In a turbulent week for financial markets, the announcement of reciprocal tariffs by former President Donald Trump has sent shockwaves through U.S. equities, erasing a staggering $5.4 trillion in just two days. The S&P 500 index hit its lowest point in 11 months, while the tech-heavy Nasdaq 100 slipped into bear market territory, down 11%. However, amidst this market chaos, the cryptocurrency sector is showcasing a surprising resilience.

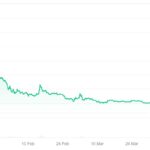

Bitcoin (BTC), the leading cryptocurrency, experienced a relatively modest decline of about 6% following the tariff news, while the broader cryptocurrency market, as measured by the CoinDesk 20 (CD20) index, fell by approximately 4.9%. According to data from TheTie, the total cryptocurrency market capitalization now stands around $2.65 trillion. In the last 24 hours, Bitcoin’s price dipped just 0.3% to $82,619.77, while the CoinDesk 20 managed a slight rise of 0.2% over the same timeframe.

Interestingly, not all news was bleak for crypto-related stocks. While most saw declines, some companies thrived; Bitcoin miner Marathon Digital Holdings (MARA) rose by 0.6%, and Core Scientific (CORZ) experienced a 0.4% uptick. MicroStrategy (MSTR), which holds a substantial 528,185 Bitcoin on its balance sheet, jumped up by 4%, significantly outperforming the beleaguered Nasdaq, which fell by 5.8% on Friday.

“Over the last 36 hours I think we can also add ‘US isolation’ hedge to the list of bitcoin uses,” noted Standard Chartered’s Geoffrey Kendrick, reflecting on Bitcoin’s potential role as a safeguard against market fluctuations.

This period of relative stability in cryptocurrency prices coincided with the celebration of the purported birthday of Bitcoin’s enigmatic creator, Satoshi Nakamoto. Enthusiasts speculate the date isn’t necessarily factual but serves as a symbolic reminder, as it aligns with the anniversary of Executive Order 6102, enacted in 1933, which required Americans to surrender their gold to the Federal Reserve.

As the financial landscape evolves, cryptocurrency may continue to emerge as a viable alternative, especially in light of its increasing accessibility through conventional investment vehicles, such as exchange-traded funds (ETFs). With experts suggesting the digital currency’s resilience during these tumultuous times, it’s clear that the marriage between traditional finance and cryptocurrency is an area to watch closely.

Impact of Trump’s Tariffs on Markets and Cryptocurrency Resilience

Key points regarding the recent market reactions to President Trump’s tariff announcements and the relatively stable performance of cryptocurrencies are as follows:

- Market Wipeout:

- U.S. equities lost $5.4 trillion in just two days.

- S&P 500 index dropped to its lowest level in 11 months.

- Nasdaq 100 entered bear market territory with an 11% drop.

- Cryptocurrency Resilience:

- Bitcoin (BTC) experienced a drop of roughly 6%, significantly less than the Nasdaq’s drop.

- The broader CoinDesk 20 (CD20) index fell by approximately 4.9% during the same period.

- Total crypto market cap remains around $2.65 trillion.

- Specific Performance Metrics:

- In the last 24 hours, bitcoin decreased by 0.3% to $82,619.77.

- The CD20 index saw a slight increase of 0.2%.

- Crypto-Related Stocks:

- MARA Holdings (MARA) increased by 0.6%, and Core Scientific (CORZ) rose by 0.4%.

- MicroStrategy (MSTR) outperformed with a 4% rise, holding 528,185 BTC.

- Investment Perspective:

- Standard Chartered’s Geoffrey Kendrick indicates cryptocurrencies might serve as a hedge against traditional financial market fluctuations.

- Potential for bitcoin to act as a “US isolation” hedge amidst economic uncertainty.

- Symbolic Anniversary:

- The crypto community recently celebrated the birthday of bitcoin’s creator, Satoshi Nakamoto.

- This date coincides with the anniversary of Executive Order 6102 related to gold confiscation, suggesting bitcoin’s historical context as an alternative asset.

“Bitcoin could be ‘useful as a TradFi hedge’” – Standard Chartered’s Geoffrey Kendrick

The Resilient Crypto Market Amidst Stock Market Turmoil

In a tumultuous economic landscape spurred by President Donald Trump’s announcement of reciprocal tariffs, the turmoil in the U.S. equities market has resulted in a staggering $5.4 trillion wipeout over just two days. The S&P 500 has plunged to its lowest point in 11 months, while the Nasdaq 100 has entered bear market territory—a development that leaves traditional investors reeling. However, not all sectors are facing the same harrowing fate; the cryptocurrency market, particularly bitcoin, has offered a surprising refuge.

Competitive Advantages of Cryptocurrencies

Compared to the Nasdaq’s notable decline of 11%, bitcoin’s drop of roughly 6% reflects a marked resilience in the crypto sphere. This contrasts sharply with the broader CoinDesk 20 index, which experienced a loss of about 4.9%. The episode underscores the potential of cryptocurrencies to act as a hedge against traditional market downturns—a point emphasized by analysts like Geoffrey Kendrick of Standard Chartered. The adaptability of crypto, especially via exchange-traded funds (ETFs), has made it increasingly accessible to average investors seeking alternative routes during stock turbulence.

Who Stands to Benefit?

Those poised to benefit from this situation include individual investors looking to diversify their portfolios away from the volatility in traditional stocks. Additionally, institutions holding bitcoin, like MicroStrategy, have found a silver lining; their stock has surged amid the stock market slide. Conversely, miners and companies integrated into the cryptocurrency space, like MARA Holdings and Core Scientific, have exhibited a surprising upward momentum, signaling a potential shift in investor sentiment toward digital assets as safe havens.

Potential Drawbacks

Despite its apparent resilience, the crypto market is not without its challenges. Notably, while bitcoin showed mild losses, the broader crypto market remains susceptible to regulatory scrutiny, especially as governments assess the impact of tariffs and global economic strategies. Moreover, the volatility that characterizes cryptocurrencies can deter conservative investors wary of sharp market swings. This dual-edged sword could create problems for novice investors or those lacking robust risk management strategies.

Ultimately, while the crypto market may offer some refuge during the current stock market chaos, the ongoing fluctuations and external pressures posed by traditional financial systems suggest that caution—and due diligence—should always prevail for anyone navigating these turbulent waters.