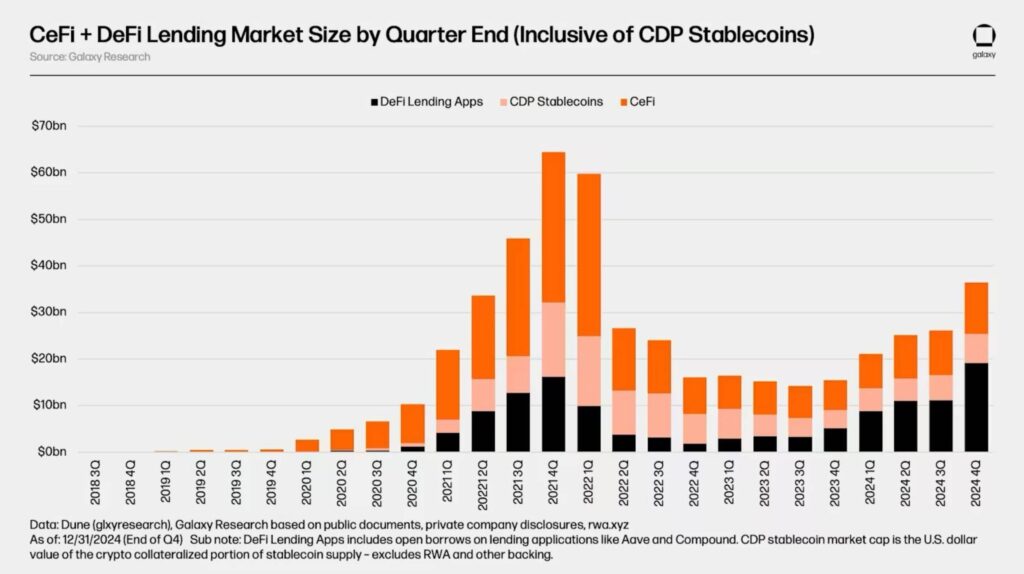

The cryptocurrency lending market is slowly starting to show signs of recovery after a challenging period known as the crypto winter, which spanned 2022 and 2023. This recovery has been highlighted in a recent report by digital asset investment firm Galaxy Research, which notes a total market valuation of $36.5 billion at the end of 2024. This figure is notably lower than the peak of $64.4 billion reached during the 2021 cryptocurrency boom, when borrowing activity surged amid speculation and excitement over digital assets.

The downturn in the lending market was largely attributed to the collapse of significant players such as Celsius, BlockFi, and Genesis, which left only a few large entities to dominate the market. According to the report, Tether leads the way in market share, followed closely by Galaxy and Ledn. Together, these three companies account for almost 90% of the total outstanding loans in the centralized finance (CeFi) sector, which itself has seen a substantial drop of 68% from its early 2022 peak of $34.8 billion.

“The real growth is playing out onchain,” — Galaxy Research

While centralized lending is facing hurdles, the decentralized finance (DeFi) segment is flourishing. Galaxy’s findings reveal a staggering 959% increase in open DeFi borrowings since reaching their lowest point in late 2022, jumping from $1.8 billion to $19.1 billion across 20 applications and 12 different blockchains. This growth exemplifies a shift toward decentralized lending protocols, which allow users to borrow crypto by locking up collateral without relying on a centralized authority.

Galaxy analyst Zack Pokorny offers an optimistic outlook for the future, noting that the cryptocurrency lending market is on the brink of a new growth phase characterized by better risk management, increased institutional participation, and clearer regulatory frameworks. Pokorny suggests that as the sector matures, it could serve as a crucial link between traditional finance and the burgeoning digital asset ecosystem, paving the way for broader adoption of cryptocurrency-based financial services.

With improved conditions on the horizon, the landscape of crypto lending continues to evolve, indicating a potentially bright future for both investors and borrowers in this dynamic industry.

