This past week in the cryptocurrency world saw a shocking turn of events as investor sentiment took a nosedive following a dramatic collapse of the Mantra OM token. Plummeting over 90% within just hours on April 13, this incident drew immediate comparisons to previous market catastrophes such as the Terra-Luna collapse, highlighting the ongoing volatility that characterizes the crypto landscape. The OM token’s crash, which spiraled from approximately $6.30 down to less than $0.50, has raised serious allegations of market manipulation among investors who are now grappling with the aftermath.

According to industry experts, the rapid decline of the OM token sheds light on broader liquidity issues within the cryptocurrency sector, especially during weekends when trading volume tends to drop. Gracy Chen, CEO of the cryptocurrency exchange Bitget, noted that a concentration of wealth and opaque governance structures may have contributed to this steep drop. This situation, combined with forced liquidations during low liquidity periods, presents a troubling picture for investors who have become increasingly disillusioned.

Adding to the concerns in the market, a recent report from Coinbase for institutional investors suggested that cryptocurrencies could remain in a bear market until at least the third quarter of 2025. In this monthly outlook, Coinbase revealed that the altcoin market capitalization had experienced a staggering 41% decline from its high of $1.6 trillion in December 2024, now estimated at around $950 billion. This downturn is seen as part of a larger trend, as venture capital funding for crypto projects has reportedly decreased by between 50% to 60% compared to the exuberant years of 2021-2022.

“Several converging signals may be pointing to the start of a new ‘crypto winter’ as some extreme negative sentiment has set in due to the onset of global tariffs and the potential for further escalations,”

said David Duong, Coinbase’s global head of research.

Additionally, the past week witnessed a warning from Manta Network co-founder Kenny Li, who reported being targeted in an intricate phishing attack impersonating trusted colleagues via Zoom. This incident underscores the ongoing security challenges that crypto professionals face in an increasingly hostile digital landscape.

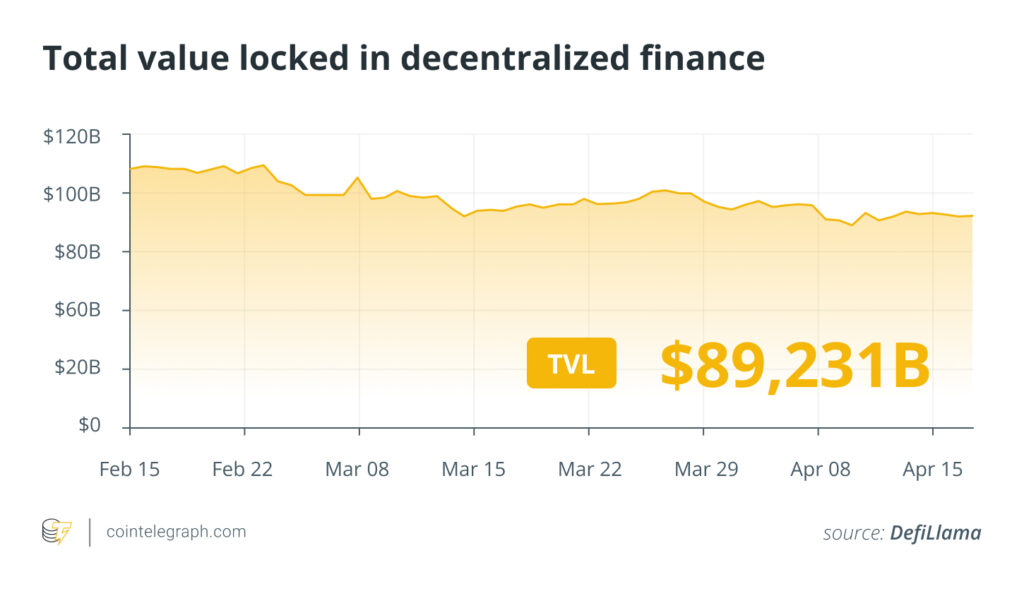

Despite these setbacks, there appear to be pockets of resilience in the market. Recent research indicated that while crypto lending has dramatically decreased—down 43% from its peak in 2021—decentralized finance (DeFi) lending has surged, with a striking 959% increase from bear market lows. This juxtaposition illustrates the shifting dynamics within the crypto ecosystem as investors seek alternative models amid traditional finance’s challenges.

