The world of cryptocurrency exchange-traded products (ETPs) is experiencing a notable shift as investors cautiously embrace recent trends. After a significant period of outflows, which had raised concerns in the market, crypto ETPs saw a combined inflow of 6 million last week, following an impressive 4 million in the previous week, as reported by CoinShares on March 31. This fleeting revival comes after a five-week streak of withdrawals, indicating a potential turning point for the sector.

However, the momentary enthusiasm is tempered by a decline in total assets under management (AUM), which dropped below 4 million by March 28. Despite the positive inflow, such figures underline a more complex narrative, as CoinShares’ head of research, James Butterfill, notes that investor sentiment appears cautious, especially in the wake of stronger-than-expected U.S. Personal Consumption Expenditures data.

“The inflows illustrate a cautious re-entry into the market,” said Butterfill, reflecting the current state of investor behavior.

Among the assets flowing into ETPs, Bitcoin (BTC) led the charge, attracting 5 million for the week. Meanwhile, short-BTC products continued to experience outflows, a trend lasting four weeks, totaling .5 million. In a powerful show of support, altcoins also joined the inflow party, with an aggregate of million recorded after weeks of significant outflows totaling .7 billion.

Notably, Ethereum (ETH) welcomed .5 million in inflows, with prominent altcoins like Solana (SOL), XRP, and Sui (SUI) also making their presence felt. Yet, the AUM decline casts a shadow over these inflows. Since March 10, AUM has dipped by 5.7%, reaching its lowest point of the year at 3.9 billion, which CoinShares attributes partly to the recent downturn in cryptocurrency values.

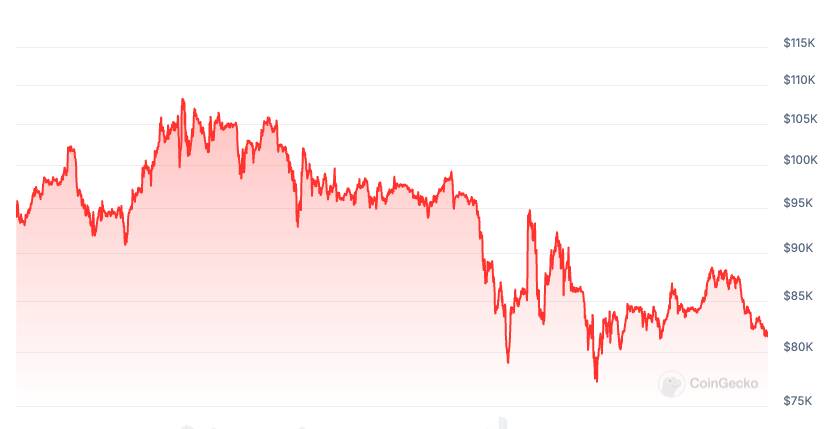

“Recent price falls have pushed Bitcoin global ETPs’ total assets under management to their lowest level since just after the U.S. election,” explained Butterfill.

As of data from CoinGecko, Bitcoin’s price has decreased by 13.6% since the start of 2025, aligning with a nearly 20% drop in total market capitalization. This landscape poses a crucial backdrop as the cryptocurrency market navigates investor sentiments and price fluctuations, showing that while there may be signs of life, the overall environment remains challenging.

Recent Trends in Cryptocurrency Exchange-Traded Products (ETPs)

The cryptocurrency market is experiencing new developments concerning Exchange-Traded Products (ETPs). Here are the key points from the latest performance data:

- Modest Inflows:

- Crypto ETPs recorded 6 million in inflows last week.

- This follows a prior week’s inflow of 4 million.

- These inflows indicate a reversal from a five-week streak of outflows.

- Declining Assets Under Management (AUM):

- Despite recent inflows, total AUM dropped below 4 billion.

- This represents a 5.7% decline since March 10, 2025.

- The current AUM is the lowest level seen in 2025.

- Bitcoin Dominance:

- Bitcoin (BTC) investment products attracted the majority of inflows, totaling 5 million.

- Short-BTC products experienced outflows for the fourth consecutive week at .5 million.

- Altcoins Performance:

- For the first time in weeks, altcoins saw inflows of million.

- Individual altcoin contributors include Ether (ETH) with .5 million and Solana (SOL) with .8 million.

- Market Price Influences:

- Cryptocurrency prices have been volatile, contributing to the decline in AUM.

- From January 1, 2025, Bitcoin prices dropped by 13.6%, adding pressure on overall market capitalizations.

The developments in cryptocurrency ETPs could impact investors by providing insights into market sentiment and trends. The reversal of outflows suggests a cautious optimism, while the decline in assets under management highlights increased volatility—factors that investors might consider when making decisions in this dynamic space.

Crypto ETP Inflows: A Cautious Positive Turn Amid Ongoing Challenges

The recent surge in cryptocurrency exchange-traded products (ETPs) observed a notable uptick in investor interest, as reported by CoinShares. However, this trend presents both competitive advantages and disadvantages within the broader cryptocurrency landscape. While a modest inflow of 6 million over consecutive weeks shows a fresh pulse of investor enthusiasm, it also casts a spotlight on the underlying instability that continues to plague the sector.

One of the most significant competitive advantages of this rebound in inflows is the growing attractiveness of Bitcoin (BTC) investment products, which accounted for a striking 5 million of last week’s total inflows. This showcases Bitcoin’s dominance and its allure among traditional investors who are increasingly looking for avenues to gain exposure to digital assets through regulated products. In contrast, short-BTC investment products are experiencing outflows for the fourth consecutive week, indicating a potential market correction or a cautious positioning from investors wary of a bullish trend.

However, the overall decline in total assets under management (AUM), which fell below 4 billion, poses a stark downside for the industry. The drop highlights the fragility of market sentiment, despite the recent inflows, and may deter hesitant investors or institutions from diving into the crypto ETP space. This shrinking AUM amidst rising inflows could create a paradoxical scenario where demand exists, but market conditions remain unfavorable, thus discouraging further investment.

The comparative analysis also reveals a broader trend among altcoins, which saw a small resurgence with million in inflows after a prolonged outflow streak. Notably, Ethereum (ETH) managed to capture a slice of this inflow, attracting .5 million. Such movements suggest potential opportunities for smaller investors or funds looking to diversify their holdings. Yet, with leading coins such as Solana (SOL) and XRP seeing more modest gains, a risk remains for those heavily invested in less-established cryptocurrencies. The persistent slump in prices for several altcoins, coupled with a notable decrease in market capitalization, could pose challenges for these assets, impacting the trading strategies of retail and institutional investors alike.

While the recent inflows primarily benefit Bitcoin and select altcoins, the hesitation among investors to fully commit amidst a struggling overall market may create complications for crypto ETP providers attempting to rejuvenate market confidence. The current landscape suggests potential opportunities for savvy investors looking to capitalize on short-term gains, but it also indicates a precarious balancing act between risk and reward, paving the way for both cautious optimism and underlying anxiety in the cryptocurrency market.