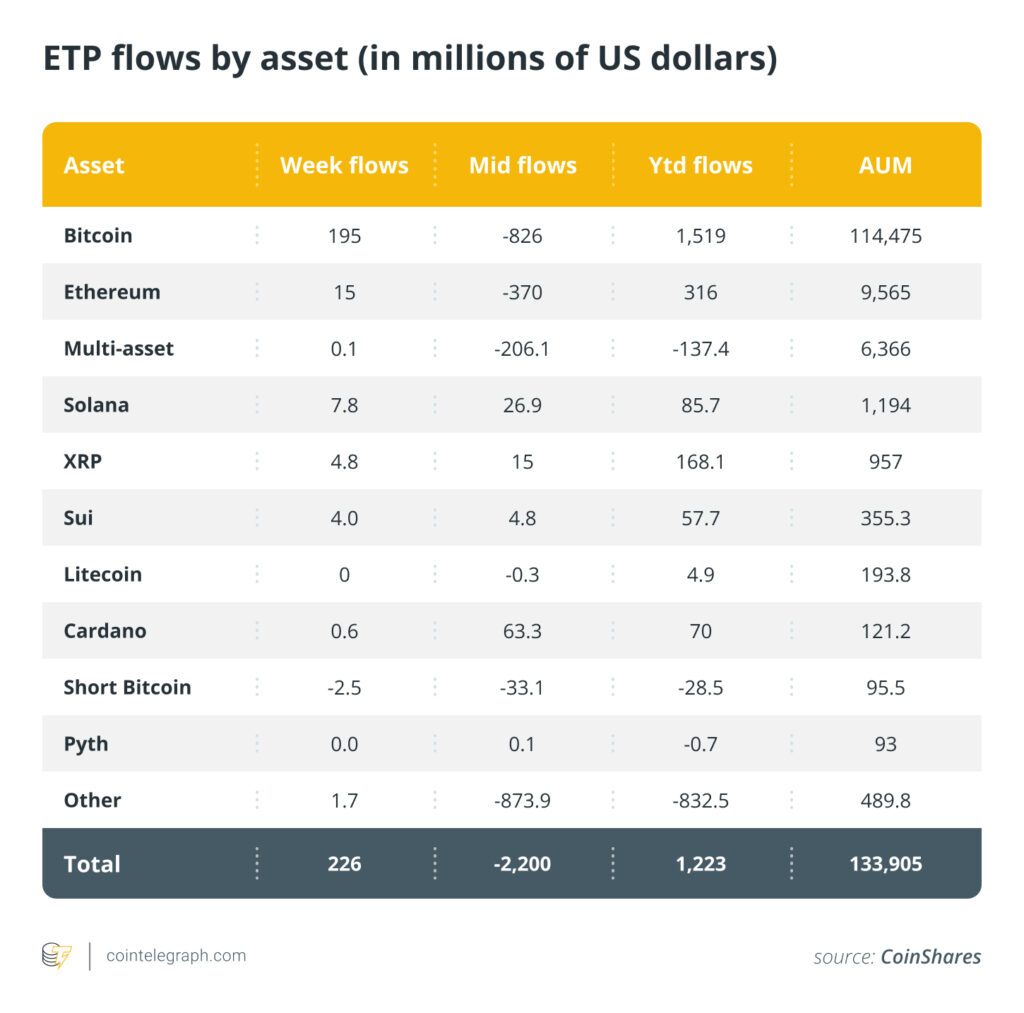

Recent reports highlight a significant increase in ETP outflows, with March 2025 alone seeing over .7 billion exit in just one week. This event marks a pivotal moment, as various economic factors, such as macroeconomic headwinds and evolving regulatory landscapes, influence these movements. The outflows also reflect a larger narrative in the cryptocurrency market, where a shift in institutional investor sentiment may herald upcoming volatility.

“Understanding the factors driving ETP outflows can help forecast market sentiment changes.”

The volatility seen in ETP flows is driven by several factors, including security worries and broader economic uncertainties. Recent high-profile hacks and ongoing regulatory discussions have added layers of complexity to investor decisions. Notably, institutional sentiment holds weight, as shifts in allocation strategies can lead to significant market movements.

As of early 2024, crypto ETPs witnessed record inflows of .2 billion, predominantly from Bitcoin and Ether products. Nevertheless, the start of 2025 saw a sharp reversal, leading to a number of net outflows. Amid these fluctuating trends, understanding historical data, such as the record-breaking length of consecutive outflow days, can provide essential context for investors watching the market closely.

“The recent swirl of ETP outflows serves as a reminder of the cryptocurrency market’s volatility and potential for rapid change.”

