The world of cryptocurrency is experiencing a whirlwind of emotions, especially following what can only be described as its worst quarter since the infamous FTX crisis. The prevailing sentiment among investors leans towards concern regarding a potential end to the bull market. However, a panel of experts recently convened at the LONGITUDE by Cointelegraph event in Paris, leaving audiences with a glimmer of hope as they asserted that the parabolic rises of Bitcoin and altcoins may just be on the brink of starting.

Michael van de Poppe, founder of MN Capital, shared his thoughts on the current downturn, which saw Bitcoin plummet below the $80,000 mark amid global tariff tensions. Drawing historical parallels, he reminded attendees of the dramatic sell-off during the COVID-19 pandemic in 2020 when Bitcoin fell nearly 40% in a single day, marking what turned out to be an optimistic bottom for the cryptocurrency. “That was the actual bottom, and since then, Bitcoin went 20x,” van de Poppe noted, suggesting that today’s chaos could create similar opportunities for a rebound.

“We never had a bull market… we had two sides of the market,” said Messari CEO Eric Turner, emphasizing the complexity of current market dynamics.

Turner theorized that the real question for investors isn’t about if, but rather when the bull market will arrive, predicting a more favorable environment could emerge in the latter half of this year. The panelists agreed that despite short-term volatility, it is crucial to focus on the broader context, particularly regarding the evolving regulatory landscape in the United States.

Excitement was palpable as John Patrick Mullin, co-founder and CEO of Mantra, discussed the supportive policy developments coming from U.S. officials. With the Biden Administration pushing for significant changes to crypto regulations, including stablecoin frameworks, there is cautious optimism. Yet challenges loom, as recent aggressive tariffs implemented by President Trump have raised concerns about their potential to stifle economic growth. This led to an exodus from U.S. stocks not seen since the pandemic.

“If you go back in time with another crisis… the Fed steps in to lower the rates and to print money,” van de Poppe explained, pointing to a likely future intervention by the Federal Reserve.

While uncertainty hangs over the market, past experiences hint at a potential turnaround, be it through regulatory shifts or Federal Reserve actions. As investors navigate this stormy period, the discussions in Paris provided a refreshing blend of optimism and analysis about the cryptocurrency market’s future trajectory. The stage is set, and the sentiments shared by industry leaders might just suggest that the story of crypto is far from over.

Crypto Market Insights and Future Projections

As the cryptocurrency market experiences significant fluctuations, investors are seeking clarity on potential outcomes and trends. Here are some key points from a recent panel discussion addressing the future of Bitcoin and altcoins:

- Market Sentiment:

- Current worries stem from the worst quarterly performance since the FTX crisis.

- Some experts believe a bull market may be just beginning despite Bitcoin’s recent plunge.

- Historical Context:

- Michael van de Poppe likens the current market conditions to the COVID-19 crash in 2020, suggesting a possible rebound.

- The historical trend indicates that chaotic sell-offs can lead to favorable market conditions for recovery.

- Market Dynamics:

- Eric Turner from Messari points out that there hasn’t truly been a bull market, but rather segmented activities in Bitcoin and memecoins.

- Questions remain over when a genuine bull market will emerge, with predictions pushing towards Q3 or Q4 of the coming year.

- Regulatory Environment:

- US regulations are evolving, with key leaders pushing for favorable policies towards crypto, potentially benefiting the market in the long run.

- President Trump’s appointment of pro-crypto leaders may influence a more structured and positive market environment.

- Impact of Tariffs:

