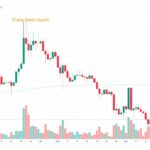

The world of digital assets is currently experiencing a turbulent phase, with traders responding to shifting economic landscapes and uncertainties by pulling back their investments. Notably, the total cryptocurrency market cap has plummeted by over 0 billion since last Friday, as various global factors, including recent tariff threats from former President Trump and broader economic unease, have fueled a wave of selling. Traders are on edge, seeking a catalyst that could spark a renewed rise in prices, but none have appeared as the first quarter winds down.

“If history is anything to go by, there might be some glimmer of hope heading into the second quarter,”

As analysts at Barchart highlight, April has historically been a favorable month for Bitcoin, with an average return of around 27% since 2010, making it one of the most promising months for the cryptocurrency. November and May follow closely behind with returns of approximately 38% and 26%, respectively. This seasonal trend has caught the attention of traders, potentially offering a silver lining amidst the current market downturn. CoinDesk analyst Omkar Godbole noted that while seasonal factors alone may not be definitive indicators, their combination with trends like the recent pause in selling from long-term holders adds weight to the bullish outlook.

However, concerns linger, particularly around the actions of the defunct exchange Mt. Gox, which has recently been transferring large amounts of Bitcoin to centralized exchange wallets. This activity has raised alarms among some market players about potential liquidations, thus introducing a risk of temporary volatility. Deribit CEO Luuk Strijers expressed caution, indicating that these movements could instigate further selling pressure. As the cryptocurrency community navigates this uncertainty, the market remains watchful for signs of stability and growth in the coming weeks.

The Current State of Digital Assets

The cryptocurrency market is experiencing significant turmoil, impacting trader sentiment and potential investment decisions.

- Massive Sell-off:

- Over 0 billion wiped from the total cryptocurrency market cap recently.

- This sell-off may be attributed to several factors, including global economic concerns and Trump’s tariff threats.

- Historical Trends in April:

- April has historically been a strong month for Bitcoin, with an average return of 27% since 2010.

- April ranks as the third-best month for Bitcoin returns, following November and May.

- Market Indicators:

- Seasonality factors may provide insight but are not standalone indicators.

- A recent halt in selling by long-term holders could indicate a stabilizing market.

- Risks Involving Mt. Gox:

- Transfer of substantial amounts of Bitcoin by the defunct Mt. Gox exchange could lead to market volatility.

- Potential fear of creditor liquidations may drive temporary selling pressure.

“Now is ‘really good time’ to buy Bitcoin,” says a leading trillion-dollar investment manager.

Crypto Market Volatility: Boon or Bane for Investors?

The current state of the cryptocurrency market has sparked intense debate among investors and traders alike, particularly with the startling decline that wiped out over 0 billion from the market cap since last Friday. In this environment, competing narratives surrounding digital assets emerge, revealing the multifaceted nature of the market. On one hand, recent geopolitical turmoil—with threats from former President Trump regarding tariffs and broader global economic anxieties—has acted like a trigger for widespread sell-offs. On the other hand, a historical pattern for cryptocurrencies, especially Bitcoin, suggests April might usher in a more favorable climate for traders, potentially offering a rich landscape for strategic buying.

When we compare this situation with other recent news in the crypto space, a couple of key differences arise. For instance, while some analysts highlight the adverse effects of global unrest, there are contrasting viewpoints that emphasize strong market fundamentals and the resilience observed during previous market dips. Some industry experts argue that the current sell-off, although alarming, could cultivate buying opportunities for savvy investors prepared to take advantage of the upcoming bullish seasonality borne out of historical data. This presents a competitive edge for traders who can maintain composure during market volatility and recognize patterns that aren’t apparent to every investor.

However, one evident disadvantage lurks—the ongoing turmoil regarding the Mt. Gox exchange and its recent Bitcoin transfers has clouded the horizon. Concerns about creditors potentially liquidating their assets instill fear and could amplify short-term volatility. Consequently, the fear of missing out versus the dread of potential liquidation creates a clamorous dilemma for traders. The unpredictable factor introduced by Mt. Gox could dissuade new investors from entering the market, even as seasoned traders may consider it an opportunity to scoop up lower prices before the anticipated upswing.

This paradox in the market dynamics showcases how diverse investor profiles could either benefit from or suffer due to current volatility. Newer investors might feel overwhelmed by the swift market movements and geopolitical uncertainties, pushing them towards safer assets. In contrast, seasoned traders who can navigate this turbulence may capitalize on these downturns by employing tactical approaches to Bitcoin purchases during known periods of seasonal strength.

With the potential for a rebound tied closely to both historical patterns and present-day events, the contrasting narratives render the cryptocurrency landscape a battleground of strategies. Investors must carefully weigh their risk tolerance against the backdrop of historical bullish returns in April, recognizing that opportunity often dances hand-in-hand with uncertainty.