The Resurgence of the Crypto Lending Market

The crypto lending market is showing signs of recovery following the significant downturn during the 2022-2023 crypto winter. Here are the key points regarding the current landscape of the crypto lending space:

- Current Market Size: The crypto lending market reached $36.5 billion by the end of 2024.

- Historical Context: This figure is notably down from a peak of $64.4 billion during the 2021 bull run.

- Impact of Major Lender Failures: The collapse of entities like Celsius, BlockFi, and Genesis significantly affected the market, leading to a concentration of loans in a few major players.

- Market Dominance: Tether, Galaxy, and Ledn now control nearly 90% of the centralized finance (CeFi) loan book.

- Decline in CeFi Loans: CeFi loans have decreased by 68% from their early 2022 peak of $34.8 billion.

- Proliferation of Decentralized Lending: Decentralized lending protocols have experienced explosive growth, with a 959% increase in open DeFi borrowings since late 2022.

- Future Growth Potential: The sector may evolve with improved risk management, increased institutional participation, and clearer regulatory frameworks.

- Bridging Traditional and Digital Finance: As the market matures, it could facilitate wider adoption of cryptocurrency-based financial services.

“As the sector continues to mature, it may well serve as a bridge between traditional finance and the emerging digital asset ecosystem.” – Zack Pokorny, Galaxy Research Analyst

Understanding these developments can help readers remain informed about potential investment opportunities and the evolving landscape of financial services, particularly if they are interested in cryptocurrency and decentralized finance.

Revival of Crypto Lending: A Comparative Analysis of Market Shifts

The latest findings from Galaxy Research reveal a resurgence in the decentralized finance (DeFi) sector of crypto lending, indicating transformative shifts amid a turbulent environment previously marked by significant downturns. While the overall crypto lending market has diminished considerably from its historical highs, the DeFi segment is experiencing remarkable growth, which positions it favorably against traditional centralized finance (CeFi) options.

One of the key advantages of the DeFi market is its decentralized nature. Unlike centralized lenders, which have suffered from collapses and scandals (think Celsius, BlockFi, and Genesis), decentralized platforms operate on a trustless framework powered by smart contracts. This inherent design not only mitigates counterparty risk but also promotes financial inclusion through lower barriers to entry for borrowers. The staggering 959% growth in DeFi borrowings—leaping from merely $1.8 billion to nearly $19.1 billion—highlights this advantage, showcasing a substantial shift in user preference towards self-custody and autonomy in lending.

However, DeFi is not without its challenges. Issues like regulatory uncertainty and complex user experiences can deter mainstream adoption. While individuals adept in navigating crypto ecosystems may thrive, novices could encounter significant hurdles. This points to a dual-edged sword: seasoned crypto users can capitalize on the burgeoning opportunities, but those less familiar with the mechanisms of DeFi may find it daunting or fraught with risk. Without clearer regulations, even established players risk facing sudden changes in the operational landscape, potentially creating financial liabilities for users.

In contrast, the centralized players, namely Tether, Galaxy, and Ledn, dominate the remaining CeFi market, capturing a whopping 90% of its loans. Though these players boast stability and a more familiar financial structure, their heavy reliance on traditional lending frameworks limits innovation and may exacerbate existing vulnerabilities. Given their historical failings, renewed scrutiny from regulators can also serve as a double-edged sword, offering the potential for improved consumer trust while simultaneously limiting operational freedoms.

As the report suggests, the embrace of improved risk management frameworks and institutional participation can create fertile ground for a new phase of growth. Financial entities aiming to innovate in crypto-backed loans may discover burgeoning opportunities, especially as regulatory clarity begins to emerge. Emerging fintech firms and institutional investors could greatly benefit from anticipated demand in the sector, while existing CeFi players need to recalibrate their strategies to remain competitive.

Ultimately, the evolving crypto lending landscape holds promise for many, but with it comes substantial risks and challenges. As the lines blur between traditional finance and the digital asset ecosystem, it will be critical for stakeholders—from seasoned investors to everyday borrowers—to stay informed and agile in navigating this changing terrain.