Going forward, despite the turbulence brought on by considerable outflows, the emergence of new ETP varieties suggests an undeterred interest in the crypto sector. Regulatory frameworks are evolving, and with institutional appetite for innovative cryptocurrency products, the future of crypto ETPs remains a focal point of potential growth and opportunity in the financial landscape.

Understanding Crypto ETP Outflows

Crypto ETPs, or Exchange-Traded Products, provide investors with access to digital assets while maintaining the structure of traditional financial instruments. Here are some key points related to crypto ETP outflows and their potential impact on investors:

- Definition of ETP Outflows:

Outflows occur when funds exit crypto ETPs, indicating a selling market where supply surpasses demand.

- Types of Crypto ETPs:

- Exchange-Traded Funds (ETFs)

- Exchange-Traded Commodities (ETCs)

- Exchange-Traded Notes (ETNs)

- Market Sentiment Gauge:

Tracking ETP flows offers insights into institutional investor sentiment, which can precede larger market movements.

- Impact of Prolonged Outflows:

Long streaks of outflows signal critical shifts in market sentiment, often leading to significant price corrections and increased volatility.

- Factors Driving Outflows:

- Macroeconomic Conditions

- Security Concerns

- Regulatory Changes

- Market Cycles

- Institutional Sentiment

- Importance of Monitoring Indicators:

- Unusual spikes in trading volume

- Shifts in premium/discount values

- Performance of leading ETPs

- Institutional holdings reports

- Flow momentum indicators

- Recent Trends (2024-2025):

The crypto ETP market experienced record inflows of .2 billion in 2024, followed by significant outflows in early 2025, highlighting volatility and changes in investor sentiment.

- Future of Crypto ETPs:

Despite short-term concerns, ongoing development of new ETP products and evolving regulations suggest a robust long-term future for crypto ETPs as investment vehicles.

Understanding these points about crypto ETP outflows can help investors make informed decisions, navigate market volatility, and potentially capitalize on shifts in investment sentiment.

Understanding Crypto ETP Outflows: Trends, Impacts, and Future Prospects

The landscape of crypto ETP outflows highlights a crucial aspect of the cryptocurrency investment world. When examining the outflows from exchange-traded products, it’s essential to understand that they serve as a barometer of investor sentiment and market volatility. Recent developments indicate that these outflows can significantly shape the broader crypto market, with varied implications for investors at different stages.

Competitive Advantages of Crypto ETPs

One of the primary competitive advantages of crypto ETPs is their ability to provide exposure to digital assets through traditional financial frameworks. Many institutional investors find this appealing as it alleviates concerns over security and regulation typical of direct crypto transactions. The trading dynamics of crypto ETPs allow for liquidity and ease of access, which attract a broader spectrum of investors, including those who may be wary of the volatile nature of cryptocurrencies.

Furthermore, established products such as Bitcoin ETFs have garnered substantial interest, contributing to record inflows prior to the recent downturns. Institutions like BlackRock with their prominent iShares Bitcoin Trust (IBIT) have paved the way for broader market acceptance and adoption.

Disadvantages and Risks

However, the current landscape is not without its disadvantages. The significant outflows recorded in early 2025 have raised alarm bells among investors. A sustained period of outflows can trigger a contagion effect, leading to decreased confidence among retail investors as well, thereby exacerbating market volatility. Investor sentiment tends to compound during such periods; as institutions pull back, retail investors often follow suit, leading to dramatic price corrections and panic selling.

Moreover, the factors influencing outflows—ranging from regulatory uncertainty to macroeconomic conditions like rising interest rates—are highly dynamic and can escalate quickly. These external pressures can lead investors to reconsider their allocations, often resulting in a mass exit from riskier assets, impacting market liquidity negatively and potentially leading to larger economic ramifications within the crypto ecosystem.

Who Benefits and Who Loses?

Currently, more risk-averse investors, including many institutional players, might benefit from the outflow trends as they seek safer investment avenues amid prevailing uncertainties. Conversely, those heavily invested in cryptocurrencies without the buffer of ETPs could find themselves at a disadvantage during such tumultuous periods; the lack of liquidity and rapid price declines can erode significant capital in short timeframes.

On the horizon, novice crypto investors looking to enter the market with lower risk profiles may find appealing opportunities as certain ETPs offer stable entry points. With increasing diversification in crypto ETP offerings, including new assets like Solana and XRP, innovation may help refocus on growth—even in the face of short-term turbulence.

The evolving regulatory framework, especially with positive moves from government bodies, may also play a pivotal role in shaping future market dynamics—potentially enhancing investor confidence and stabilizing outflow rates in the longer run. As we watch these developments, understanding the nuanced interplay of inflows and outflows will be critical for both seasoned and new investors navigating the complexities of the crypto market.