Finally, it’s noteworthy that discussions around crypto narratives have largely remained stagnant, with artificial intelligence tokens and memecoins dominating interest. According to CoinGecko’s latest report, these categories accounted for over 62% of investor focus in the first quarter of 2025, signaling a continued preference for familiar themes despite the evolving market conditions.

Impact of Recent Crypto Market Events on Investor Sentiment

This week’s significant events in the cryptocurrency market have left investors feeling anxious and uncertain about the future. Here are the key points that reflect these changes and their potential impacts on readers:

- OM Token Collapse

- The Mantra OM token plummeted over 90% in a matter of hours, raising alarms about potential market manipulation.

- The crash has drawn comparisons to past disastrous events in the crypto world, indicating a fragile market.

- Liquidity Issues Revealed

- The collapse highlights critical liquidity problems in the crypto industry, particularly during low-volume periods.

- This raises concerns for future investments and risks, as many tokens may be susceptible to similar volatility.

- Bear Market Signals

- Coinbase’s report suggests that cryptocurrencies are facing a bear market, potentially lasting until Q3 2025.

- Investors may need to prepare for a long period of low returns and reevaluate their strategies and positions in the market.

- Attack on Manta Network Co-Founder

- Kenny Li, the co-founder of Manta Network, faced a sophisticated phishing attack, highlighting security vulnerabilities in the crypto space.

- This incident exemplifies the ongoing risks associated with digital communications and the importance of cybersecurity.

- Decline in Crypto Lending

- The crypto lending market has significantly decreased, reflecting broader issues in the finance sector and potentially impacting individual borrowers and lenders.

- With a 43% drop from previous highs, this decline may limit access to liquidity and borrowing opportunities for investors.

- Continuing Dominance of AI Tokens and Memecoins

- The market remains fixated on AI tokens and memecoins, indicating a lack of innovation and new narratives in the crypto space.

- This trend may limit diversification and lead to repetitive investment patterns among retail investors.

Overall, these developments indicate a turbulent period for cryptocurrency investors and emphasize the importance of remaining informed and cautious in an unpredictable market.

Market Turmoil and the Ripple Effect: A Closer Look at Recent Crypto Developments

The recent collapse of Mantra’s OM token has sent shockwaves through the cryptocurrency landscape, stirring memories of past calamities like the Terra-Luna fiasco. This incident raises significant concerns about market volatility, especially during weekends when liquidity tends to experience substantial fluctuations. The reaction from investors has been a mixture of disbelief and urgency, with many likening the situation to previous black swan events. The immediate repercussions of OM’s dramatic fall place a spotlight on the broader industry and its inherent vulnerabilities.

Comparative Market Analysis: In conjunction with Mantra’s situation, Coinbase’s recent report for institutional investors paints a sobering picture, suggesting the crypto market might remain in a bear state until 2025, possibly jeopardizing investor confidence further. While Mantra’s liquidity struggles highlight critical governance issues, Coinbase’s observations reflect a bearish sentiment that pervades the market for various cryptocurrencies, making it clear that investors are now more cautious than ever.

Unlike Mantra, which showcased extreme volatility primarily through its token collapse, Coinbase provides a more structured overview of the industry’s health. While Mantra’s missteps appear alarming, Coinbase’s perspective may appeal more to institutional investors seeking insightful, data-driven analysis of the challenges ahead. However, the chilling caution suggested by Coinbase could deter potential new entrants eager to engage with nascent digital assets, leading to a stagnant or regressive market, which could hurt innovative projects relying on venture capital.

Opportunities and Challenges: Investors with a robust risk appetite might find opportunities in the aftermath of these tumultuous events, as lower prices could attract buyers who are savvy about long-term market potential. Yet, the negative sentiment could deter retail investors, posing challenges for emerging projects in the crypto space, particularly those that heavily rely on public sentiment and community support.

Moreover, Mantra’s liquidity crisis underscores a more systemic issue within the crypto world where wealth concentration and opaque governance structures can lead to rapid declines in token value. This predicament could serve as a cautionary tale for other emerging tokens and platforms that have not yet established a transparent governance model, potentially inviting regulatory scrutiny.

The challenges faced by both Mantra and the broader market might also carve a path for new entrants to leverage improved governance and liquidity protocols. As established players grapple with reputational damage, innovative startups can fill the void by presenting themselves as trustworthy alternatives. However, these developments may not equally benefit all market participants—while some investors could capitalize on price drops, others could find themselves trapped in a cycle of losses as uncertain waters continue to plague the industry.