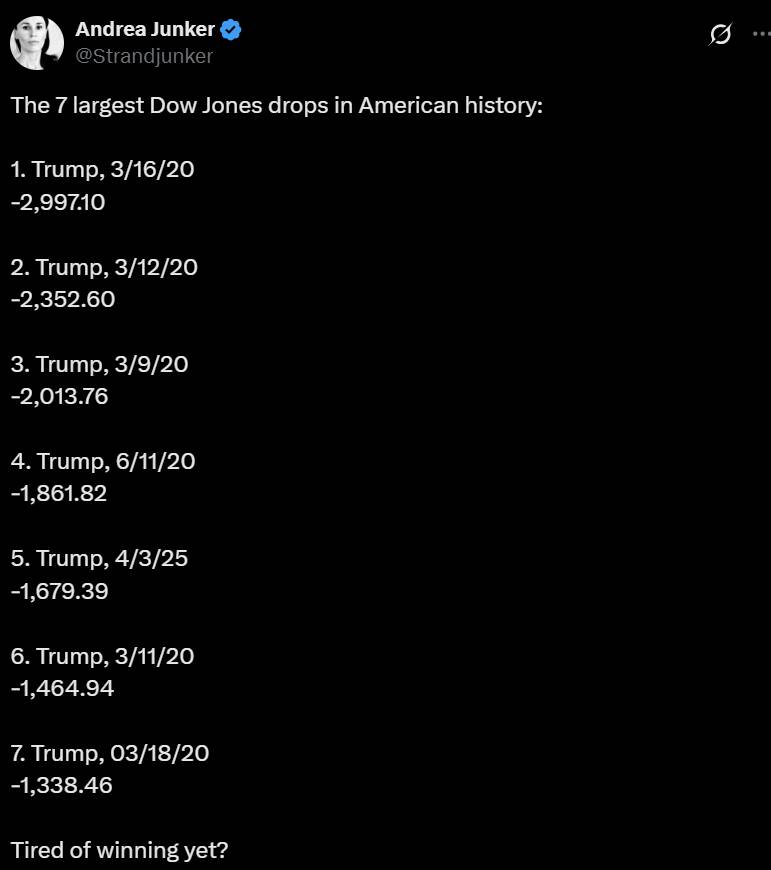

- Recent tariffs have exacerbated market anxieties, leading to record stock sell-offs.

- The overall economic climate influences capital flows into cryptocurrency, preventing significant investment increases.

- Market Support Predictions:

- Experts anticipate potential intervention from the Federal Reserve to stabilize the market if downturns continue.

- Historically, the Fed’s actions in times of crisis have been pivotal in market recovery efforts.

“The question is when the Fed will step in to backstop the market.” – Michael van de Poppe

Understanding these factors can help readers make informed decisions about investments in the crypto space, particularly regarding timing and potential regulatory impacts on the market’s future.

Market Sentiments: Analyzing Crypto’s Future Amidst Recent Turmoil

The cryptocurrency market is currently in a state of unease, with the latest quarter seeing its most significant decline since the FTX debacle. Investors are rightfully concerned, fearing the end of the bullish trend that many anticipated. Yet, a recent panel discussion at the LONGITUDE by Cointelegraph event in Paris suggests a different narrative around Bitcoin and other cryptocurrencies, hinting that an upward trajectory might just be on the horizon.

Comparative Advantages: The insights from well-known industry figures like Michael van de Poppe and Eric Turner provide a glimmer of hope for crypto enthusiasts. Van de Poppe’s assertion that “the bull market is actually getting started” resonates strongly with historical data, particularly referencing the post-COVID-19 crash recovery where Bitcoin skyrocketed by 20 times. This kind of optimism is crucial, particularly in a market that thrives on sentiment. Additionally, with positive regulatory movement from Washington—including stablecoin bills and pro-crypto appointments—the U.S. market could become more favorable for crypto investments in the longer term, offering a potential safety net amidst global economic tensions.

Disadvantages in the Current Environment: However, the shadow of the recent tariff announcements by the Trump administration looms large. These tariffs have spooked investors, causing a sell-off reminiscent of major previous market dips. The complexities of intertwining regulatory changes with adverse macroeconomic conditions create a potent mix of uncertainty. While regulatory clarity could be beneficial, the simultaneous fear stemming from trade policies might dilute investor confidence and further complicate market dynamics, especially in the short term.

Who Will Benefit or Face Challenges: The optimistic outlook for Bitcoin and altcoins might attract those with a high-risk appetite and a belief in historical recovery patterns. Investors who can weather volatility may find opportunities during dips, potentially benefiting from future market upswings. Conversely, risk-averse investors may feel pressured to withdraw amidst fears of further declines, creating problems for market liquidity. In essence, while the panel discussion highlights potential positives, it equally serves as a reminder of the current risks that could deter investors from re-entering the market actively.