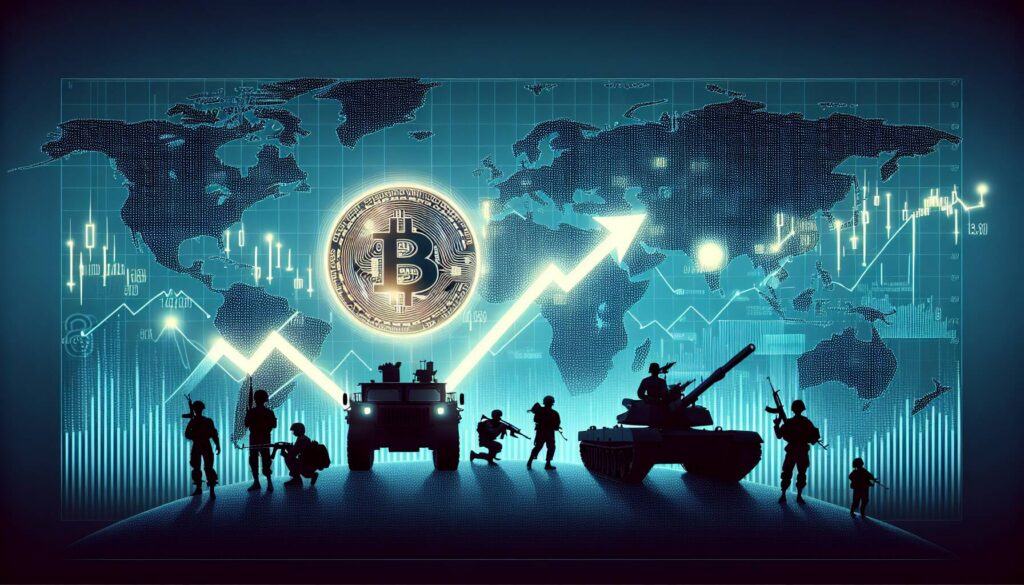

The cryptocurrency market has recently faced a dramatic downturn, wiping out an astonishing $1 trillion as Bitcoin plunges once again. Major news outlets, including Bloomberg and CNN, highlight this troubling trend as not just a crisis for cryptocurrencies, but also a reflection of broader market instability.

In a shocking turn of events, Bitcoin’s price has dropped below $90,000, marking a striking drop that has erased its gains from 2025. This significant decline has left many investors reeling and has raised concerns about the future of digital currencies.

As captured by Business Insider, the ripple effects of this sell-off are being felt across the wider crypto market, indicating that the fallout might just be beginning.

In addition to Bitcoin’s challenges, analysts at Decrypt have noted a concerning trend with Ethereum, which seems poised to follow suit. The emergence of a ‘death cross’ for Bitcoin signals potential ongoing struggles within the crypto space, leaving many to wonder about the future of their investments.

Impact of Recent Cryptocurrency Market Trends

The cryptocurrency market is currently experiencing significant volatility, affecting investors and the broader financial landscape. Here are the key points:

- $1 Trillion Loss: The crypto market has seen a massive reduction in value, totaling $1 trillion.

- Bitcoin’s Decline: Bitcoin’s price has plummeted below $90,000, signaling a downturn.

- Wipeout of 2025 Gains: The recent sell-off has erased Bitcoin’s anticipated gains for 2025.

- Market Trends: Stocks are also continuing to fall, indicating a correlation between traditional and crypto markets.

- Technical Analysis – Death Cross: Bitcoin has entered a “death cross,” a technical indicator that suggests further declines could follow, with Ethereum also showing similar signs.

The current volatility in the crypto market could impact personal investment strategies and financial planning for individuals considering cryptocurrency.

Cryptocurrency Market’s Roller Coaster: Analyzing the Current Downturn

The recent plunge in the cryptocurrency market, wiping out a staggering $1 trillion, has sent shockwaves across the financial landscape. Major news outlets, including Bloomberg and CNN, provide insights into the underlying factors contributing to this downturn, notably the significant decline in Bitcoin’s value below the $90,000 mark, as reported by The Wall Street Journal. The sell-off impacts not just Bitcoin but threatens the stability of altcoins like Ethereum, as highlighted by Decrypt.

Among the competitive advantages, major news outlets are leveraging their established credibility and expansive audience reach to deliver timely updates on market sentiment. This positions them as trusted sources during these turbulent times, allowing investors to stay informed and make better decisions regarding their assets. Furthermore, stories concerning Bitcoin’s ‘death cross’ signal significant market shifts, which could lead to increased engagement from readers seeking insights into market trends.

However, the constant barrage of negative news can also create panic, fostering an environment of distrust among potential investors and everyday consumers. This could deter newcomers from entering the crypto market, knowing that the landscape is rife with volatility and unpredictability. On the flip side, this downturn may benefit experienced traders and institutions that thrive in a bearish market, allowing them to acquire assets at lower prices.

The implications of this downturn are profound. Retail investors, who often lack experience in navigating such tumultuous waters, might find themselves facing severe losses, creating a barrier to their entry into cryptocurrency investing. Conversely, seasoned traders could leverage this situation for profit, thereby widening the gap between novice and advanced investors in the crypto space. Market watchers and financial analysts will undoubtedly continue to dissect these developments, contributing to an ongoing dialogue about the future of digital currencies.